Feed demand is described as similar or slightly below last year. With the current price differentials between Irish and imported feed ingredients, there is considerable demand for native cereals. With more barley now replacing 3rd country maize imports the differential between the two products has narrowed from €35 to €20/t.

This season has again shown Ireland’s over reliance on 3rd country sub- standard feed ingredient imports which would be illegal to produce in the EU. In this regard it is welcome to see a group of international companies, urging major commodities traders to stop supplying soy linked to deforestation from the Cerrado, a vast savanna region in Brazil.

Forward green prices for harvest 2021 are somewhere in the region of €155/t for barley and €170/t for wheat.

The spectre of a hard Brexit continues to play a major role in UK prices. With 85% of UK feed barley exports going to the European Union, much will depend on a trade deal being agreed with the union by the end of 2020.It looks like UK Winter plantings will be back closer to the average which will result in more overall wheat production for the year but a reduction in barley production due to less predicted Spring planting.

On the malting barley front, the increase demand for feed barley and exports to China have used up all the old stock of malting barley throughout Europe. This has seen the FOB Creil price for the 2020 old crop reach €200/t while the 2021 crop is currently trading at €195/t.

Irish Native / Import Dried Feed Prices 15/12/2020

| Spot €/t | Feb/April 2021 €/t | |

| Wheat | 221 | 223-225 |

| Feed Barley | 194 | 194-198 |

| Oats | 180 | 180 |

| OSR | 400 | |

| Maize (Import) | 213 | 213 |

| Soymeal (Import) | 420 | 415 |

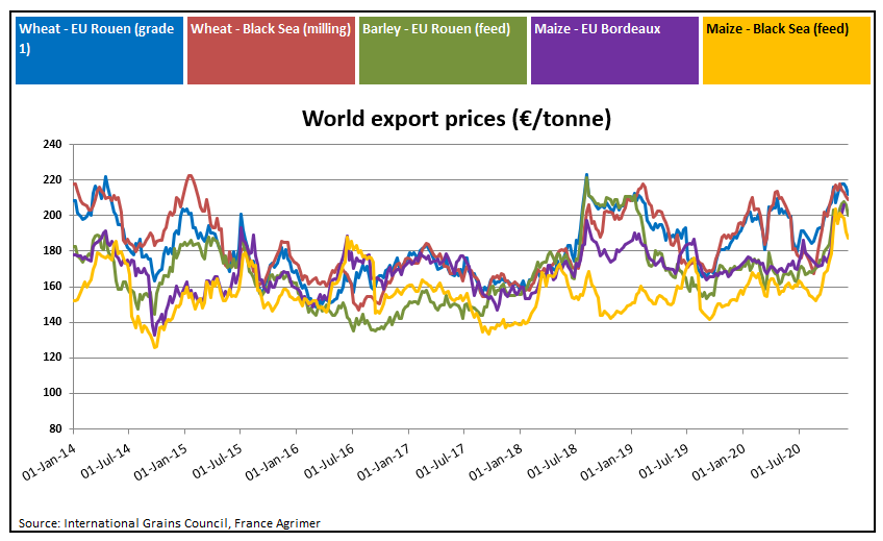

Following a decline in world wheat futures in recent weeks, the market has reverted to a bullish theme again. The most recent report from the USDA reiterated its forecast for a tightening in wheat supply coupled with demand increases. The announcement by the Russian government of a €25/t tax on Russian grain exports along with an export quota and another report on a poor outlook for the countries crops has been favourable for prices.

However, it must be noted that similar quotas have been in place previously and The Russian harvest has been the second largest on record, so its longer-term effect on price may not be significant. In addition, European wheat production should improve on this year’s figure based on the Winter plantings, unless weather etc. intervenes.

Corn (maize) futures remain strong, although the upward momentum has tempered recently. The buying by China has abated somewhat, however, with the national pig herd expected to fully recover to pre swine fever levels the buying should continue. The markets are watching weather developments in key production areas of Brazil and Argentina after dry weather early in the growing season raised concerns about the prospects for both the corn and soybean crops.

Soybean futures edged higher this week as strong demand pushed the oilseed to more than a two-week high. Due to high US and international demand, US soy processors recorded their third largest monthly crush on record.

Rapeseed and canola futures have risen in tandem with other oilseeds but also due to forecasted reduction in world production of the crop and reduced inventories. Global ending stocks are estimated at 5.09Mt for 2020/21, down from 5.205Mt and the lowest since 2007/08.