April output back in many countries

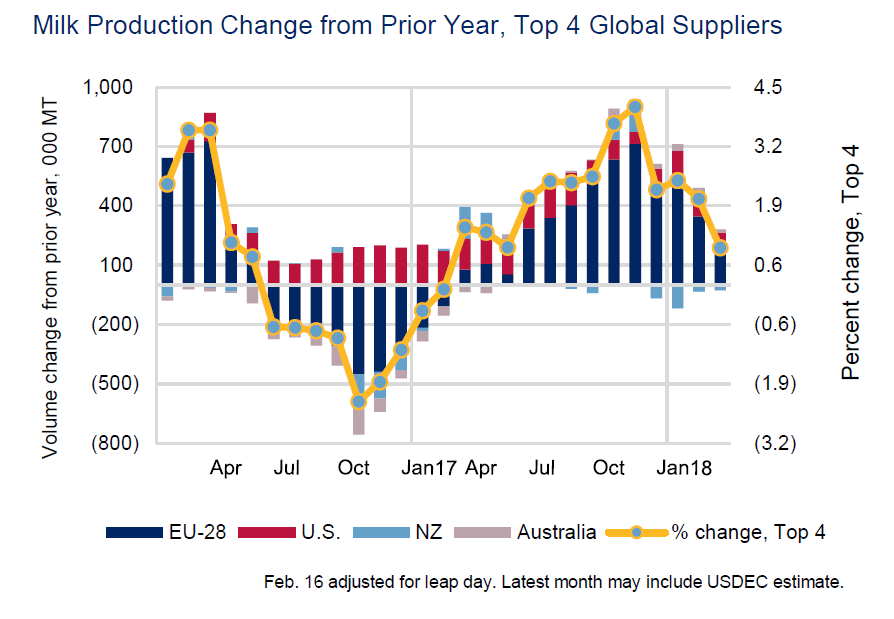

The graph right shows output to March 2018 for the main milk production regions. With the exception of New Zealand which registers a decrease in production for March, it is a case for most regions of far more modest growth.

In April, however, some important producing countries, especially around Europe have registered a decrease in output. Hence Irish milk supplies were back 5.9%, and French output is estimated down 1.6%, with an expected 0.6% decrease for May. UK April production is estimated at 0.8% below the same month last year, with May predicted to be down 0.3%.

In contrast, German output for the month of April has increased 3.5%, and Polish production by 3.7%.

US April milk collection were up a very modest 0.6% as higher feed costs and lower milk prices take their toll.

Source: USDEC

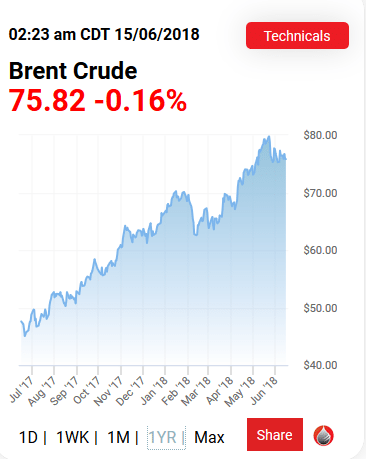

The view expressed by most analysts is that the turn around in dairy price trends in the last few months is down to this overall decreased global production growth, coupled with continued strong demand from emerging countries, especially China and SE Asia, with other countries better able to afford food and dairy imports as a result of improved oil export earnings (higher oil prices, now reaching between US$75-80 per barrel). SMP intervention stock – substantial disposal likely by year end

SMP intervention stock – substantial disposal likely by year end

The Commission are now considering increasing the number of monthly SMP intervention sales from 1 to 2 per month, possibly from July. The next tender is scheduled to close on 19th June, and is making 147,000t of SMP available to bidders. Results should be published a couple of days later.

The last two tenders (April and May) sold 66,000t at prices that were low but stabilised, and even increased by €100/t in May relative to April. The outcome of the next tender will confirm just how irrelevant to fresh product prices – rising progressively, see below – the intervention sales have become.

