Global dairy output is down, intervention stocks empty – so why aren’t we seeing more market optimism?

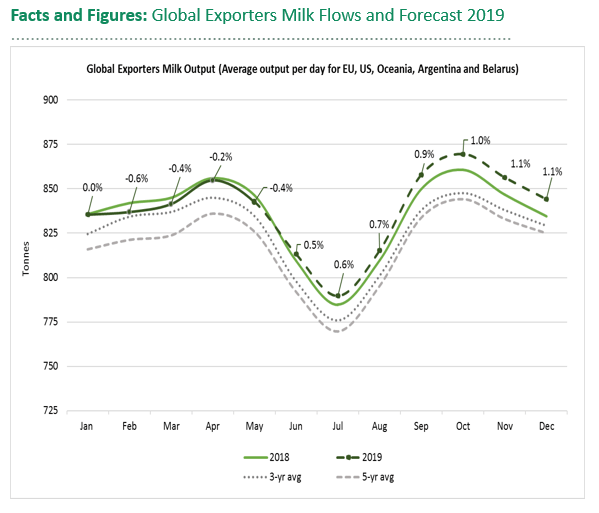

2019 global milk supplies to May were estimated down 0.3% (down 0.4% for May itself), with US production static, New Zealand down as the season comes to a close, Australian supplies sharply reduced, Argentinian output well back, and only EU production up very modestly.

The forecast for the rest of 2019 (see graph below) is for a switch from mid-year to a trend slightly above 2018, with a stronger recovery as we move to year-end trough.

Source: Ornua

Private butter stocks have been reported as higher than normal, but intervention stocks of SMP are now empty, with the last 162t sold on 18th June for a minimum price of €1759/t. This is a total of over 405,000t of SMP now gone out of intervention and most likely by now fully absorbed by the market.

So why are dairy prices and market sentiment gloomy, and is the pessimism justified?

Is demand depressed?

With supplies subdued in almost all production regions, it is logical to consider whether depressed demand is what affects market sentiment.

Recent high butter prices were always difficult to sustain when they were difficult to recoup from the retail or food services chain. But those have fallen back from up to €7000/t in 2017 to just under €4000/t. And these lower prices appear to start to have an impact: while EU retail demand for butter had been sluggish, there are now reports of retail demand recovering.

This is a quick round up of the state of demand in the main regions, courtesy of Ornua:

- Demand is reasonably good in the following regions:

- North America (US) have seen weaker exports (reflecting weaker milk output), but domestic consumption of butter and cheese in particular is on the up, with SMP consumption also rising.

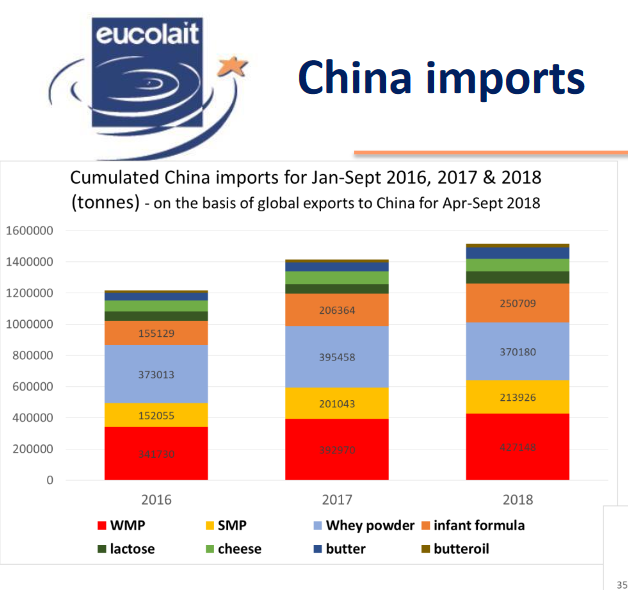

- North Asia, including China, saw a significant increase in imports, by 13%. This was majorly influenced by China’s increased imports of powders and liquid milk. The African Swine Fever impact on the pig herd, however, has reduced significantly the imports of whey for pig feed.

