Spring planting is now in full swing with good progress being made throughout the country. There were 170,000 ha of Spring crops planted last year, however, this was only to compensate for the lack of Winter plantings. A combination of good weather and stronger forward prices might see Spring plantings reach 125,000 ha this year which, would see the overall main cereal plantings breach the 270,000ha figure.

Local supplies of feed wheat and barley have become very scarce which will ensure little carryover at the harvest. Now is an ideal opportunity for livestock producers and the Irish animal feed industry to secure supplies of Irish grain for next harvest. The feed sector needs to prioritise the use of native grain, to reduce its overdependence on imported grains from non – EU countries such as Brazil.

Forward green prices for barley harvest 2021 have weakened slightly, however, when compared to this time last year they are €16/t higher for barley and €10/t for wheat. In relation to maize and soymeal, forward prices for next Autumn have again strengthened for maize while soymeal has stabilised.

November rapeseed prices have taken a jump again to €425/t.

The FOB Creil July 2021 malting barley price, is trading above €210/t, however with China requiring 3.5mt of malting barley this season and Australia still out of the picture, the market should remain robust. The pricing tracker for those supplying Boortmalt will kick in on the 15th of April and will run until September 23rd.

Irish Native / Import Dried Feed Prices 31/03/2021

| Spot €/t | Nov 2021 €/t | |

| Wheat | 242 | 202 |

| Feed Barley | 210-214 | 188 |

| FOB Creil Malting Barley | 212 | |

| OSR | 425 | |

| Maize (Import) | 245 | 213 |

| Soymeal (Import) | 420 | 410 |

International Markets

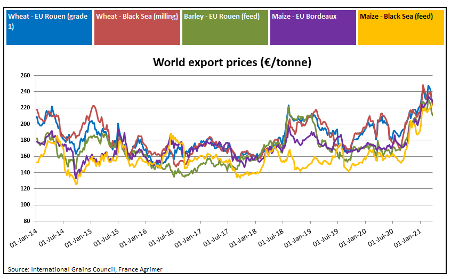

Matif wheat front month prices have weakened to €208/t while December is down to €196/t. Crops in Europe are reported to be doing well with much of the Spring planting now completed. The Black sea areas are just beginning Spring planting but Winter crops are reported to be looking well, particularly in the Ukraine.

The latest stocks and planting report released by the USDA yesterday, certainly surprised the market, causing a severe spike in spot prices for the main commodities. Stocks of maize were lower than expected but, the real news in the report, was the underestimation in the predictions for new crop plantings of maize and soya. There will be further updates in June, but if plantings remain below expectations it will leave the world supply/demand situation for both these commodities extremely tight.

The delay in the planting of the Safrinha maize crop in Brazil has been been compounded by dry conditions. This, along with news that the area of Ukrainian maize plantings could decline by 14% on last year is adding to the bullish sentiment in the corn market.

Production of oil seed rape in the EU/UK is predicted to increase by 1m tonnes to 17m this season. However, this will do little to offset the 6m import requirement of the region. The OSR market remains very strong going forward, however, the ultimate fate of prices will be dictated by production figures from the main exporting countries namely Australia, Ukraine and Canada.