Domestic Market

Demand continues to struggle in the feed market. Adequate fodder supplies, combined with a reduction in demand from beef finishers, has had a negative effect on the feed sector. In this scenario suppliers are finding it difficult to move barley, however, wheat supply has tightened considerably. We now see a gap of up to €30/t between the spot price of barley and wheat. Not surprisingly imports of maize up to December were down almost 35% compared to the same 5-month period last season. On a positive note, with barley now trading at such a discount to wheat and maize, it is now beginning to buy back demand in the market.

Again, due to the limited amount of planting and poor prices, there has been little interest in forward selling with some quoted prices for Nov 2020 at €172/t for dried barley and €190/t for wheat.

Irish Native / Import Dried Feed Prices

| Spot €/t | May 2020 €/t | |

| Wheat | 202 | 205 |

| Barley | 172 | 175 |

| Oats | 160 | |

| OSR | 390 | |

| Maize (Import) | 195 | 200 |

| Soya (Import) | 350 | 350 |

International Markets

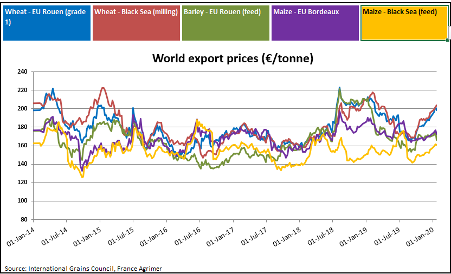

Due to reduced Winter wheat plantings across Europe and a general tightening of world wheat supply, futures have remained near recent highs. The Matif March contract touched a high of €200/t last week, but has since retreated in tandem with other markets due to the perceived threat of the Coronavirus to demand in the Chinese market.

EU wheat and barley exports are up 69% and 29% respectively compared to last season while total Ukraine grain exports have increased by 29%. Recent news that the world’s largest wheat exporter Russia may curb exports in the coming months has also driven prices to season highs.

A recent report from the MARS EU agency has indicted that EU winter crop plantings could see a higher disease and cold weather risk due to the unseasonably mild weather in January.

Barley has not scaled the recent highs of wheat due to local supply in Europe and the prediction of record Spring barley plantings in the main growing regions. However, Saudi Arabia has recently purchased 900,000 tonnes of barley which has added support to the market.

Better demand for US corn has given support for prices in recent days. However, the IGC have raised their world corn production forecast for 2020.Although lower than last season, it is still significant as they predict high production figures from South America and reasonable final figures from the US.

On the protein and oilseed crop front, soybeans have fallen to levels seen in mid-December. The initial optimism from the trade deal between the US and China has somewhat dissipated as there has been no concrete evidence of commitment to increased Chinese imports. Palm oil also fell 10% in the past week but the price has now somewhat recovered. This general weakness in the market has affected the recent strong run of rapeseed however, with EU, Canadian and Australian production down over 15%, the rapeseed market should remain strong in the medium term at least.