Chinese dairy imports – January to May 2019

Source: CLAL.it

- In South East Asia, import demand was up strongly a +11%, but the rate of growth has eased somewhat since. Powder and soft cheese imports have been strong, while butter, hard cheese and whey were weaker.

- Demand is muted to stable in the following regions:

- EU domestic demand is muted for cheese and butter, though as previously stated there is some response from retail sales due to lower butter prices. Whole milk powder use remains solid, though SMP consumption is weaker.

- South America (see more re. Mercosur below) started the year strongly with imports, and while demand eased somewhat for WMP, whey and SMP in March and April, cheese and casein demand has remained strong.

- Demand is somewhat problematic in the following regions:

- Total African imports are down 5%, though this does not include enriched milk powders, (fat filled milk powders) which are offsetting somewhat the lower SMP and WMP sales. Also, cheese demand does continue to rise.

- Middle Eastern demand for WMP is poor, though SMP and butter imports are growing somewhat. There are signs of import improvements for most dairy products.

What are the factors impacting demand?

Global economic growth is forecast to fall this year, because of economic weaknesses in developed countries and in China. China is currently recording the slowest economic growth rate in 27 years, at 6.2%. It was telling, last month, that IMF Managing Director Christine Lagarde was urging the US and China to sort out their differences to reduce the risk of a global economic downturn.

Despite a recent decision by OPEC to reduce crude oil supplies, prices remain around US$65/barrel, again kept down by concerns around global economic growth.

The € is stronger against both the US $ and Sterling (Brexit uncertainty), affecting the competitiveness of EU exports.

Traded volumes have been generally strong in the first two quarters of the year, but there is a view that this will slow down in the second half because of trade wars and the build-up of (private) stocks. Such stock build-up has been caused in the UK by the preparation for 2 Brexit deadline (the next on 31st Oct, and the risk of a no-deal deemed to be greater, stock build up will not be resolved in the short term).

The main drivers of this strong first half demand were developing countries, and it is good to see that demand in developed countries (EU and US) is improving.

So, while most reports do not suggest very strong growth in demand at this point, they do not suggest that there is a major demand downturn.

It seems that markets are nervous because of international economic and geopolitical factors that have yet to impact (Brexit, US erratic trade policy and an expected lower growth in the Chinese economy all come into this).

Dairy returns comfortably underpin current milk prices – June Ornua PPI is 1c/l above most co-ops’ milk prices

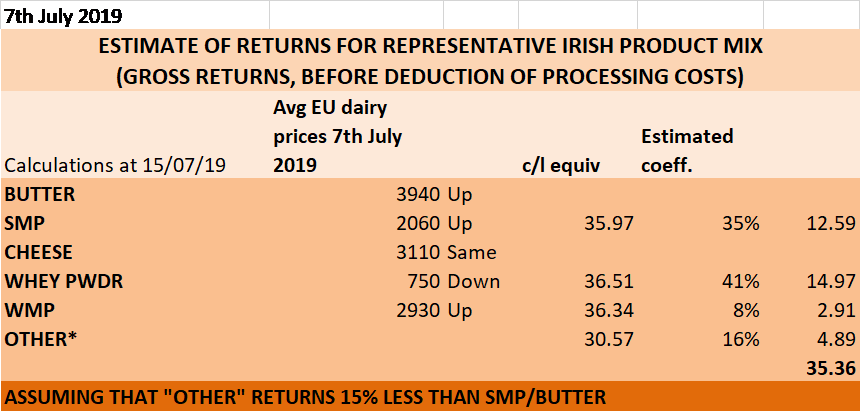

Average EU dairy prices as recorded by the EU Milk Market Observatory for 7th July showed very slight price improvements for butter, SMP and WMP. During June, only very slightly easier gross returns compared to May were mostly in excess of a gross 35.5c/l before processing costs.

