Domestic Market

Good progress has been made with the grain harvest over the past 10 days. However, a lot of crops remain to be cut in some regions of the west, particularly in Donegal, due to the above average August rainfall.

In general, yields are reported to be ok however, there remains much variation within farms. Again, it must be said that even if yields are above average, overall production will not reach 2015 levels due to the reduced acreage.

There continues to be very little activity in the market as buyers stay on the side-lines.

The continued weakness of sterling and combination of a good harvest and has ensured that UK wheat remains very competitive. It is estimated that the UK could have an export surplus of 1.6m tonnes of wheat this season although on a positive note some of the ethanol plants which had switched to corn last year are now back on wheat.

Irish Native/Import Dried Prices

| Spot 02/09/2019 | Nov 2019 | |

| Wheat | €177/t | |

| Barley | €167/t | |

| FOB Creil Malting Barley (Av) | €176 | |

| Oats | €170 | |

| OSR | €365 | |

| Maize (Import) | €177 | €177 |

| Soya (Import) | €325 | €325 |

International Markets

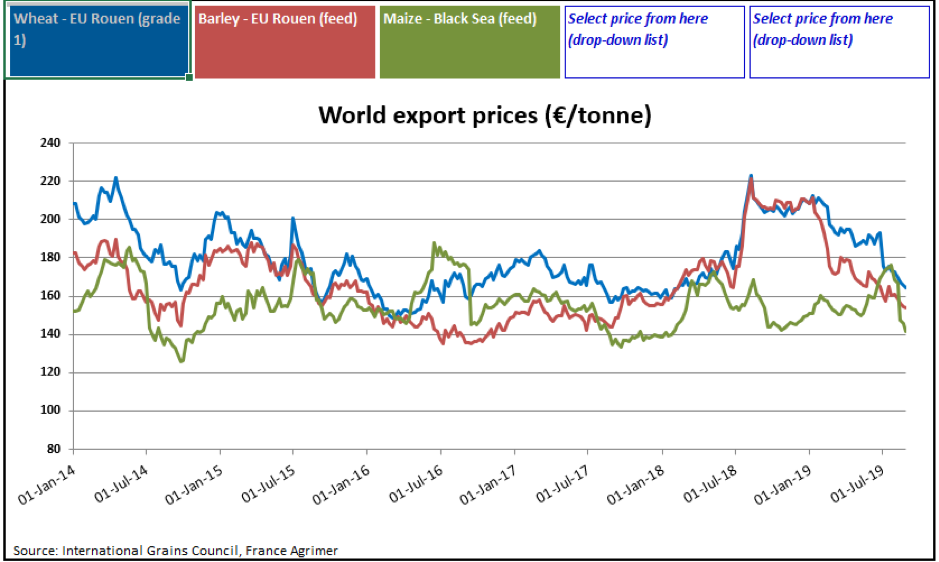

European wheat and barley prices continue to remain under pressure due to good harvests and ample world supplies. European exports are well up on last year however, there is major competition from the Black sea region on international markets. The Matif Dec 2019 is at its lowest level since April 2018, currently trading at the €167/ t mark. With the US spring wheat harvest progressing well, the southern hemisphere regions of Australia and Argentina remain the only current variables in world wheat production. Apart from some drought in Australia there are no issues at present. Any positives in the wheat market in the coming months will really depend on the outcome of the US corn crop.

Corn (Maize) futures have traded within a narrow range since they plummeted by 12% following the updated corn planted figures from the USDA on August 12th. Favourable weather has ensured that futures have not recovered with many traders now holding bearish bets on the commodity. Record corn exports from Brazil due to large crops and a weak currency along with increased production from the Ukraine have also impacted the market. However, some market watchers believe that the USDA predictions for corn production are overly optimistic and believe that the poor establishment of crops and a shortened growing season will ultimately change these predictions which will prove bullish for corn futures.

Just like corn the continuing impasse in the US/China trade dispute is keeping downward pressure on soybean prices with world supply continuing to exceed demand. Rapeseed prices continue to remain positive due to forecasts of reduced production in Canada and a further downgrade to EU production from the EU commission.