Beef Update

IFA Livestock chair Declan Hanrahan said as beef prices move upwards, factories must do more to keep pace with prices in our key export markets. “Strong demand and tight beef supplies here and across the EU are driving the trade in the primary markets we export into, but factories are failing to reflect the strength of these markets in prices paid to farmers,” he said. The latest Bord Bia prime export benchmark price has strengthened again and has now opened a gap of 50c/kg with the Prime Irish Composite price. UK prices are now over €1/kg above ours. Demand for beef in these markets are very firm in the lead up to Christmas creating strong demand for Irish beef. “Factories are currently filling orders for these markets and with supplies of suitable In-spec cattle tight, prices must move on to reflect the full value of these market to farmers,” he said. “There is a 5c/10c/kg difference between quoted and paid prices. The price factories are willing to pay is evident in marts where finished and store cattle are freely exceeding what they are offering in most cases,” he said. Up to €5.30kg and €5.35kg base price has been secured this week for steers and heifers and farmers should not be misled with the lower quotes. Declan Hanrahan said market conditions justify stronger prices and it’s vital factories move to close the gap with the key markets we are exporting into.

Beef Price Update 08/11/2024

Base Quotes Steer €5.15/5.30kg. Heifers €5.20/5.35kg. Higher deals and flat prices for larger and specialist lots. Y Bulls R/U €5.30/5.50Kg. Cows €4.50/5.20kg.

Supply Figures as Reported by DAFM – WK 44 (03.11.2024)

| Animal | Number | Change prev wk | % of total | YTD | YTD Change |

| Y Bulls | 1,190 | ▼-283 | 4% | 89,907 | ▼-8,360 |

| Bull | 420 | ▼-45 | 1% | 24,969 | ▲820 |

| Steer | 13,168 | ▼-2,768 | 39% | 583,838 | ▼-11,099 |

| Cow | 8,995 | ▼-1,265 | 27% | 368,439 | ▲32,835 |

| Heifer | 10,010 | ▼-1,768 | 30% | 431,476 | ▲19,216 |

| Veal-V | 26 | ▲11 | 0% | 20,362 | ▼-10,306 |

| Veal-Z | 35 | ▼-7 | 0% | 1,571 | ▲194 |

| Total | 33,844 | ▼-6,125 | 100% | 1,520,562 | ▲3,665 |

Official Irish Prices as Reported by DAFM – WK 44 (03.11.2024)

| c/kg (Incl. VAT) | U3 | Change prev wk | R3 | Change prev wk | O3 | Change prev wk | P+3 | Change prev wk |

| Steers | 551 | ▲5 | 539 | ▲3 | 527 | ▲7 | 500 | ▲6 |

| Heifers | 557 | ▲6 | 547 | ▲6 | 540 | ▲4 | 496 | ▲3 |

| Y Bulls | 544 | ▲4 | 539 | ▲5 | 522 | ▲5 | 508 | ▼-4 |

| Cows | 0 | ▲0 | 504 | ▲5 | 473 | ▲7 | 452 | ▲4 |

Official GB Prices as Reported by AHDB

| Steers | Steers | Heifers | Heifers | Y bull | Y bull | Cow | |

| p/kg | R3 | R4L | R3 | R4L | R3 | R4L | -O4L |

| 26/10/2024 | 522 | 526.5 | 519.5 | 524.9 | 509.6 | 508.0 | 376.2 |

| 02/11/2024 | 522.7 | 526.6 | 519.9 | 525.2 | 505.2 | 511.3 | 373.2 |

| Change | ▲1 | ▲0 | ▲512 | ▲0 | ▼-4 | ▲3 | ▼-3 |

| Price in c/kg (Incl VAT) | 657.1 | 662.0 | 653.6 | 660.3 | 635.1 | 642.8 | 469.2 |

