Domestic Market

Most of the Winter barley and Winter oats harvest are now completed with good progress made on Winter oilseed rape, however work has ground to a halt in the past week due to the wet conditions.

On average, yields are described as reasonable however, there is much variation even within farms. It must be remembered that we have one of the lowest cereal plantings on record this season so even if yields are above average, overall production will not be high compared to the long-term average.

There is very little activity in the market as buyers stay on the sidelines.This would be normal, however it is extra quiet as there are doubts over Winter demand in the beef sector; the implications of a hard Brexit and the knowledge that domestic grain supply is up compared to last year with less anticipated demand.

The combination of a good harvest and weak sterling has ensured that the UK has some of the cheapest grain in Europe. However, the reduced plantings and yield of oil seed rape in Britain have provided support to this market.

The French malting barley harvest is virtually finished with reports of good yields but low proteins in general. The spot FOB Creil malting barley price which has now dropped to €162/t with the running average for the Irish pricing model now at €179/t.

Irish Native/Import Dried Prices

| Spot 14/08/2019 | New Crop 2019 | |

| Wheat | €176/t | €177/t |

| Barley | €167/t | €170/t |

| FOB Creil Malting Barley | €162/t | €179(av) |

| Oats | €180 | |

| OSR | €360 | |

| Maize (Import) | €185 | €185 |

| Soya (Import) | €325 | €330 |

International Markets

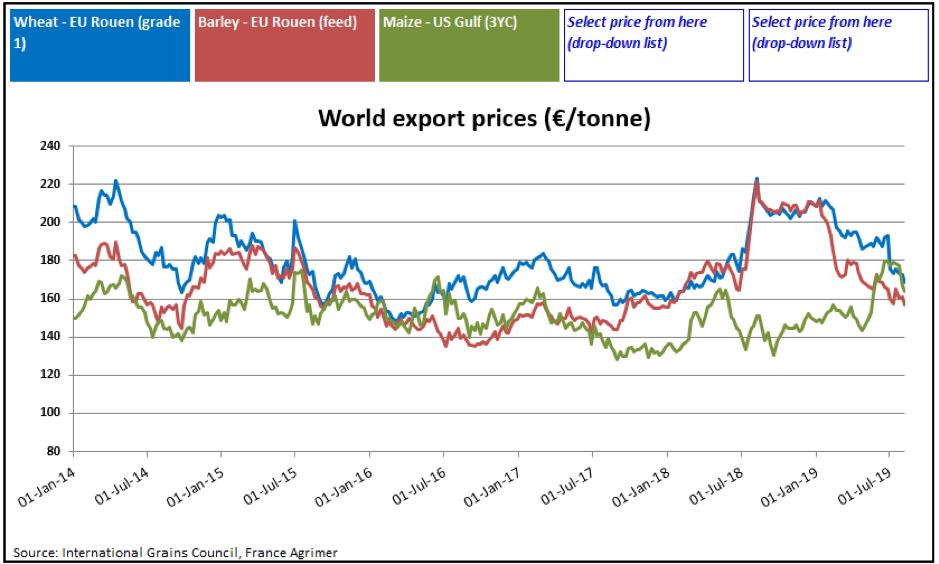

Wheat and barley harvests are virtually finished across the main EU producing countries but there are some delays in the UK and Germany due to wet weather. In general yields and quality have been quite good with the two heat waves causing minimal harm to crops. Production will be well up on the drought hit figure of 2018 but may only be similar to the 5-year average.

Wheat production in Russia is also expected to be up on last year but 10 million tonnes below the 2017 harvest, while the Ukraine is expected to have a good production figure similar to 2018 due to favourable weather. Latest reports see estimates for world wheat production this year at 768 million tonnes compared to 730 MT last season.

The major news in the market this week was the release of the updated corn(maize) planted figures from the USDA. It revealed higher production figures than expected by the market and this caused US corn futures to drop by over 10% in two days. There was a knock-on effect in wheat futures with US markets falling by 6% and the European Matif Dec 19 down 3%. Maize eventually found support due to short covering and some positive developments on the US/China trade war however, the market remains bearish due to forecasts of warm wet weather in the US corn belts.

Notwithstanding the positive production report from the USDA, the story on corn has a long way to run yet, as the crop is behind in its development stage and weather events and the possibility of a poor back end to the season could see the market turn positive again.

Soybeans initially turned positive after Monday’s USDA report which showed increased corn plantings but reduced soybean plantings. They got a further boost from the US/ China trade talks however they have now retreated again on favourable weather in the US and a continuation of high world stocks.

The rapeseed market continues to remain robust as the reduction in EU acreage has been followed by only average yields across Europe, therefore further reducing production forecasts.