Focus on SMP: markets recover globally as intervention stocks collapse

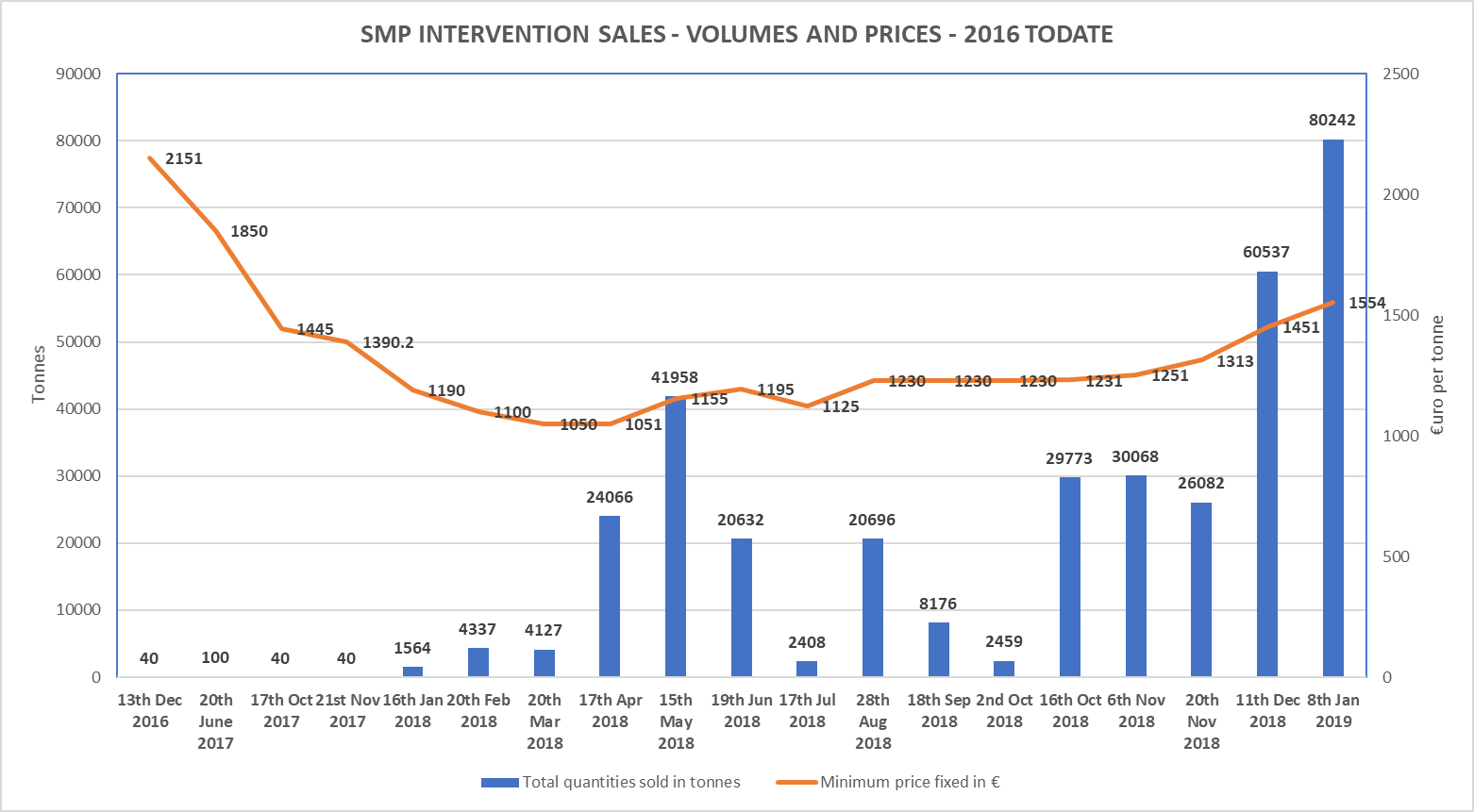

The positive indicators for SMP markets have continued to mount up into the New Year, the most remarkable probably being the rapid sales of increasingly large tonnages out of intervention at rising prices. A total of 357,345 tonnes have been sold out of intervention in the period from December 2016 to-date, leaving only around 22,000t in stock after a whopping 80,242t were sold earlier this week.

The minimum sales prices have been rising since last July, now practically matching fresh Dutch and German spot quotes for feed grade powder. At €1554, the most recent minimum accepted price was about on par with the EU average spot quotes for feed grade powder quoted for 9th January 2019.

Based on EU MMO data.

