Light at the end of the tunnel?

More milk, challenges on demand – but improved mid-term outlook?

After up to 2c/l in March, most co-ops have by now announced a 1c/l cut on April milk. This is quite a blow coming up to peak. Assuming no further adjustment, and over the peak months of March to June inclusive alone, that is up to a €6500 loss for an average dairy farmer producing 500,000l.

There is little doubt that market returns have been affected by the impact of COVID19 on global demand. Food services closing practically overnight the world over has resulted in milk in search of an outlet going to create surpluses in other areas, and putting pressure on commodity prices.

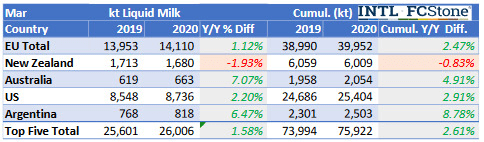

In addition, milk supplies have been increasing this spring in most regions except New Zealand in the first quarter of 2020 – total additional output for the period is estimated by INTL FCStone at 2.6%, and by Ornua at a more conservative 1.4% for the top five production/exporting regions compared to the same period in 2019. The difference in expectation for March are narrower, with FCStone indicating 1.58% and Ornua 1.4%.

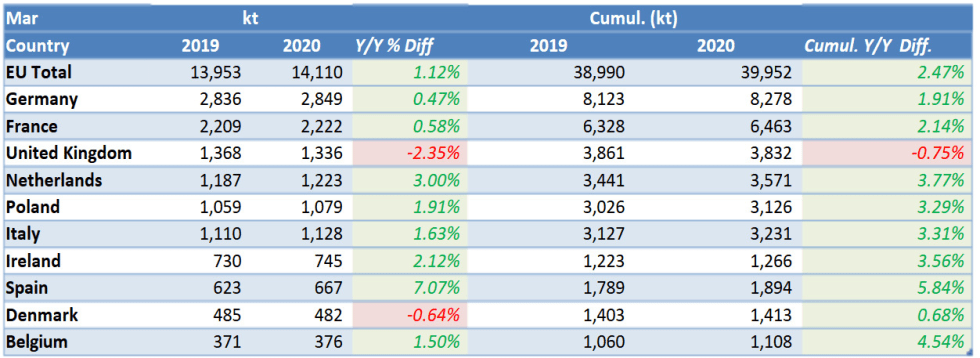

The significant increase in US production for the period is particularly remarkable, bearing in mind the crash in milk prices, and the fact that farmers in some states have had to dispose of milk. The Australian increase follows months, if not years of decreases. More important are the significant increases in EU milk production, nearly 2.5% for the first quarter, though more modest at 1.12% for March. Many take the view that significant milk price falls almost the world over in the first half of the year will contribute to more modest output growth in the second half.

Source: INTL FCStone

In the EU too, all countries have seen output increases, with few exceptions, namely the UK and to a lesser degree, Denmark for the month of March.

Source: INTL FCStone

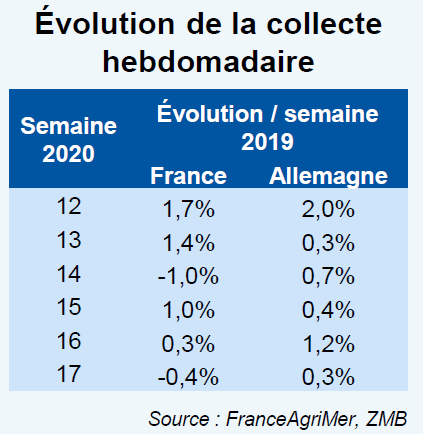

It is worth noting however that the two largest producers, namely France and Germany have experienced only modest growth in March. This modest trend has continued into April in both countries – see table right, which in the last three lines captures the first 3 weeks of April (15 to 17) for France on the left and Germany on the right.

French industry organisation CNIEL has expressed a view that production has been moderated in April, a month for which they received retrospective approval for the incentivisation to the tune of up to 32c/l of a 2 to 5% reduction in April 2020 production relative to April 2019.

Sources France AgriMer, ZMB (Germany)

Demand meanwhile has been very severely impacted by the collapse in food services. In the EU and the US, retail sales have increased spectacularly as consumers eat all their meals at home – up 17% in Ireland for all groceries in the last 2 months according to Kantar WorldPanel – but not so much as to offset the difference. Product unused in food services cannot always be shifted directly into retail – e.g. catering size packs of semi-processed creams for cooking and pastry. However milk not processed into those products has found its way into other processing chains – say butter in the case of cream – where it creates product surpluses which put pressure on product prices.

Have dairy prices bottomed out?