Overall, the notional Irish product mix, after deduction of 5c/l for processing costs, would return a farm gate milk price equivalent of 30.36c/l + VAT (32c/l incl VAT). This represents a very slight easing of under 0.5c/l during the month.

Based on EU MMO data

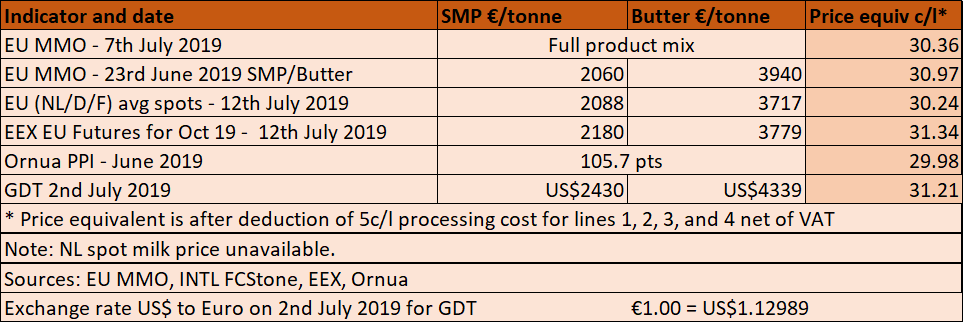

Other indicators have also eased a little, as is shown in our usual table keeping tabs on the main international and national (Ornua PPI) indicators.

Speaking of the Ornua PPI, it has eased by 1.6 points for June trade, down to 105.7, equivalent to a milk price of 29.98c/l + VAT (31.62c/l incl VAT) – which remains 1c/l more than what our main milk purchasing co-ops are paying for June milk.