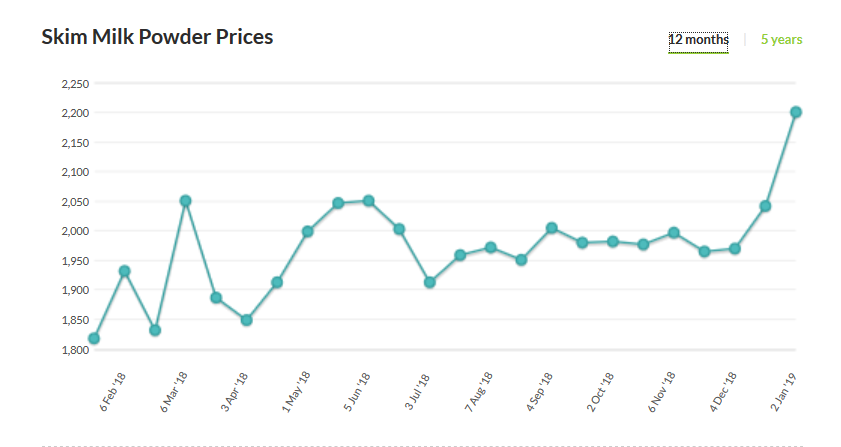

With very strong SMP exports out of the EU in 2018, all SMP price quotes are also on the up, from EU market averages to GDT trends, as are forward indicators such as spot quotes and futures. Now that intervention stocks have dropped to below their March 2016 level, will we see a continued recovery in SMP prices, and a rebalancing of the butter/powder prices to more “normal” levels? GDT SMP prices have been rising steeply in the last three auctions – albeit from very low prices – to a level of US$ 2,200 last seen in June 2017.

Source: GDT

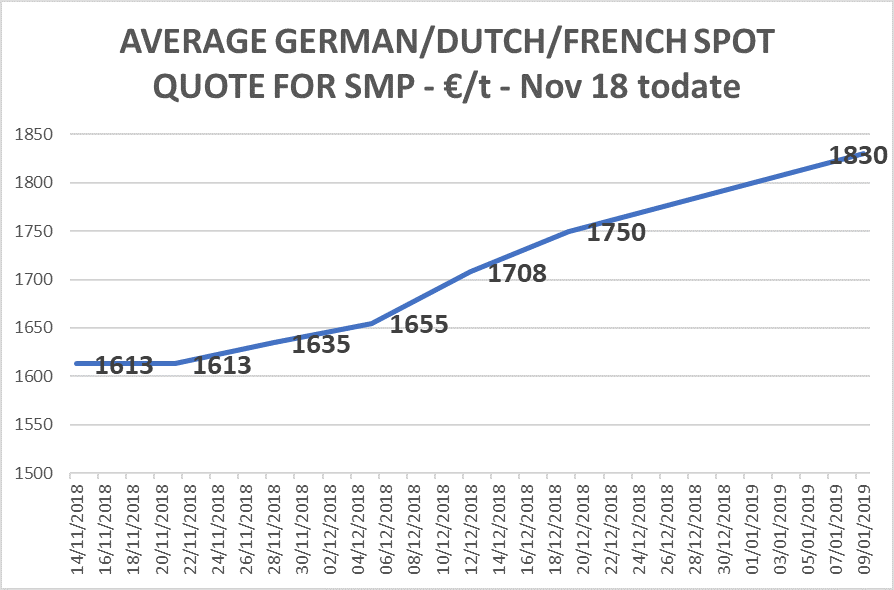

European spot quotes for food grade SMP have also improved consistently in recent weeks, with Kempten (German), France Agrimer and Dutch PZ quotes now at €1830/tonne. We are even hearing anecdotal trade at prices nearing €1900/t.

This is happening at the same time as significant sales out of intervention for what must by now be feed grade SMP are reaching prices that are on par with fresh feed grade product spot prices.

On 9th January, the Dutch PZ spot quote for feed grade powder was €1580/t, while the German (Kempten) quote was €1550/t – about the same as the most recent minimum intervention selling price. While the spot market trends suggest where average market returns will become in the short term, futures deal with the medium to longer term trends.

Even futures markets are looking up for SMP, with latest EEX quotes suggest prices rising above €2000/t by the end of 2019.