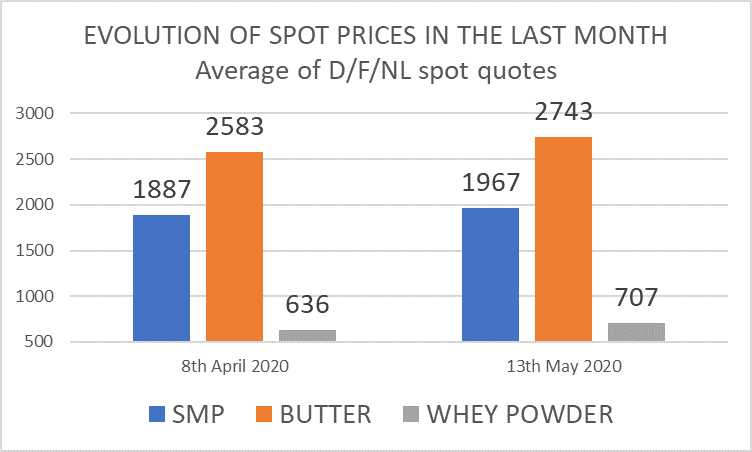

Dairy futures and spots have been firming for the last 3 to 4 weeks, with average current market prices reported by the EU MMO a little slower to follow.

As demonstrated by the graph right, between the 8th April and 13th May, the average spots quoted for SMP in Germany, France and the Netherlands increased by €80/t or 4.2%, for butter by €160/t or 6.2% and for whey powder by €71/t or 11.2%.

There is increasing evidence that dairy prices may have bottomed out – unfortunately at a very low level, but still well above intervention equivalent.

Source: INTL FCStone/IEG Vu

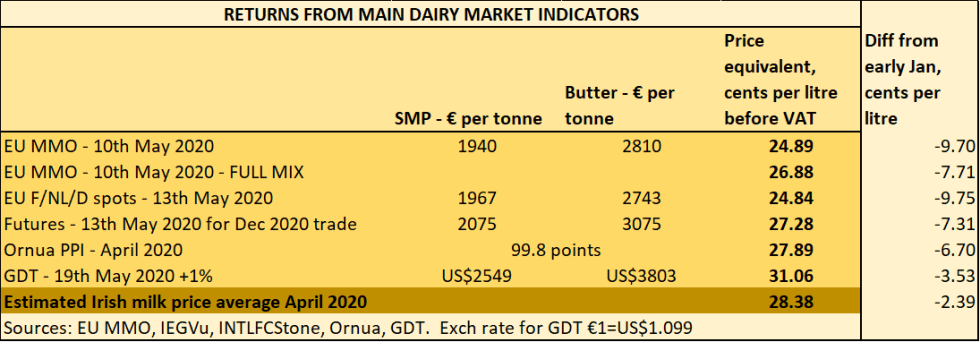

Dairy returns down on January, but some firming

Returns are still quite a bit below where they were in early January, as is clear from the table right, and remain for most of them just a little below our estimate of Irish milk prices for April 2020.

However, there have been some (small) improvement in spots in particular.

APS supports

A very limited APS scheme was reluctantly introduced by the EU Commission, with a budget of €30m for all of the EU’s dairy sector out of a total APS scheme of €76m. While it is clearly insufficient, the very fact that the EU has shown it would support the sector after giving very negative responses, has contributed to the bottoming out of prices, and in particular has helped remove the threat of SMP prices collapsing in short order to intervention level.

