A turn around for the better?

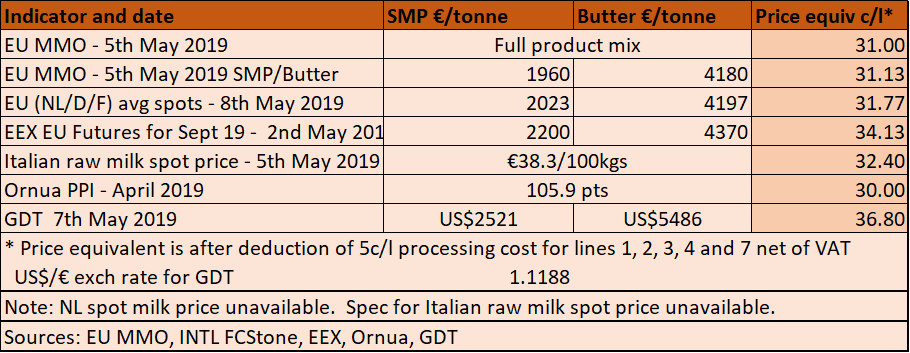

EU powder prices reported by the EU MMO and average spots in the Netherlands, Germany and France have resumed their increase. SMP spots have now broken the €2000/t barrier, with average EU prices close behind. Butter prices, on the other hand, are somewhere between stable and slightly easier. On the international stage, GDT is on its 11th consecutive positive auction.

Is global scarcity impacting prices? Is intervention SMP finally working its way through the market place, after leaving EU stocks in recent months? Is the kicking of the Brexit can to next Halloween at least buying us time of normal trading conditions, at best making a crash out Brexit less likely?

Improved prices

One thing for certain: all the indices industry watchers monitor are on the up.

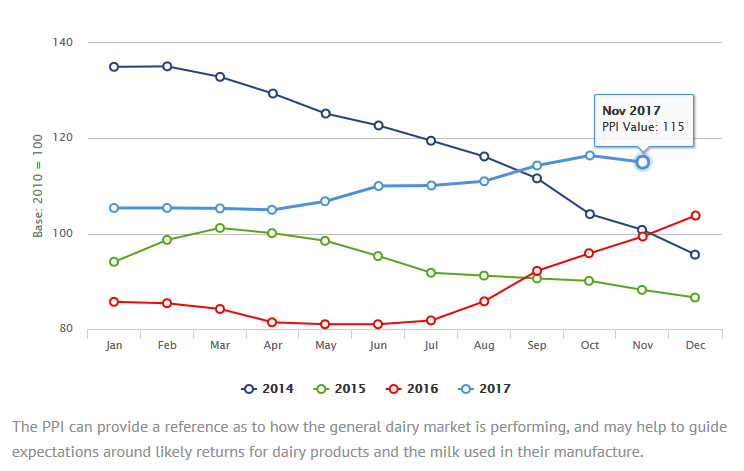

To start at home, the Ornua PPI for April has lifted from 104.1 points for March to 105.9 points. This is equivalent to a milk price of 30c/l + VAT (31.6c/l incl VAT), an increase of 0.6c/l on the previous month, and a little more than many of the main milk purchasers have been paying for March milk (see graph below).

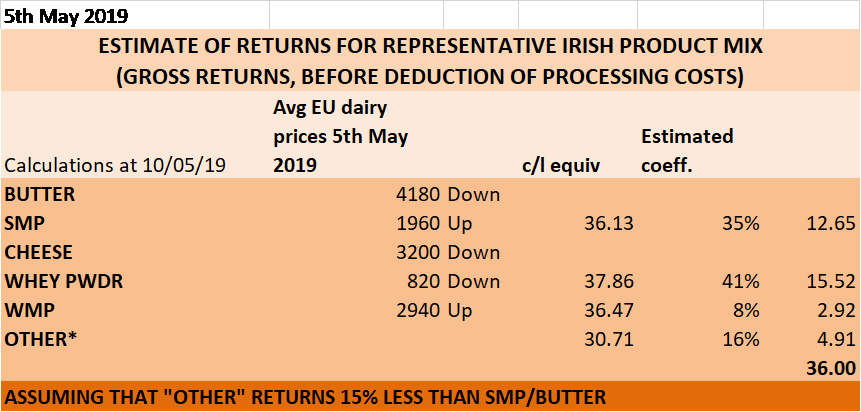

The average EU MMO prices for week ending 5th May saw increases in milk powder prices, and a slight settling of butter, cheese and whey powder. The upshot is that the returns for the notional Irish product mix in the table right is 36c/l before the deduction of processing costs. Assuming our usual notional 5c/l, this would be equivalent to 31c/l + VAT or 32.67c/l incl VAT. Again, 1 or 2 c/l above what the main milk purchasers payed for milk in March.