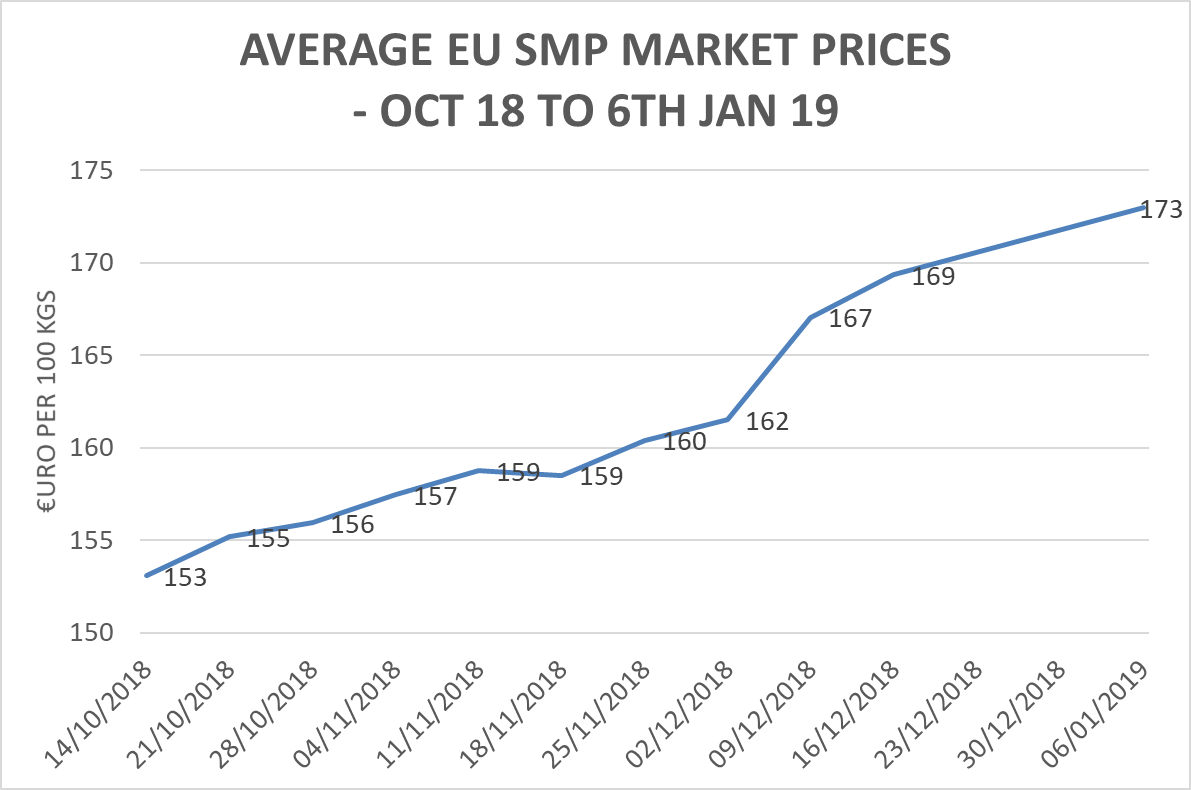

Average EU market prices also reflect this same trend. In the first week of January 2019, they reached €1730/t.

It is also the improvement in the spot and market prices of SMP which caused the December Ornua PPI to increase from 104.9 points to 107.5, equivalent to a milk price of 30.55c/l + VAT (32.2c/l incl VAT).