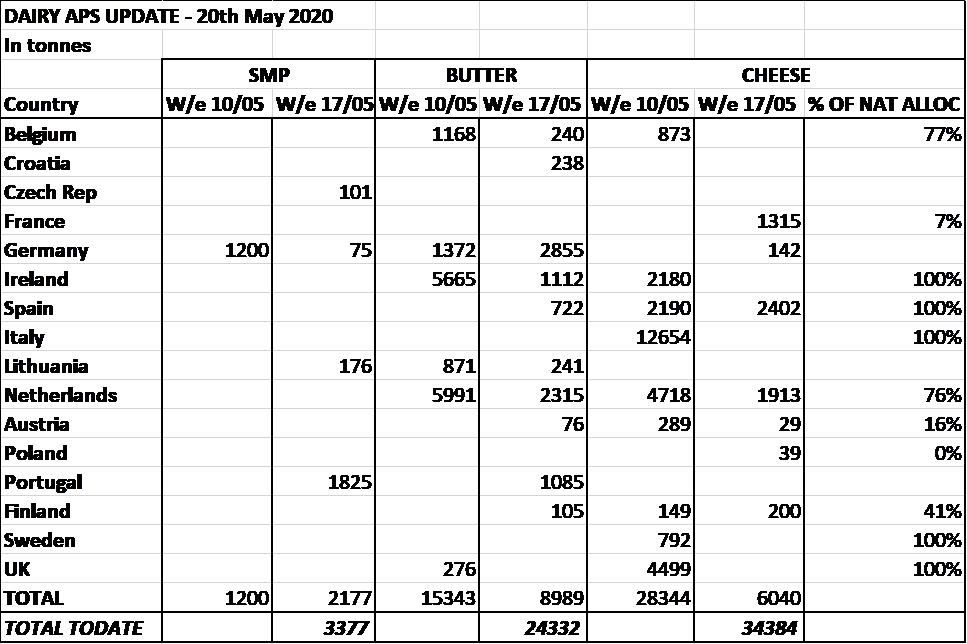

As we write (20th May), around 34% of the EU cheese for all countries (100,000t) has been utilised. Ireland had utilised its own very modest 2180t in the first few days of operation as had Italy, Sweden and the UK. They are now joined, by Spain, with the Netherland and Belgium have by now utilised ¾ of their own allocation.

Ireland has sought a reallocation of all unused quantities to boost its own very modest tonnage – but that remains to be seen.

A few countries have also put SMP into storage, with both more countries and more volumes of butter being stored in both the first and second weeks, as outlined in the table on the right.

Source of data: EU MMO

However more than APS supports which are extremely modest, other positive market signals have been crucial to helping dairy prices first bottom out, and now hopefully firm up – at least for powders.

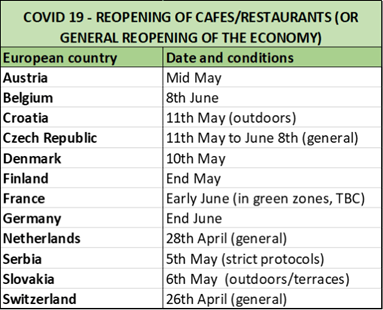

Firstly, there is the real prospect of food services coming back on line – very slowly – as countries world-wide progressively come out of lockdown and re-open their economies and societies. In Europe, most countries have either already reopened their restaurant/café trade, or will do so before the end of June. The table below is a roundup of the planned or already implemented measures by the main European countries with regards to reopening at least certain aspects of the hospitality trade.

Source: European Presidents CCEF

Further afield in China and the rest of Asia, where the progress out of lockdown is more advanced, food trade has increased substantially. For some markets, the pipelines are empty after the lockdown, and demand to to refill those is very significant.

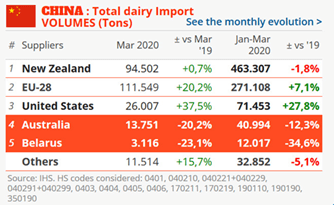

Food imports are being prioritised into China, for example, and the figures for imports (right) show strong results for March, benefiting the EU (and the US) in particular.

Source: CLAL.it

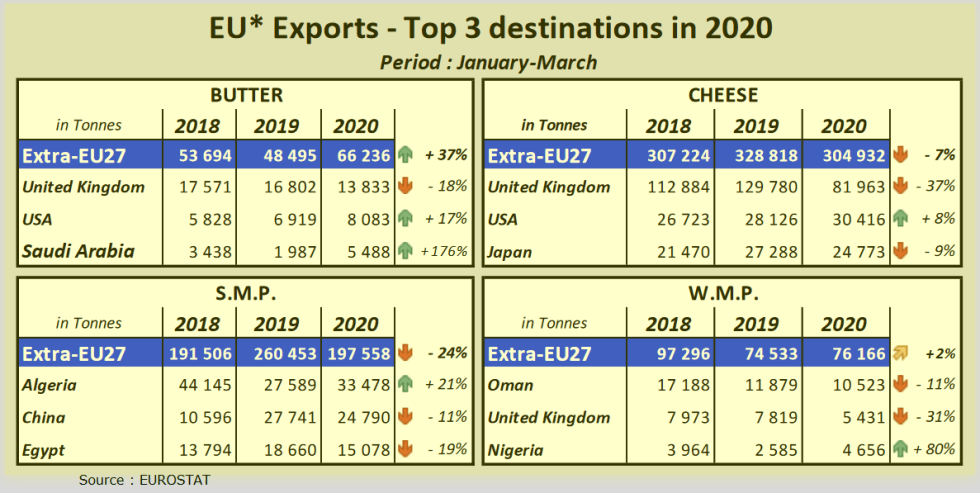

EU exports for the first quarter of the year have been a mixed picture, but with butter exports particularly strong at + 37% with the main focus on the US and Saudi Arabia in this increase. EU powder exports have also benefited greatly from Algerian purchases of SMP (+21%) and Nigerian imports of WMP (+80%).

The US also imported 8% more cheese from the EU than in the first quarter of 2019.