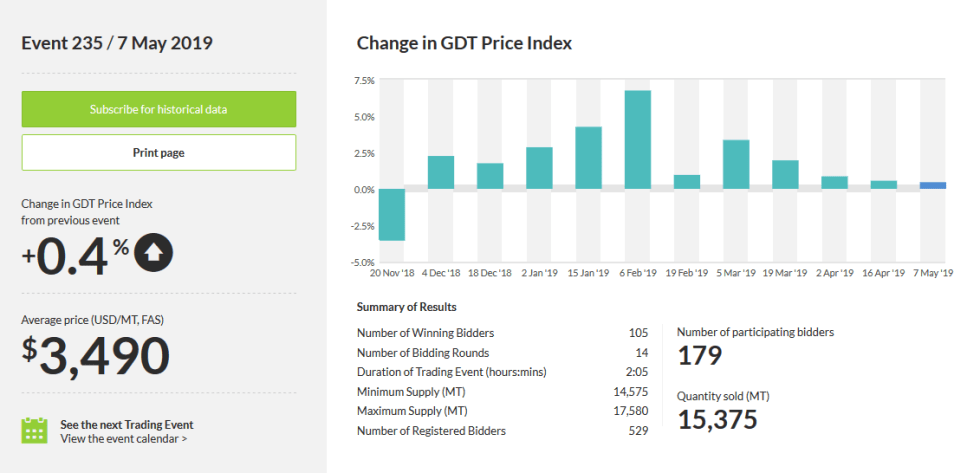

Other indicators have also continued to improve, not least GDT prices, with the auction platform registering last week its 11thconsecutive positive index movement, but also European spots and futures.

The GDT index is now 28.4% up on last November, with the most noticeable element the continued improvement in SMP prices, to a current level of $2521/t.

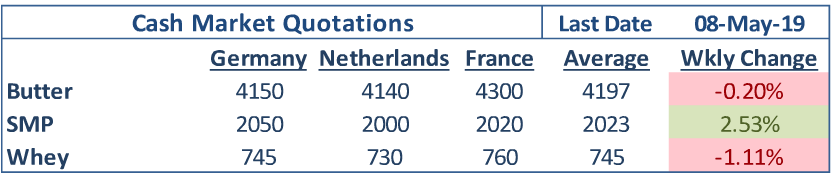

EU Spot prices have shown a recent resumption of SMP price increases, perhaps suggesting that SMP stocks sold out of intervention have by now mostly been absorbed in the market place. Latest EU spots showed SMP breaking the €2000/t barrier, at €2023. Butter prices are settling around €4150-4200 for the moment, with whey powder slightly weaker.

As to current expectation of September 2019 prices from the EU futures markets (EEX), they predict a butter price of around €4370/t – slightly less than recent weeks’ expectations – but a SMP price of around €2,200, slightly up on previous results, and 10% above current spot market quotations.

The table below shows that the combination of those futures prices would yield a notional price of just over 34c/l + VAT.

What underpins the stronger prices?

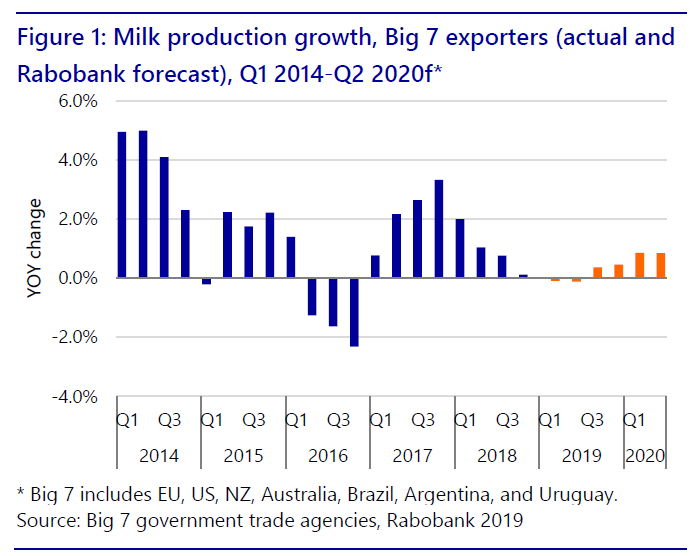

We’ve seen for a number of months now that global milk output has grown by a lot less than expected, and crucially at a lesser pace than demand is growing.

