Domestic Market

Due to the wet October, animals have been housed earlier than last year, which has led to an increased demand for feedstuffs. Due to competitive pricing and issues with the quality of imported maize during the year the proportion of Irish grains used in feed rations has increased, which has led to good demand.

Most merchants have now issued prices for harvested grain, with green barley in excess of €140/t and green wheat approximately €10/t higher. Market prices were probably at their lowest around harvest time but have since increased and that augurs well for those farmers storing grain for future sale.

Irish Native/Import Dried Prices

| Spot €/t | Nov 2019 €/t | |

| Wheat | 178 | 180 |

| Barley | 168 | 170 |

| Oats | 160 | |

| OSR | 375 | |

| Maize (Import) | 181 | 181 |

| Soya (Import) | 332 | 332 |

International Markets

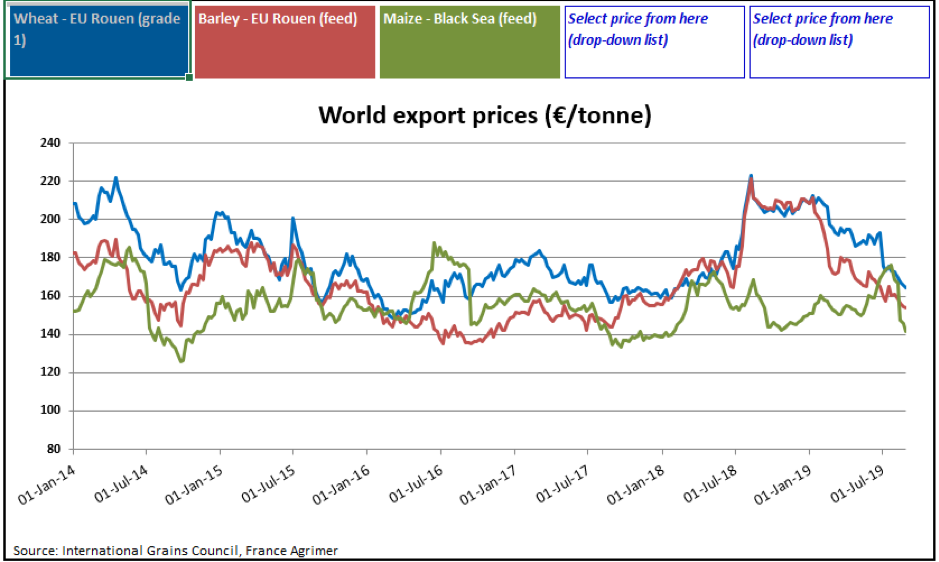

A combination of factors has helped European wheat prices to reach a 3-month high, with the Dec 2019 Matif wheat contract now trading at €181/t , significantly off the low of €164 /t seen in mid-September. The cereal harvests in the southern hemisphere countries of Australia and Argentina have been further downgraded due to drought, with the Australia harvest estimate for wheat now at 15.5m tonnes from a previous figure of 19m tonnes. On the sowing front, recent news that Winter Wheat plantings in the Ukraine will be reduced has proved positive for the market.

The rise in the price of Black sea grains along with an increasing number of tenders from importing countries in north Africa and the middle east, has added to overall price support in the wheat and barley markets. However, wet and cool conditions in the mid-west of the US have again been the main focus of the market, with US wheat driven higher by the delay in the US Spring wheat and maize harvest.

Corn (Maize) futures have continued to trade based on the final outcome of the US harvest. Snow and wintry weather in states such as North Dakota have certainly cast doubt over the predicted final maize yield. The corn harvest is now 30% complete in the US, against the 5-year average of 47%. It now seems likely that favourable weather during the growing season could not outweigh some of the earlier problems of high moisture during planting and the resulting late harvest. However, poor export demand for US demand is keeping a lid on US futures as importers source maize elsewhere.

Some positive signals from the US/China trade dispute such as tariff rate free quotas for US soybeans have boosted the soybean market, however there still appears to be ample supplies available from the South American countries.The soybean harvest in the US is now 45% complete, versus 64% on the 5 year average, with an expected reduction in yield now also factored in. Other commodities in this space such as rapeseed and palm oil have also risen in tandem with the bullish soybean market.