Domestic Market

The harvesting of winter barley is almost finished at this stage. Harvesting of Winter oats, wheat and rape is now underway; however, progress is slow and intermittent due to the broken weather. As expected, the impact of a difficult winter followed by drought conditions in late spring has had a devastating effect in some areas, with instances of grain and straw yields dropping by as much as 70% on last season. The situation is particularly acute from Kilkenny right up through the midlands and into the east and northeast.

Yields continue to be very variable even within farms, depending on soil type, planting conditions, rotations etc. With over 65% of the harvest still to be completed it is still too early to put a figure on total output this season. A lot will depend on the Spring barley crop which represents 54% of the total maincrop area this year.

Grain prices have softened slightly, however green harvest prices for barley and wheat still remain in the range of €140- €150/t and €158 – €162/t respectively. The future direction of Irish prices will depend on the international maize markets and the UK barley production situation in particular.

The EU Commission has reinstated the import levies on maize, from 12th August at 5.48 €/t. due to the decline of Chicago maize price and the parity of €/$. In addition, international maize futures rose by 5% towards the end of last week, all of which are keeping some floor on prices.

The UK wheat harvest will be down almost 7 million tonnes, while the barley harvest may be similar to last season. With only 20% of the UK Spring barley harvested a lot will depend on the actual yield of this crop. Some of this barley may replace wheat in feed rations although they also have to compete with cheap maize imports. The overhang of a no deal Brexit may also cause some panic selling of barley which would also force exports.

With 5 weeks remaining of the pricing model, The FOB Creil malting barley average price remains at €173/t. However, the main issue in the sector is actually getting barley to reach specifications. It would appear to be a higher protein year than 2019 therefore, derogations on protein etc will be necessary.

Irish Native / Import Dried Feed Prices 14/07/2020

| Spot €/t | Nov 2020 €/t | |

| Wheat | 196 | 193 |

| Feed Barley | 168 | 173 |

| FOB Creil Malting Barley | 173 | |

| Oats | 160 | 160 |

| OSR | 375 | |

| Maize (Import) | 187 | 175 |

| Soymeal (Import) | 330 | 330 |

International Markets

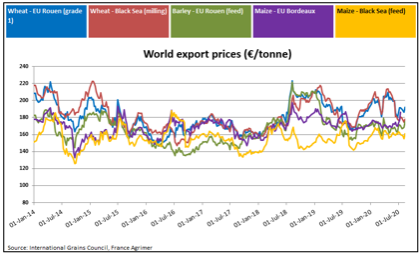

The most recent reports suggest, the world grain crop is lowered by 13 million tonnes since last month, but supplies remain comfortable.EU wheat prices had struggled again in recent weeks, due to an improvement in harvests in Germany and across the the Baltic and Black sea regions.

However, the front month Matif futures had fallen to €176/t but are now back over €180/t due to short covering and a jump in maize prices. With the French wheat harvest completed and, the German harvest almost over, EU wheat production is seen down over 13%. The UK and France have been hardest hit while Germany and Poland have fared better. The decline in the EU and the Ukraine production has been compensated by production increases in Russia and Australia, while the Argentina outlook remains positive despite current drought issues.

Chicago corn futures climbed to a one-month peak, last week rising on concerns over widespread storm damage to parts of Iowa and Illinois. In addition, last week’s USDA report, again raised questions over the certified area of US corn plantings. There are some drought concerns in certain US regions which is posing questions in relation to the exact potential of the US maize harvest. The potential of the EU maize harvest has also been questioned due to the recent spell of hot weather which has stymied crop development.

The soybean market surged last week due to increased Chinese purchases of US product. The pig herd in China has increased by 13% since last year as it recovers from the swine flu. The recent storm in the US has also damaged crops in the affected areas. The overall rise in crude oil and palm oil has also supported rapeseed prices. In addition, the rape harvest across the EU is only average which is providing further support to the market.