Supplies of milk in the 7 most important export regions (EU, US, New Zealand, Australia, Argentina, Brazil and Uruguay), as reported by Rabobank in its Q1 2019 Dairy Quarterly Report, grew by a mere 0.1% for the first quarter.

The main reasons have been weather – drought and other inclement events – and price related – producer prices have been falling in the last year, and no longer cover costs in many regions.

For the EU, Rabobank expect milk supplies to only start picking up in the second half of the year – which will be well past peak.

Source: Rabobank 2019 Dairy Quarterly 1

In the US, supplies are challenged also by economics, and prospects are poorer due to international trade challenges, especially caused by the Trump administration’s approach to trade with China.

New Zealand March milk supplies fell a dramatic 7.5% (9% for Fonterra), with Rabobank predicting lower growth for the rest of the season due to moisture deficit encouraging farmers, especially in the North Island, to dry off earlier.

In South America, production is on the up, but prices are poor, and local demand challenged by difficult economic conditions.

Finally in Australia, production is continuing to fall as margins continue tight despite some improvement in milk prices.

In China, imports have continued strong, with double digit growth expected for all of the first half, possibly more moderate in the second half. Disease has cut back significantly pork production, which is both good and bad from a dairy consumption perspective: pigs consumer quite a bit of whey, so imports of that commodity will likely decrease. However, pigmeat being one of the most important sources of protein for Chinese consumers, alternative protein, including dairy, will see an increase in consumption as pigmeat gets scarcer.

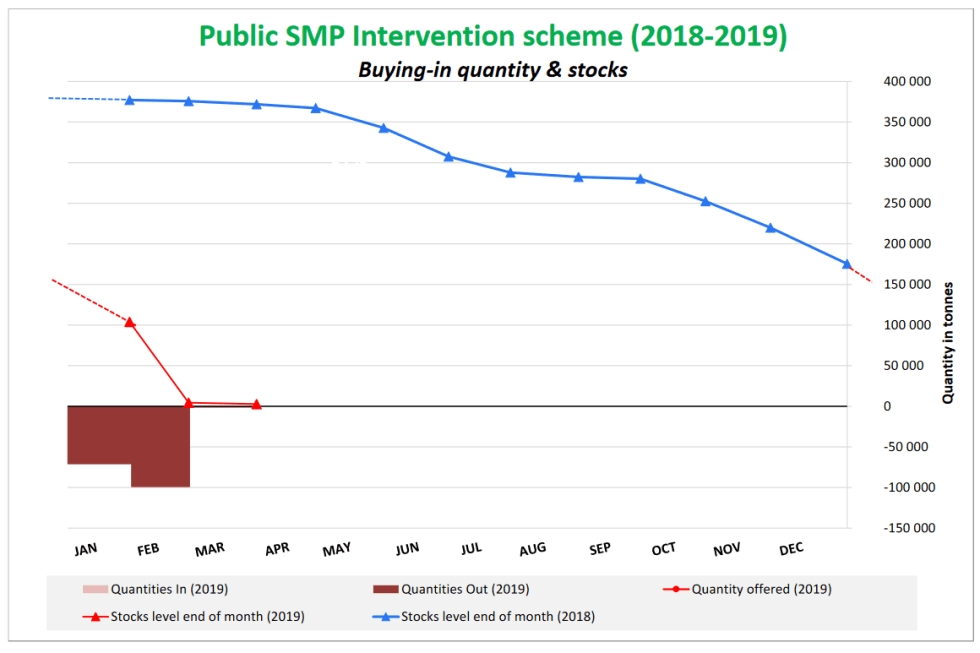

The recovery in the supply/demand balance has been further favoured with a rapid disposal of SMP out of intervention stocks. A total of 378,600t were sold since sales began (very, very slowly!!) in December 2016. Most recently, 33 tonnes were sold on 16th April at the maximum offered price of €1660/t, leaving 1106t for sale at the next tender of 21st May. What is left of the stock is held in Spain (510t), the UK (389t) and Slovakia (207t).

For some time, however, the view among commentators was that though the product was being sold out of intervention, it was taking time for it to be absorbed by the market, and therefore it continued to influence and restrict price increases for the fresh product. It does look now like that effect has come to an end.

So, should we see better Irish milk prices soon?

