Dairy Market Outlook and Analysis – December 2018

Recovering EU milk supplies and stubbornly overhanging SMP stocks, will likely be the main factors influencing milk prices in 2018. Thankfully, demand remains strong, with EU exports continuing to grow in recent months, and strong demand increases in China and the rest of South East Asia, and in South America.

So, as 2017 draws to a close, what will next year have in store for Irish dairy farmers?

EU milk production growing strongly

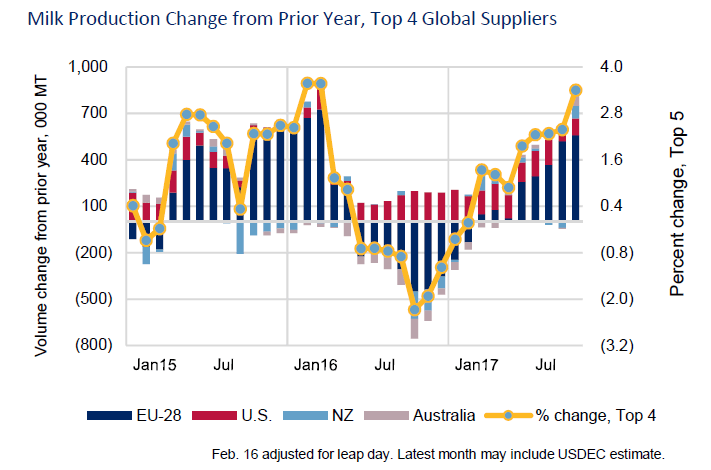

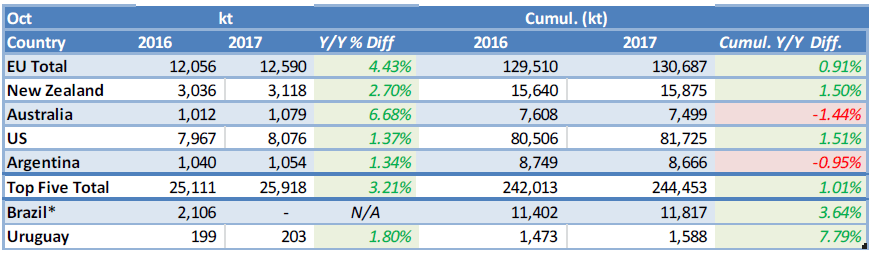

The USDEC compilation of milk production for the top 4 regions in the globe up to October shows a return to strong growth, with the main 5 regions supplying an estimated 3.21% more milk, mostly caused by the recovery of EU milk output.

Source: USDEC

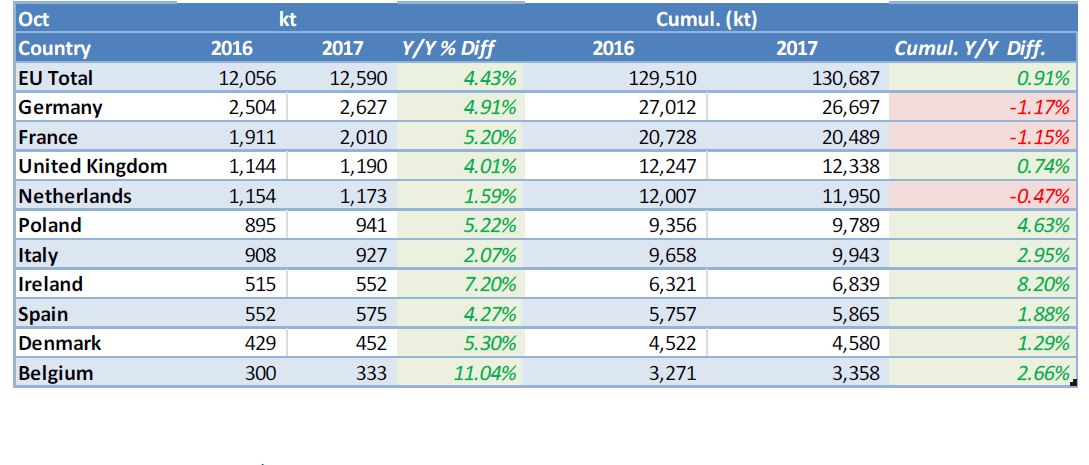

EU production grew 4.43% in September, and a further 3.97% in October. The main impetus for this growth is to be found in France and Germany, which until August had been in negative growth territory.

