Domestic Market

It looks like the grain harvest will start in the south of the country sometime after the 15th of July. What originally looked like an early harvest earlier in the year now looks to be normal timing. If yields are above average, we should see a total cereal harvest around 2.2m tonnes which would be still 200,000 tonnes below the 2017 harvest but 350,000 above last years.

Forward green prices for the harvest still remain around the €145 – €150/t range for barley and €157 – €162/t for wheat.

The FOB Creil malting barley (July 2019) price remained around the €178/t mark recently as the outlook remains for favourable yield and protein level forecasts across northern Europe.

Native/Import Dried Prices

| Spot 01/07/19 | July2019 | New Crop 2019 | |

| Wheat | €198/t | €200/t | €187/t |

| Barley | €173/t | €173/t | €175/t |

| FOB Creil Malting Barley | €177/t (July 2019) | ||

| Oats | €210 | ||

| OSR | €370 | ||

| Maize (Import) | €192 | €192 | €192 |

| Soya (Import) | €338 | €338 | €335 |

International Markets

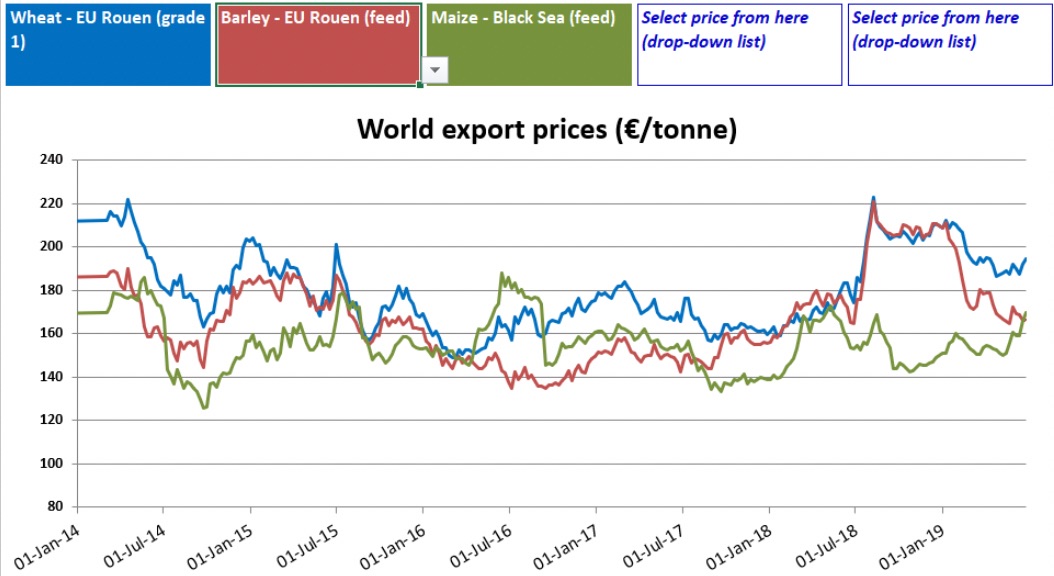

All wheat markets followed the lead of US markets in recent days by tumbling from their recent highs. This was mainly caused by the surprise forecast for US corn plantings which were 6 million above most analyst figures. In the past two days US wheat futures fell by 8% although the European Matif was down only 4%. The US Winter harvest has made good progress in the past week due to better weather and the recent hot spell in Europe is predicted to have had little impact on yields. Overall wheat world stocks are on the high side and although predictions for the Russian and EU harvest have been trimmed, they are both expected to increase by 7 and 12 million tonnes respectively from last season. The wheat harvest has begun in the Southwest of France and is well on in parts of Russia therefore news on yields and quality are filtering into the market.

The figures from the USDA last Friday which indicated that the acreage for corn plantings was estimated at almost 92million against analyst’s figures of 86million has caused US futures to drop by 10% in the past two trading days and dragged other commodities down along with it. However, many believe these predictions to be inaccurate and the USDA has agreed to access them again before mid-August. On a positive note corn is still up by 20% since its lows in mid-May making barley more competitive at current prices.

Good weather across the US has accelerated soybean plantings and the USDA reckon 92% of the crop is now planted. The warmer weather in the Midwest has helped with emergence and growth of existing corn and soybean plantings also. Soybean futures initially reacted positively to the USDA acres report and to the US/China trade truce at the weekend however, they are trading lower again today as large US stocks continue to overhang the market. Meanwhile strategic grains have kept their forecast for the EU rapeseed harvest at 17.8 million tonnes, nearly 11% below last season’s level and the smallest volume in 13 years.