SMP prices recovering very slowly

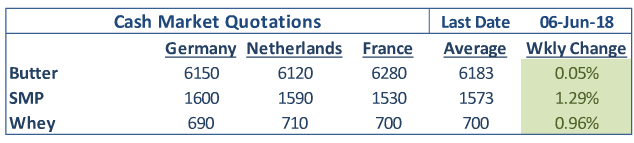

| Source: FCStone |

It is remarkable that SMP price for fresh products no longer appear to be affected by the intervention stock, but prices are slow to recover to “normal” levels. They have only just breached €1500/(actually €1520/t week ending 10th June) based on reported average EU market prices, and just exceeded €1600/t on German spots. Progress is slow, and buying in price is €1698/t – a “normal” price (let’s say the average of the 3 years ending 2015) would have been closer to €2500/t.

Source: FCStone

| Based on EU MMO data |

There is some concern that butter prices are too high to be sustainable – the average over the same 3-year period was €3000/t – and need to be rebalanced by greater increases in SMP prices – which will hopefully continue to materialise as the summer progresses. Recent butter price increases have been more tentative, and more modest.

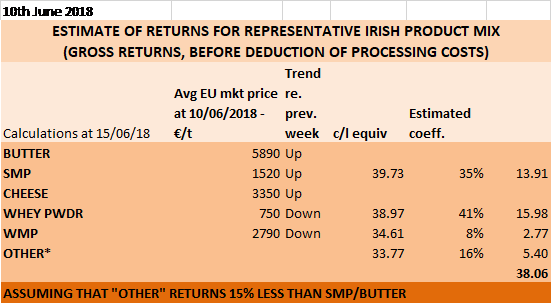

EU MMO reported returns, at a gross 38.06 c/l for the nominally representative Irish product mix, before deduction of processing costs, would now support price increases relative to what Irish co-ops are currently paying. Co-ops must recognise that not only have we seen the end of milk price cuts, we are now coming to a point where milk price increase are totally realistic. While this is a snapshot in time, and may not reflect the exact product mix of any one co-op, it nonetheless suggests that improved returns are becoming increasingly available for our co-ops, which should enable them to pay improved prices this summer.

The current (10th June 2018) EU MMO returns would support a milk price after deduction of a 5c/l nominal processing cost of 33.06c/l + VAT (34.84c/l including VAT).

Based on EU MMO data

European and New Zealand milk purchaser have already moved to increase prices

Friesland Campina have announced an increase in June milk prices of +€0.25/100kgs to €34.25/100kgs, while Arla Denmark announced a 1c/kg uplift. For UK Arla suppliers, this translates into an increase of 1.15ppl. (Get actual prices for both here). Any July price increase announcement by those?

First Milk (UK) have announced a 1.2ppl price lift for July to 28.58ppl (32.85c/l) .

Fonterra have revised the 17/18 pay-out (price + dividend) to NZ$6.90-6.95/kg MS (equivalent to roughly 30c/l incl VAT at Irish standard constituents); and announced their first price forecast (no dividend yet) for 18/19 at NZ$7.00/kg MS (30.5 c/l incl VAT).

Scope for price increases for Irish farmers

The Ornua PPI for May rose 5 points to 105.4 points, equivalent to a VAT exclusive milk price of 29.8c/l. This was a few points more than anticipated even only a few weeks ago, and is yet another sign that Irish co-ops are benefiting from the improved market returns we have been highlighting in this blog for a couple of months now.

Spot SMP/butter on 6th June 2018 would return a gross equivalent of 41.5c/l before deduction of processing costs. The average EU returns as reported by EU MMO for 10th of June around 38c/l – also before processing costs.

It is very clear that steadily improving returns are now translating into higher priced contracts between processors and their customers. Some co-ops have held their May payout, some even rolling in their bonus of last month into the base, a welcome move which secures it for future months.

It will be important for all co-ops to start leveraging those improved returns to pass back strong price increases on June milk and beyond

CL/IFA/15th June, 2018