Germany lifted output by 3% in September, and a further 4.9% in October, though year todate Germany is still down 1.17% on last year. France has experienced the same trend, after a negative first half. September supplies were up 4%, and October’s 5%. Supplies year todate are 1.15% down on the same period last year.

We should of course remember that, this time last year, both countries were among the strong users of the EU incentivised milk production reduction scheme, and still low (though rising) prices were not yet incentives to extra output.

Even the Netherlands, which earlier this year implemented a Nitrates Derogation-related herd reduction scheme which took out around 50-60,000 dairy cows from the national herd, have seen their output tip into positive territory in October, up 1.6%. Year todate, Dutch milk production is marginally down, by 0.47%.

Clearly, the vast majority of EU member states with a reasonably significant dairy activity have seen a strong recovery starting over the autumn.

Source: FCStone International

In the US, production has been quite resilient throughout the year, at around 1.1% to 1.8-2% up most month on the same month in 2016. For October, supplies were up 1.37%, and by a further 1% in November.

New Zealand output is also up, though the early spring was wet and depressed production, and weather continues to be challenging – this time with moisture deficit. Supplies are up 2.7% for the month of October, and by 1.5% for the calendar year todate.

Australia also registered very strong growth in October, up 6.68%, and the trend is also to growth in recent months in South America (Argentina, Brazil and Uruguay).

SMP intervention stock – 101,000t on offer in January

Tenders for the sale of SMP out of intervention stock started 12 months ago, and over that period, only 220 tonnes in total have been sold, over 15 tenders, out of just over 20,000t made available by the EU Commission – it being the SMP sold into intervention up to November 15.

The prices at which those tenders were adjudicated reflected the weakening market price, going from €2151/t 12 months ago to €1390/t in the tender of 21st November. The most recent tender, on 12th December, saw no sales as the EU Commission chose not to accept the top price bid (€1300/t). It should be noted that in the last two tenders, the lowest bids made were €800/t – someone taking the proverbial?

Tender number 16 is scheduled for 16th January, and this time the EU Commission is making available product sold in up to April 2016, a total of 101,000t. Time will tell what impact this will have on the pricing expectations of buyers.

On the proposed buying-in method, an attempt at a “silent” (written) procedure failed earlier this month, so the topic is now up for discussion by the SAC or the Agriculture Council at some point in the New Year. Our information is that the Commission’s proposal to not guarantee a fixed price from the very start of the buying in period appears to have strong support from member states, and will likely come to pass. It would be crucial that this frankly regrettable move would be exceptional, and would not create a precedent for intervention buy in either before the end of the current CAP or into the new, post-2020 CAP.

The French have requested that the overall strategy around SMP intervention be debated by the Agriculture Council, most likely in late January. This is vital, as it is important that the value of intervention in providing a safety net for milk prices would not be jettisoned in the rush to eliminate problematic stock!

Source: EU MMO

]Dairy prices easing

The nearly €7,000/t spike in 2017 butter prices could not last, and as milk output started to recover, so the butter prices started to fall. They remain between €4,500 and €5,000/t (€5,160/t is the latest official EU average communicated by the EU MMO as we write), with spots suggesting further decreases.

Weak SMP prices, as well as increased availability of milk for processing, have also put pressure on other protein prices, with whey powder, whole milk powder and casein prices all sliding.

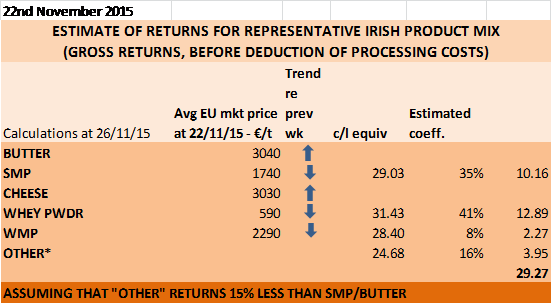

Returns from the representative Irish product mix have eased to a current (10/12/2017) 35.4c/l gross.