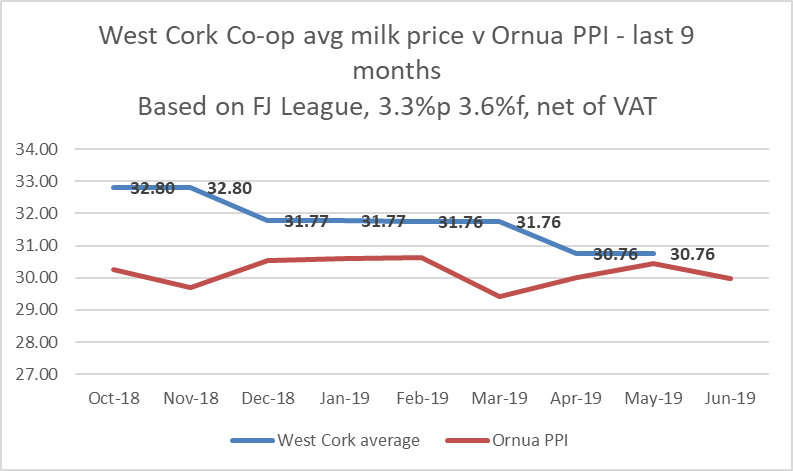

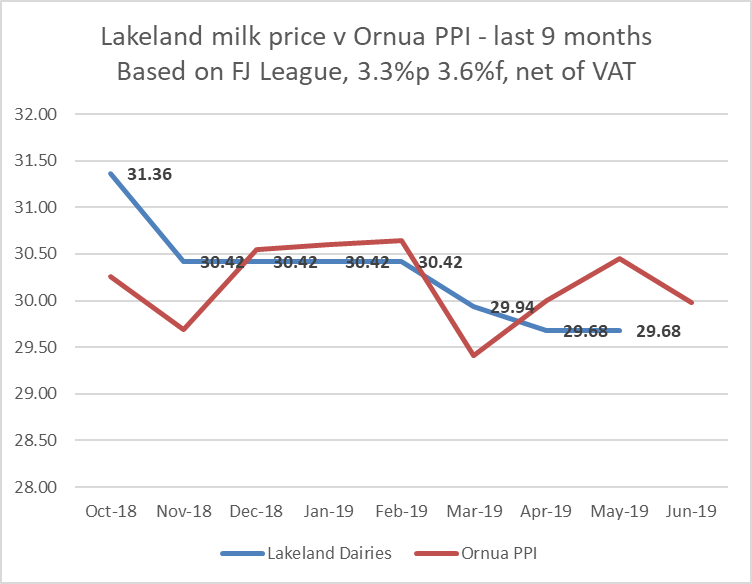

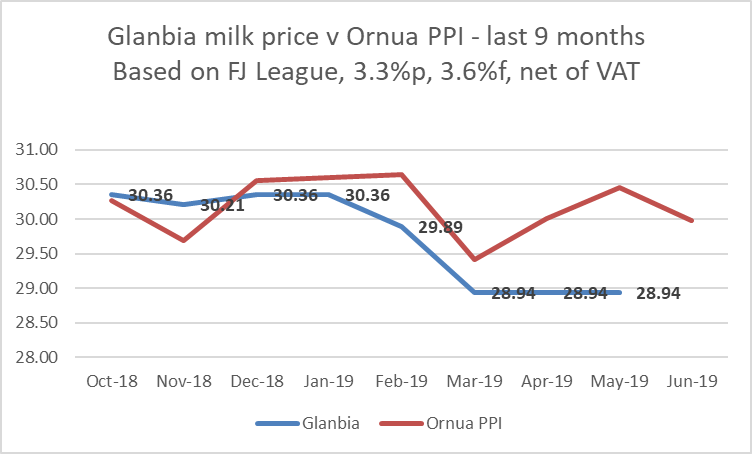

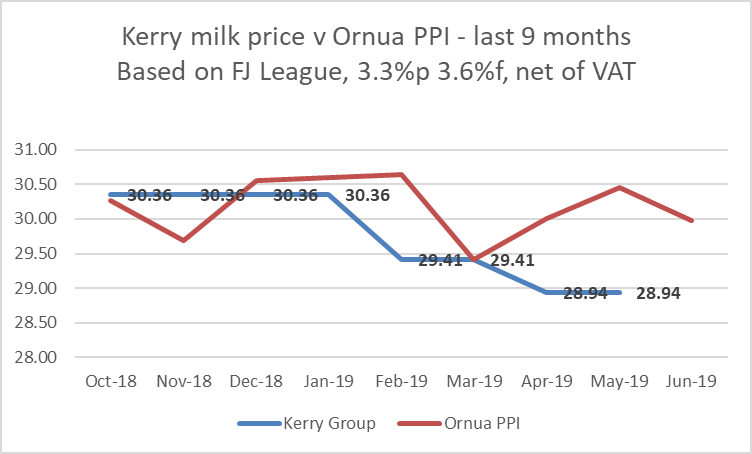

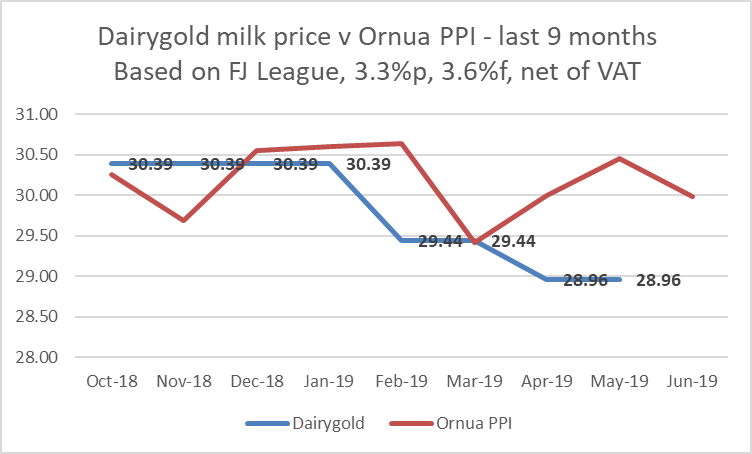

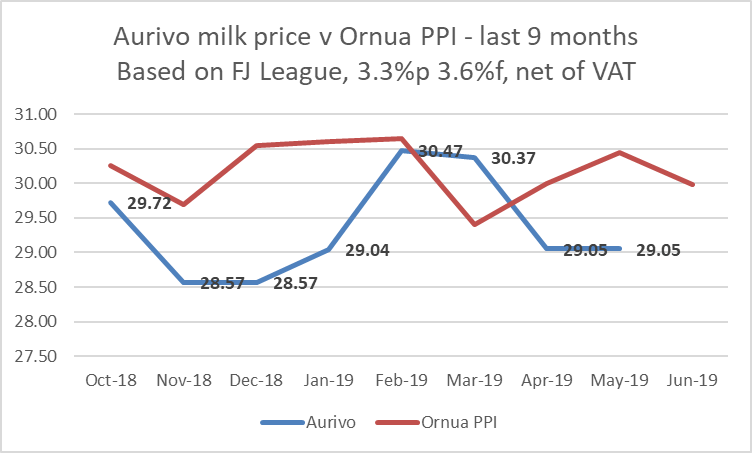

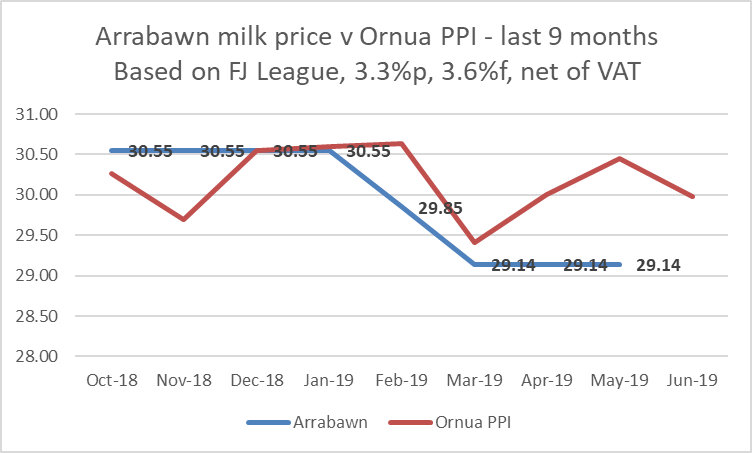

IFA has tracked the milk price paid by the main Irish co-ops, using the Farmers’ Journal monthly milk league, and compared those with the evolution of the Ornua PPI milk price equivalent over the last 9 months. With the exception of the West Cork co-ops, the other co-ops have paid less than the PPI for the majority of those 9 months.

Note: while as we write the June Milk League has yet to be published in the Farmers’ Journal, all those co-ops that have announced their price have held at May levels.

Based on Farmers’ Journal’s monthly milk price league and Ornua PPI milk price equivalent

Strong support was provided by co-ops for farmers in 2018, in the form of milk price top ups, merchant credit and other rebates, and even fodder/feed imports. These were as appreciated as they were needed.

However, it is clear that co-ops have not passed back the full of the market returns this year so far, banking on the impact on milk cheques of additional volumes and improved constituents to rebuild balance sheets. They are also voicing much of the cautious sentiment highlighted above to create negative expectations for the next number of months, when the negative market factors have yet to materialise.

And finally: the EU/Mercosur Deal and Dairy – (Analysis courtesy of IDELE (French Livestock Institute)).

There has been much commentary and press coverage about how the Mercosur deal is bad news for beef farmers. But there have also been suggestions that it was a far more positive story for dairy. Is that so?

French agri-economists at l’Institut de l’Elevage (IDELE), the French Livestock Institute, have published an interesting analysis, the dairy aspect of which is translated and summed up below. By all accounts, the dairy story is less negative, but nor does it provide spectacular enough opportunities to make up for the likely impact on beef.