Logic would suggest that we should. And this would be particularly important as peak milk production months are now upon us, and those larger milk cheques are critical to every dairy farmer in dealing with the still outstanding bills incurred during 2018. While many co-ops provided much appreciated support in merchant credit facilities, rebates and even fodder imports when it was so badly needed, those bills must now be paid. Farmers need every possible cent for the milk they produced last month, and for what they will be producing over the summer.

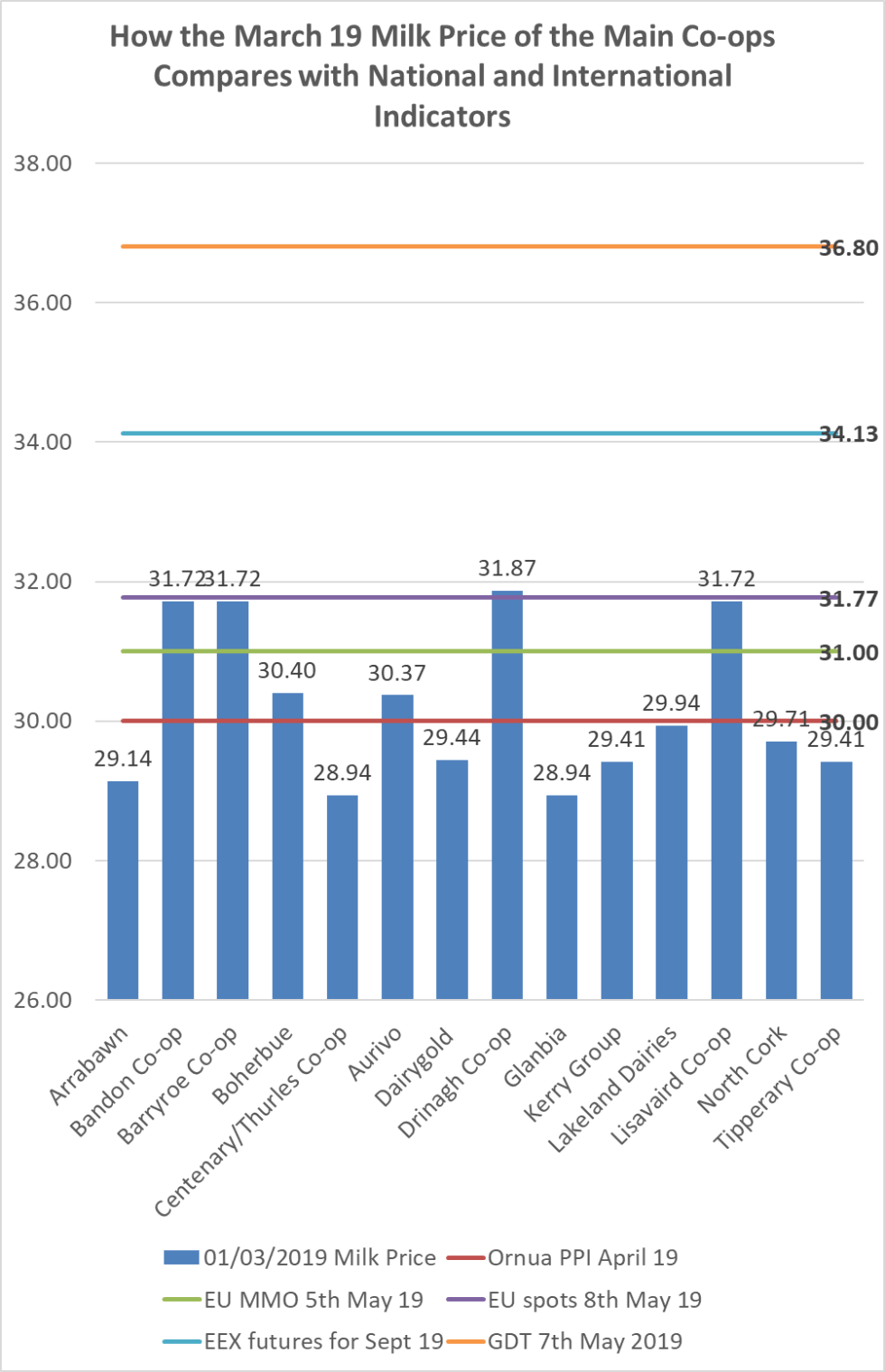

In the graph below, we compare the prices paid by the main co-ops for March 2019 as recorded in cents per litre in the Farmers’ Journal Milk League, and we compare them with some of the most relevant indicators we have already reviewed.

Some are paying less than the Ornua PPI, and only the West Cork Co-ops are matching (more or less) the current EU spot prices’ returns.