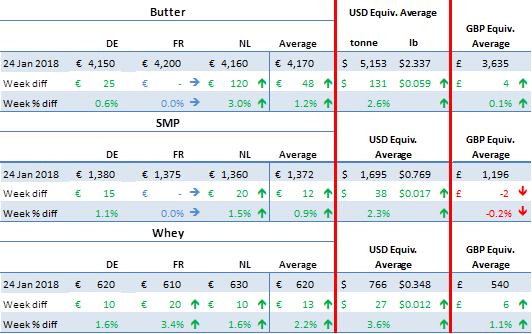

Source: INTL FCStone

Source: EU MMO

Returns from other products, apart from whey and Emmenthal cheese, are easing

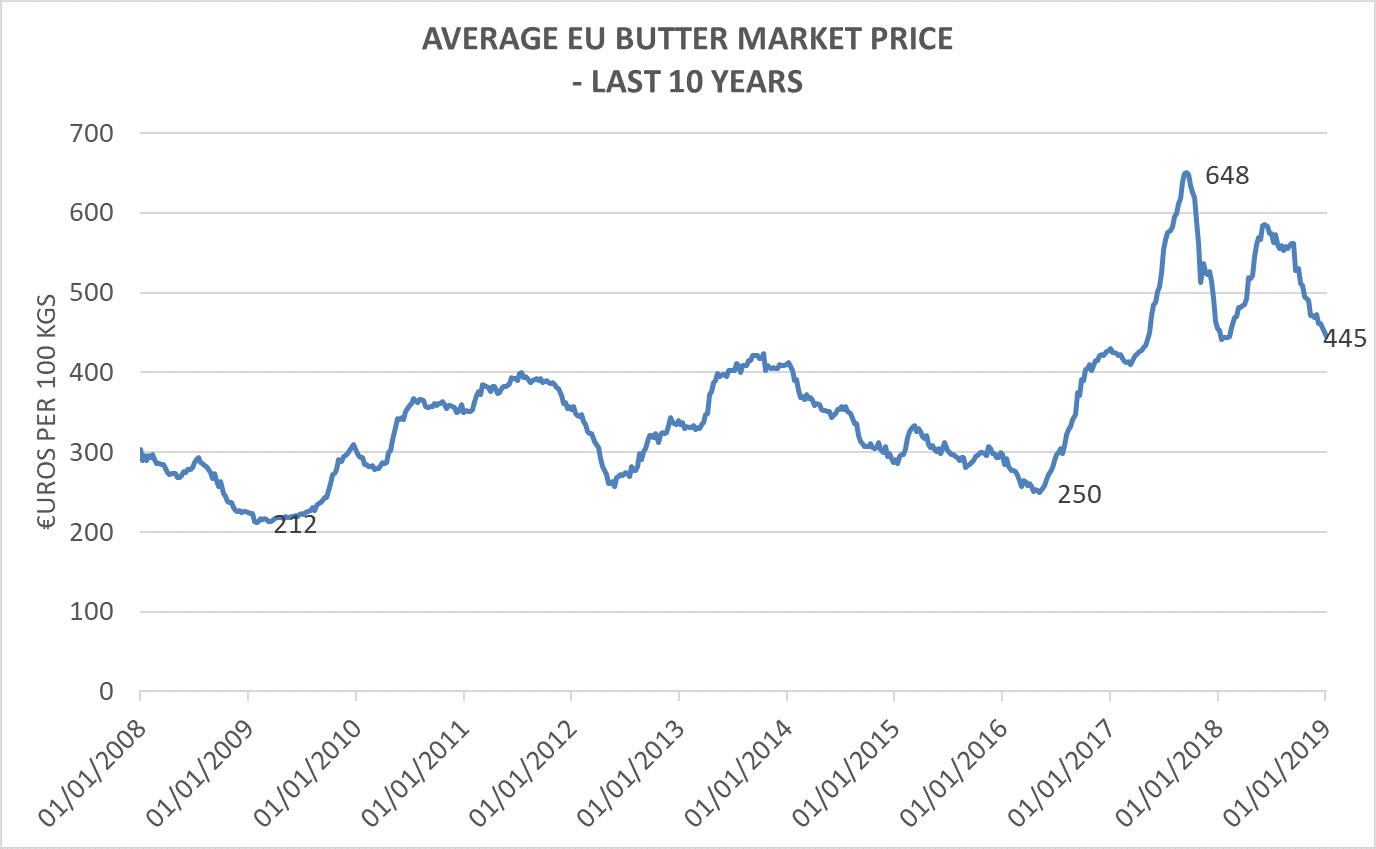

It is important to state that, while many bemoan just how much butter prices have eased since the vertiginous peaks of 2017, at around €4300 (spot) and €4450 (early January average EU price), they remain significantly above the average of the last 10 years.

This is however a significant reduction in the last 15 months, and one which has yet to be fully offset by still historically weak SMP prices, at least relative to the old equilibrium which used to prevail between the prices of those two products.

Based on EU MMO data.

Whey prices have started firming in recent weeks, with spots at €790/t – though the latest available market prices for December 2018 suggested better prices than that, around €840/t.