Based on EU MMO data

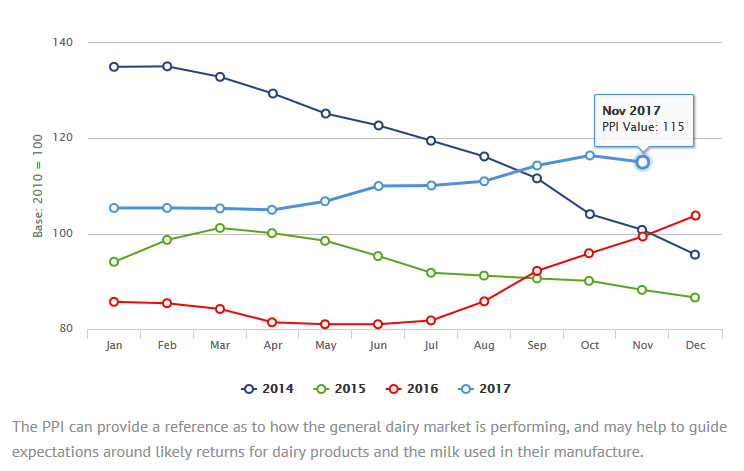

The Ornua PPI has however duly reflected the delaying factor of forward contracts on the way down, and it is only for November that the index has eased – and at that only slightly compared to October. The November milk price equivalent of the PPI was calculated by Ornua at 33.11c/l + VAT (34.9c/l incl VAT) – significantly better than average market returns reported by the EU MMO.

Source: Ornua

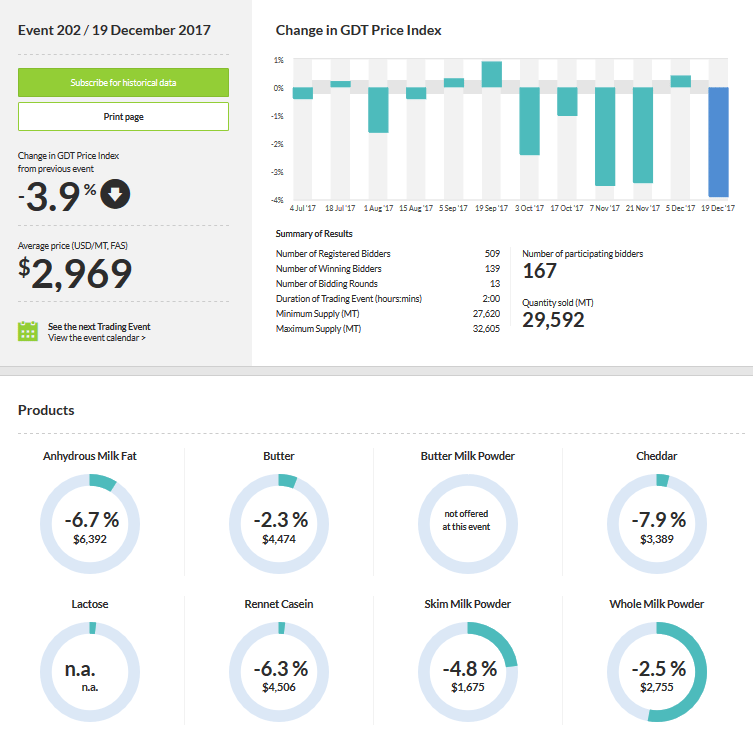

The GDT auction, which while concerning only a small minority of world dairy product trade is nonetheless hugely influential due to its public and immediate nature, has also shown general weakness in the price of all dairy products at global level in its most recent event (19th December).

The butter and SMP prices reached at the 19th December auction, allowing for the current US$ exchange rate, would return around 30c/l gross.

Source: GDT

Strong demand factors expected to hold

While supply side factors are causes for concern, there is a really positive upside on demand.

A return to strong economic growth

According to the EU Autumn Economic Forecast, for 2017: “The euro area economy is on track to grow at its fastest pace in a decade this year, with real GDP growth forecast at 2.2%. This is substantially higher than expected in spring (1.7%).