Euro Price for the Most Recent Week (€/KG Deadweight excl. VAT)

| Country & Type | 22.10.2022 | 21.10.2023 | 26.10.2024 |

| EU + Y Bulls | € 5.00 | € 4.89 | € 5.38 |

| IE + Steers | € 4.59 | € 4.58 | € 5.12 |

| UK + Steers | € 5.08 | € 5.51 | € 6.16 |

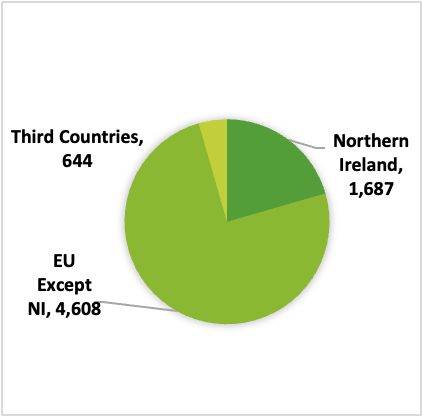

Live Cattle Exports 21st October

Sheep Update

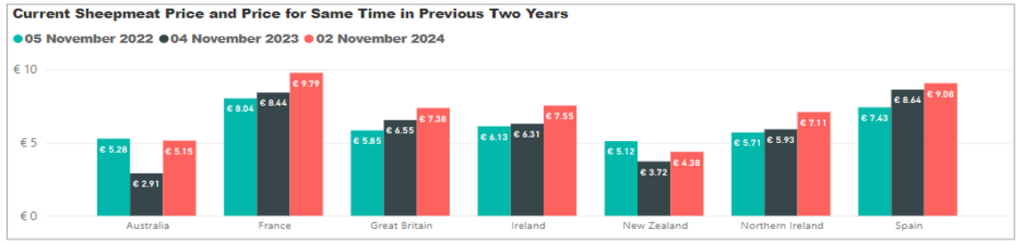

IFA Sheep chairman Adrian Gallagher said lamb prices continue to rise as factories struggle to match supplies with market demand increasing a further 10c/kg this week. He said supplies of suitable finished lambs are extremely tight on the ground as weekly spring lamb throughput continues to fall. Total lamb throughput is currently back 9% to date in 2024. Supplies of sheep meat produced across the EU and UK are also down this year and factories must stand firm and maximise returns from the market place for sheep farmers He said prices for lambs are making from €7.60kg to €7.90kg in general with up to €8.00kg paid on weights to 23.5kg. Cull ewes are making from €3.80kg to €4.20kg in general. The mart trade has also strengthened for finished and store lambs ensuring farmers are under no pressure to offload lambs to factories that require further feeding. The IFA Sheep chairman said the lower volumes of supplies available here and the reduced imports of lamb from outside the EU to our key export markets will help underpin the trade for the remainder of the year. Adrian Gallagher said its important factories continue this upward trajectory in prices to maintain confidence in the sector and ensure store lamb buyers remain active in marts.

Lamb Price Update 08/11/2024

Spring Lamb €7.60kg/8.00kg. Weights to 23.5kg. Higher deals groups/larger lots. Ewes €3.80/4.20/kg.

Supply Figures as Reported by DAFM – WK 44 (03.11.2024)

| Animal | Figure | Change | YTD | YTD Change |

| Lambs/Hoggets | 146 | ▲46 | 897,797 | ▼-84,331 |

| Spring Lambs | 37,273 | ▼-1,626 | 1,043,174 | ▼-103,269 |

| Ewes and Rams | 4,696 | ▼-769 | 241,650 | ▼-43,121 |

| Light Lambs | 0 | ▼-1 | 112 | ▼-26 |

| TOTAL | 42,115 | ▼-2,350 | 2,182,733 | ▼-230,747 |

Official Irish Prices as Reported by DAFM – WK 44 (03.11.2024)

| c/kg (Incl. VAT) | This week | Change prev. wk | 2023 | Change prev. yr |

| National Avg Price | 755.07 | ▲15 | 630.58 | ▲120 |

| YTD Avg | 774.29 | ▼-1 | 662.54 | ▲111 |

Official GB Prices as Reported by AHDB

| R3L | Overall SQQ* | Type of lamb | |

| 26/10/2024 | 621.5 | 619.2 | New season Lamb |

| 02/11/2024 | 616.9 | 614.0 | New season Lamb |

| Change | ▼-5 | ▼-5 | |

| Price in c/kg (Incl VAT) | 757.5 | 753.9 | 1 |

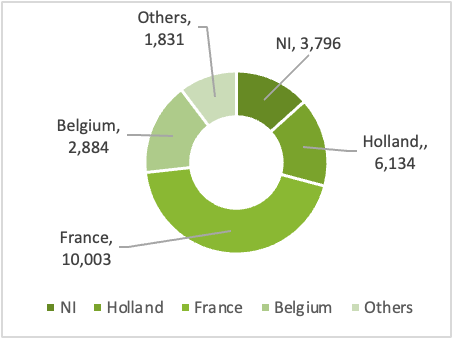

Live Sheep Exports 15th October