Farm Business Council Report February 2024

VAT

The issue on items farmers not registered for VAT can claim VAT back on under VAT 58 claims continues. A delegation led by the IFA President and the Chair of the Farm Business Committee met with Revenue and the Department of Finance on 22nd of January in Dublin Castle on the issue. The seriousness of the issue was laid out by IFA. Revenue reiterated what the Statutory Instrument says on what can be refunded. It states the following is what refunds can be made upon;

- the construction, extension, alteration or reconstruction of any building or structure which is designed for use solely or mainly in his or her farming business,

- the fencing, drainage or reclamation of any land intended for use for the purposes of his or her farming business, or

- the construction, erection or installation of qualifying equipment for the purpose of micro-generation of electricity for use solely or mainly in his or her farming business,

After much discussion the following was the position on a number of contentious items;

Refunds will be allowed on drafting gates, new instillation milking parlours and hydraulic (automatic) scrapers. No refunds allowed on Heat and Health Monitoring systems, slurry bags or robotic scrapers. There are a number of other items we are still in discussion with Revenue on their inclusion and we will be making a detailed submission these to Revenue. Subsequent to this submission and consideration of it by Revenue they will issue a detailed guidance on what is reclaimable by farmers who are not registered for VAT

Separately due to the fact that some items are no longer receiving a refund means the TAMS grants on these items, which is based on the VAT exclusive cost are devalued. If the items has a VAT rate attached of 23% (which most equipment would have) then the TAMS grant is only returning a maximum of 32.5% of the cost rater than 40%. IFA are in correspondence with Minister McConologue on this matter and his lates response is below;

Increased Cost of Business Scheme

It was announced in the budget that the minimum wage will increase to €12.70 from 01 January 2024, an increase of over 12%. In response to the affect this will have on businesses Minister Coveney announced the Increased Cost of Business Scheme to support business with this extra burden. The announced scheme will be available and based on rates paid by businesses. As agriculture is exempt from rates it will mean that in its current form no business involved in primary agriculture will be able to avail of this scheme. The below letter was received from Minister Coveney on this issue.

Banking

The Committee recently met with both the Credit Unions and the SBCI. In the meeting with the Credit Unions they outlined how they hoped to get Cultivate rolled out to many more Credit Unions in the next year with a plan of reaching all rural credit unions as soon as possible.

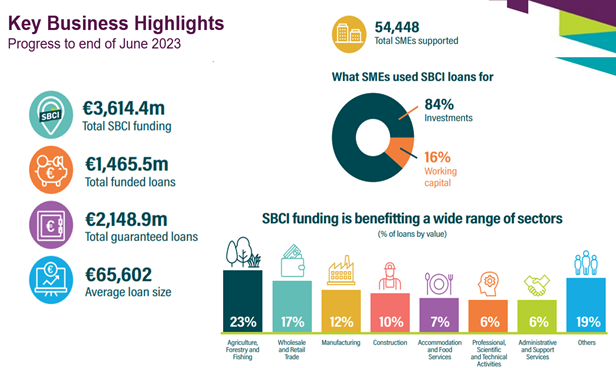

SBCI outlined the lending they have enabled into the Agri sector since it was set up in 2014. To the end of 2022 39.5% of all loans issued has been to the Agri sector and as per the below slide Agri is also its biggest sector by loan value.

Meeting with AIB.

The Farm business chair and the Environmental committee vice chair met a delegation from AIB on 29 of January. The main topic of discussion at this meeting was on the new reporting requirements AIB must adhere to going forward whereby tonnes of carbon emitted will be allocated across their loan book. This will see the Bank disclosing how much carbon is attributable to Agriculture, the means of calculating this will be based on EPA figures combined with best assumptions. It was also outlined at this meeting that in the future loans will not only be assessed on financial terms but also environmental, with more favourable terms available for those farming most efficiently.

Also discussed was the criteria AIB will use for assessing agri loans into the future in relation to the Nitrates directive. AIB stated that their policy is that all loans are assess at a nitrates level of 220 kgs of N per Hectare, if you are farming at a higher rate and for example using export of slurry to bring you to 220 kgs of N per hectare a notional land rental charge will be attributed to you for the amount of hectares required to bring you down to 220. It was indicated that there are no plans to assess loans at a lower rate currently but this could change if the internal risk function in AIB assess this is required.

It was agreed that close contact will be maintained between the AIB Agri team and IFA on both of these to ensure any possible affects are minimised as much as possible at farm level.

Residential Zoned Land Tax

The IFA Farm business Committee held an information webinar on this issue on Wednesday January 31st. The Farm Business Committee invited the Department of Housing, Local Government and Heritage and the Department of Finance to present at this webinar on the publishing of new maps on 1 February and the new opportunity for affected landowners to make submissions up to 1 April 2024.

A substantial number of questions were posed to the attendees from both departments and there was a high level of frustration among farmers on what this tax may do to their farms and livelihoods. James Staines IFA solicitor also spoke on this webinar on the issue of making appeals and the possibility of this tax being challenged through the courts.

IFA position always has been and will remain that all genuinely farmed land must be excluded from this tax and this point must be remembered by all, especially when lobbying local councillors on the run up to local elections later this year. If a farmer wishes to get their land dezoned it is the local councillors who have the power to make this happen

Next Meeting

- Teams meeting at 11am on Wednesday 28th of February.