The EU economy as a whole is also set to beat expectations with robust growth of 2.3% this year (up from 1.9% in spring).

The European Commission expects growth to continue in both the euro area and in the EU at 2.1% in 2018 and at 1.9% in 2019 (Spring Forecast: 2018: 1.8% in the euro area, 1.9% in the EU).”

At global economic level, Goldman Sachs Research economists Jan Hatzius and Jari Stehn say that “For the first time since 2010, the world economy is outperforming most predictions — a trend that will not only be continuing but amplifying in 2018.” Their November global economic forecast predicts 4% global GDP growth for 2018.

Brexit aside, a return to strong economic growth in the EU and globally, and continuing falling unemployment are good news for consumer spend and consumption.

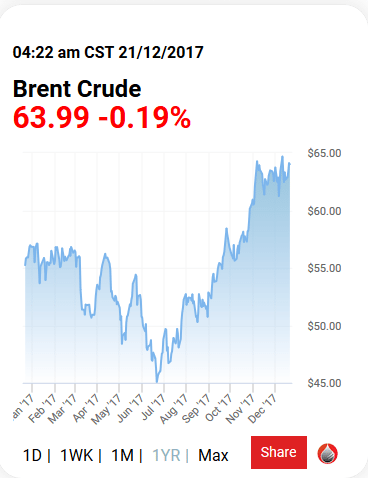

Recovering oil prices

Higher oil prices in recent months have had a positive impact on the purchasing power of many global food importers and dairy customers.

When prices were below US$50/barrel, the point was often made that prices in excess of US$60 would have a positive influence of global dairy purchases.

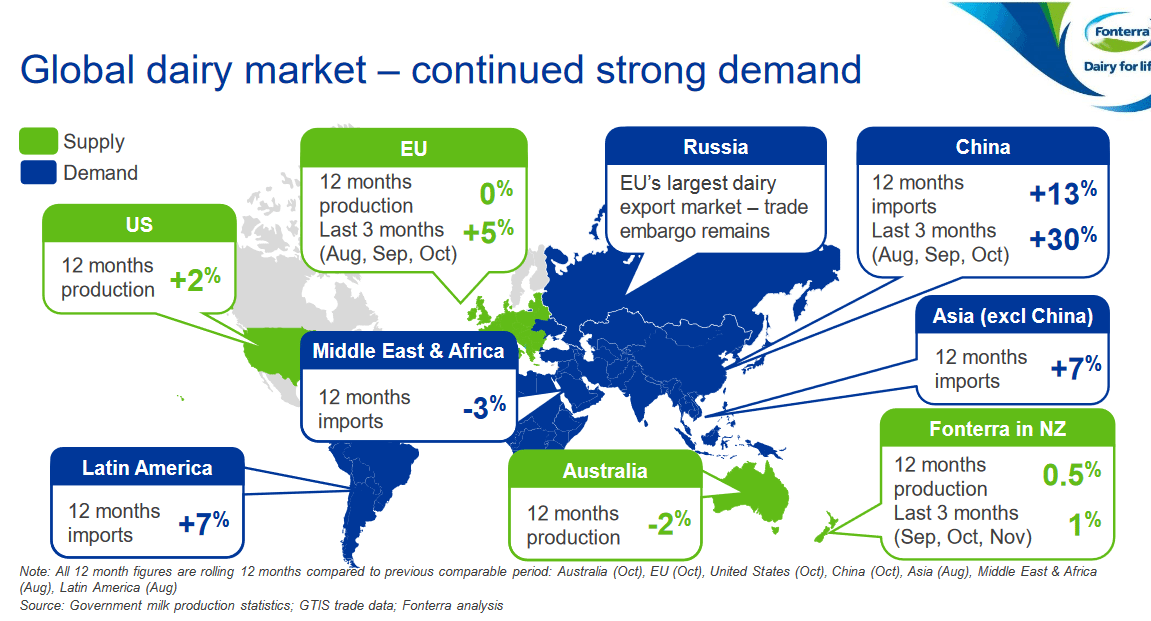

Strong demand growth continues in China…. And elsewhere!

Strong demand growth continues in China…. And elsewhere!