Source: EU MMO

GDT another positive

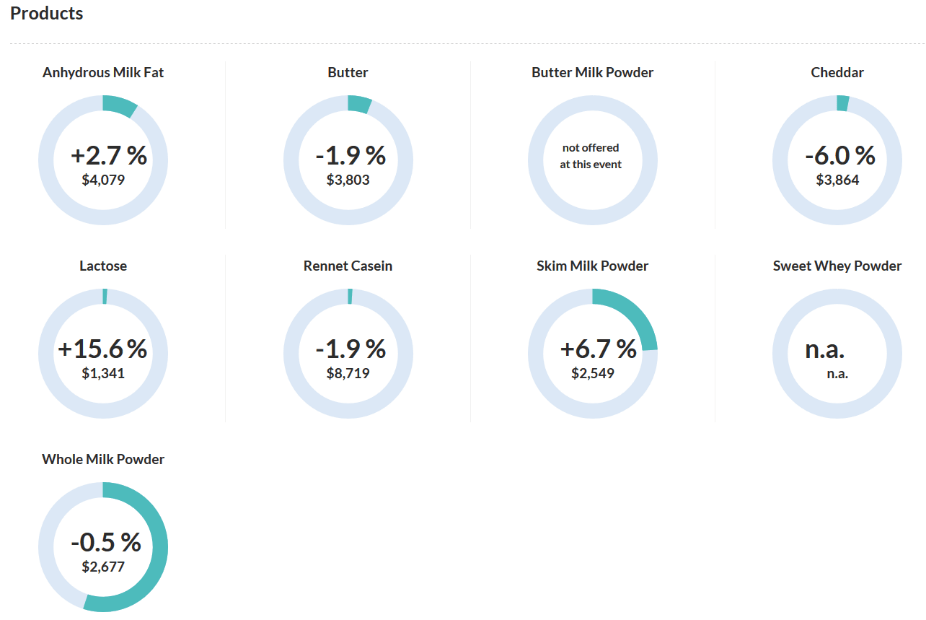

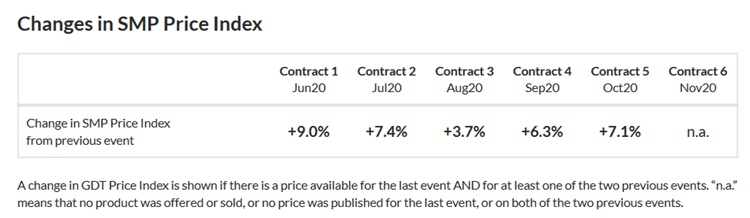

A further sign of more confidence returning to markets is this week’s GDT auction, which saw a modest index increase of 1%, but a spectacular 6.7% increase in the price of SMP – an increase which is consistently strong across the 5 contracts for which trade took place, with the strongest (+9%) for the first contract for June 2020 trade.

At -0.5%, the WMP price index was most positive for August 2020 trade (+1.7%).

While butter prices were disappointing at -1.9%, AMF (butteroil) was well up at +2.7%.

Lactose, which trades in very small volumes, was spectacularly up at 15.6%, and Cheddar cheese well back at -6%, with consistently poorer prices than in the previous auction at all 5 contracts it was traded for.

Source: GDT

What prospect for farmgate milk prices this summer?

After the major shock of up to 3c/l coming off the first two big months of the dairy year, and somewhat more optimistic prospects for dairy markets than was feared even only a few weeks ago, farmers could legitimately expect stable milk prices over the next few months.

Most co-ops, we have shown in throughout 2019 and into 2020, have undershot the most relevant indicators (including the Ornua PPI) for most of the last 18 months, and would therefore have some scope to hold prices while markets come back to meet them.

There remains some uncertainty, of course: Firstly, we do not know how long it will take for our food services customers to return to sufficient levels of normality after the COVID19 lockdown to constitute again a strong outlet for dairy products.

Secondly, we do not know the extent to which the impact of the lockdown on the economy will affect consumer purchasing power and demand.

And finally, the likelihood of a no-deal Brexit appears to have increased in recent weeks, as the UK refuses to seek an extension of the transition period which ends, reneges on its customs commitments between the EU and the UK with regards to the NI/UK/ROI situation, and as British MPs last week voted against a bill aiming to protect UK farmers in terms of food standards conceded on imports.

2020 will be a difficult year for farmers. Farmers will need support, from the EU and government in terms of market support measures and the provision of COVID19 related competitively priced working capital, and also from the perspective of achieving the best possible deal on Brexit, and should no deal be doable, to be supported in coping with the impact on markets and prices.

But they will also need support from their co-ops. The fact is that with COVID19 has created a huge challenge on the sector, which boards, management teams and most of all workers in co-ops have managed remarkably, by collaborating on complex re-organising and contingency plans which farmers are fully appreciative of. As a result, every drop of milk through peak is being collected and processed, which is crucially important for farmers.

Beyond this, however, co-ops must do everything in their power to hold prices at the highest possible level. The medium-term outlook is better than, or at least not as bad as, was earlier predicted. Farmers will need their co-ops to look to costs beyond milk prices, and just like farmers are having to do, reconsider their margin expectations for the year.