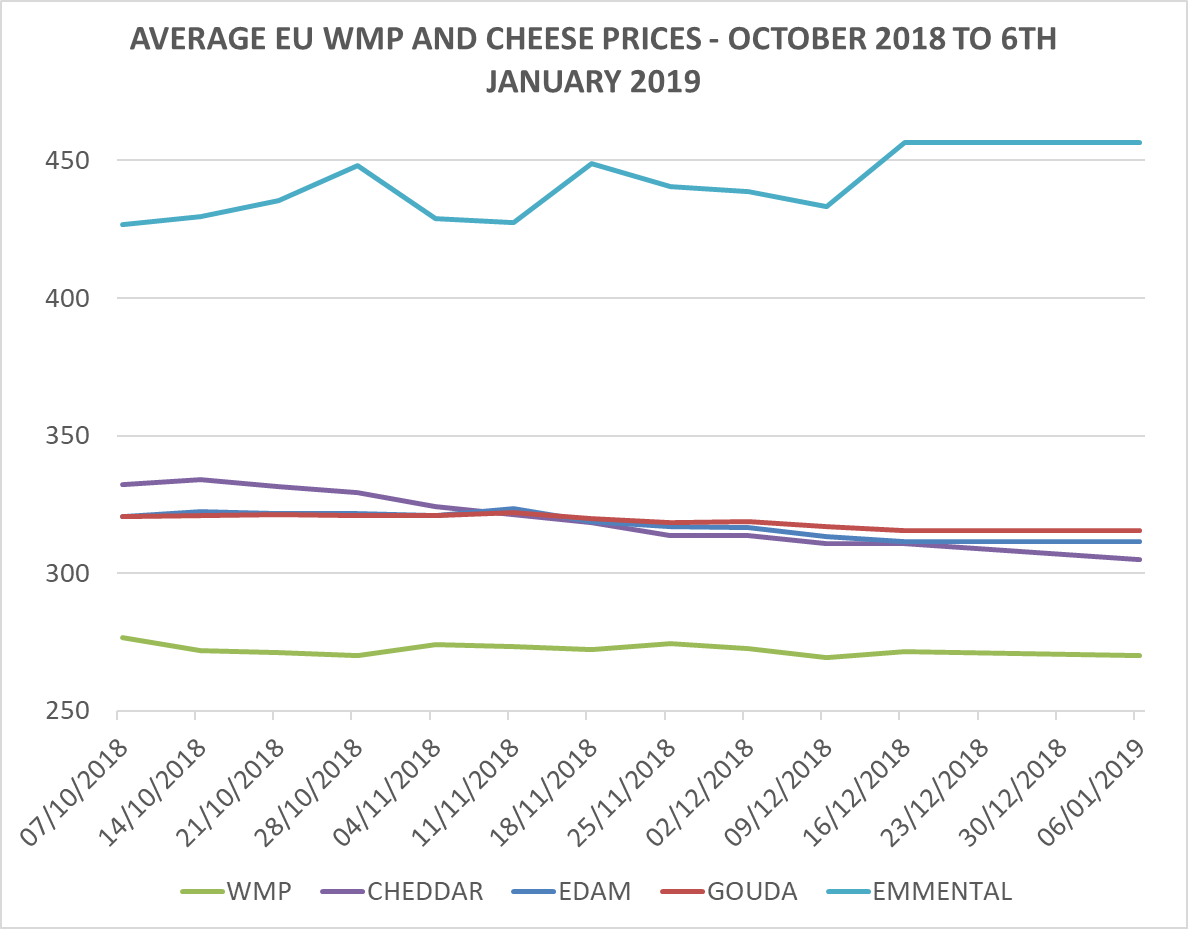

Whole milk powder and the main cheeses, except Emmenthal, have also experienced price weaknesses in recent months, as shown by the graph below.

Source: INTL FCStone

Based on EU MMO data

Demand outlook for 2019?

Geopolitical factors including Brexit, international trade and tariff disputes driven by the Trump Administration and concerns over the global economic growth are all worrying economic and trade commentators.

These concerns certainly affect dairy market sentiment to a point.

However, lower supplies in the EU, which have dipped into negative territory over the autumn, have continued to moderate output growth expectations from the bloc. The EU Commission reports a likely production increase of 0.8% for 2018 over 2017, and predicts only 0.9% increase in 2019. Their long term prediction is for moderate growth of 0.8% per annum to 2030 as environmental factors become more of a restraint in Europe.

Predictions for global milk output growth for 2019 are for no more than 1% increase, a significantly lower level than seen through 17/18.

Key of course is the supply demand balance, and supplies have trended towards better matching demand growth in recent months. However, we will have to see the extent to which the headwinds outlined above may moderate demand.

In its Quarterly Dairy Report published in December, Rabobank predicts “double digit” demand growth from China for dairy products, due largely to excessive production costs restricting domestic output.

Rabobank also expresses the view that buyers may be taken unawares by a more rapid than expected dairy commodity price recovery in the first half of 2019, based on relatively low privately held stocks, all the more so now that the intervention cupboard is getting very bare!

Domestic dairy demand in most of the developed world remains solid enough, especially for butter and cheese which tend to be traded more domestically than on export (Ireland being an exception to this rule for obvious reasons).

Oil revenues for some emerging countries will have suffered in the last few months as crude oil prices went from near $80/barrel to around $55-60 today, and this will undoubtedly play a part in their food import affordability.

The long-term demand outlook – which looks beyond the shorter-term geopolitical difficulties outlined above – remains very positive, with global population and income growth in emerging countries expected to continue to drive dairy demand growth, in the context of more moderate global output growth.

So, stability on milk prices is well justified for now, but could we see justification before long for more positive moves by our milk purchasers? Who knows?

CL/IFA/11th January 2019