The infographic below is a neat summary of both supply and demand trends, courtesy of Fonterra. It shows in particular very strong demand trends in China, Asia generally, and Latin America, with a more sluggish situation for the Middle East and Africa, which may improve into 2018 as a result of higher oil prices.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

Source: Fonterra

Rabobank predictions for 2018

In its 2017 Quarter 4 Dairy Report, Rabobank points out that the growth of exportable surpluses of milk has affected market sentiment during Quarter 3, with uncertainty on EU policies (especially intervention) and geopolitical concerns (Brexit, Trump foreign/trade policies…) feeding into this.

Production trends in the EU over the first half of 2018 will be watched closely, Rabobank says, and they expect exportable surpluses to grow further – though the signals of lower milk prices and some attempts by processors to limit supply growth may mitigate this.

They confirm their views that the growth of exportable production is unlikely to overwhelm demand, which is growing strongly, and expect China to continue to feature strongly.

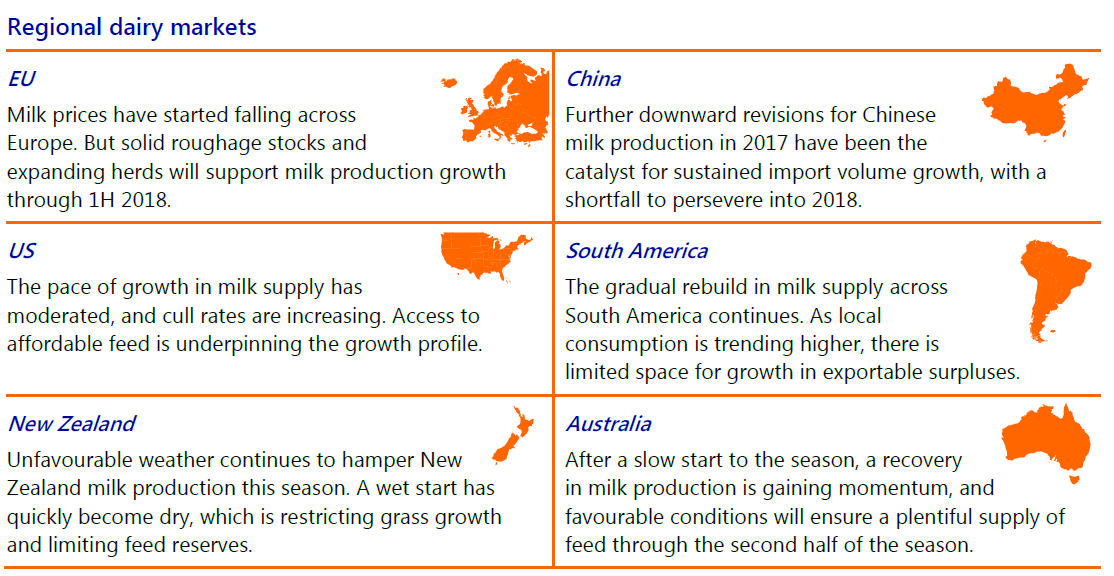

The following is their regional forecast:

Source: Rabobank

Milk prices easing in Europe, New Zealand and the US

Milk supplies are much less seasonal in Europe than they are in Ireland. Our seasonality has historically protected farmers from winter/very early spring price cuts in the event of market downturns, because of the low volumes and relatively lower cost of holding prices.

Friesland Campina have reduced their December price 0.25c/kg to 41.50c/kg (this is for milk at 3.47% protein, 4.41% butterfat).

Milk prices have started to ease for some EU and international farmers: Fonterra have revised their forecast 2017/18 price from NZ$6.75/kg MS to 6.40/kg MS (note this does not include whatever dividend will be paid for the season).

In the US, prices have stabilised after some relatively modest growth in 2017, with an October price reported at US$17.90/lb.

We have shown in our recent analysis – see our December newsletter on this – that Irish co-ops have benefited considerably from improved markets in 2017, over and above what was passed back to farmers.

Co-ops should have sufficient comfort to hold prices well into spring, and to take a leaf out of the Carbery book, who have announced they will pay a 1c/l bonus on all 2017 supplies!