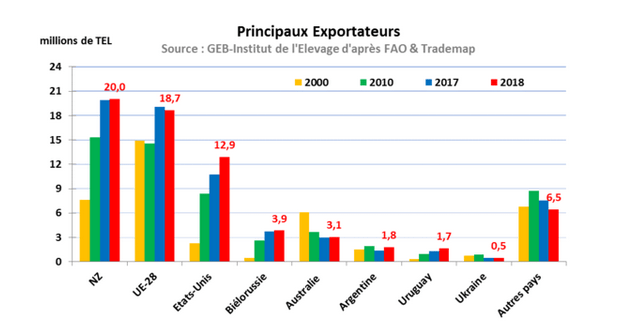

Definite potential for Argentina and Uruguay

Argentina and Uruguay are 6th and 7th world exporters of dairy products (1.8 and 1.7m tonnes of milk equivalent respectively). Output has been growing in Uruguay, and there has been a recovery in Argentinian production after 2 years of crisis. Argentina trades mostly with Brazil, while Uruguay currently ships to Algeria, Russia and China.

Source: Idele (France)

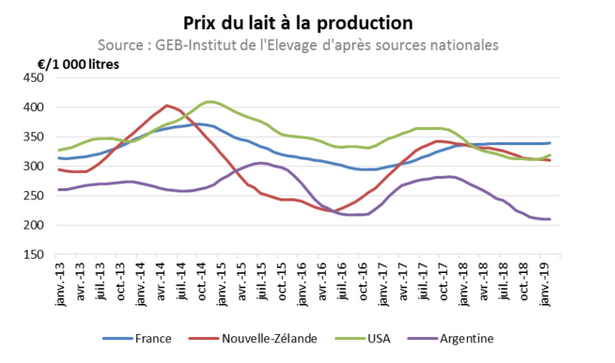

Argentina’s milk price is far lower than that of the other exporters, and made even more competitive by the devaluation of the local currency.

It is therefore clear that Argentina in particular would have a competitive advantage, starting, just like for beef, with a significantly lower raw material price (milk).

Source: Idele (France)

However, the EU has equivalent opportunities to export more into Mercosur countries (the quotas agreed are reciprocal).

The same concerns arise regarding differences in standards as are relevant to beef.

Mercosur and dairy: extra volumes at lower tariffs

The dairy concessions under the EU-Mercosur deal are bilateral. Each party will be given the same opportunity to export to each-other’s market tariff free, after a transitional period of 10 years – i.e. within quota tariffs will be lowered by 10 % p.a. from their current levels. Dairy import tariffs average out at around 28% of the EU price for the product currently.

The volumes concerned are 30,000t cheese, 10,000t milk powders and 5,000t infant formula. There has been no further details as to what type of cheese, or as to the divvying out of the export opportunities between countries in either group.

This is not in the IDELE document, but it is worth noting that there has been no import of SMP, butter, cheese, WMP or whey powder from the Mercosur countries into the EU in the last number of years.

Exports from the EU to the Mercosur country are tiny, with only 900t of whey powder and 100 t of WMP exported to Brazil in 2018 (and this reflects a normal enough historical trade pattern).

Validation of the agreement

The Mercosur/EU trade deal is expected to be, similar to the Japan agreement, a simple trade deal which does not require individual member states’ approval. For implementation, it must be adopted by the EU Parliament (blocking minority is 35%) and Council (qualified majority = 55% of MS representing 65% of the population).

There remains many technical details to be sorted, as well as evaluation work before any votes in Parliament and Council, and this could take around 2 years before ratification and implementation actually begins.

So any impact from Mercosur, good or bad, will be some years down the line relative to a Brexit outcome!

Note: while the above on the validation of the agreement reflects the IDELE analysis (and the presentation of the Deal by the EU Commission), some hold the view that the deal is not a simple trade deal, because it includes intellectual property considerations (protection of Geographic Indication for up to 350 products, for example). Should this be the case, there may be a legal argument that the deal does indeed require approval by individual member states, which would give every member state an effective veto. Watch this space!