Dairy Market Blog – Dairy prices stable to firm

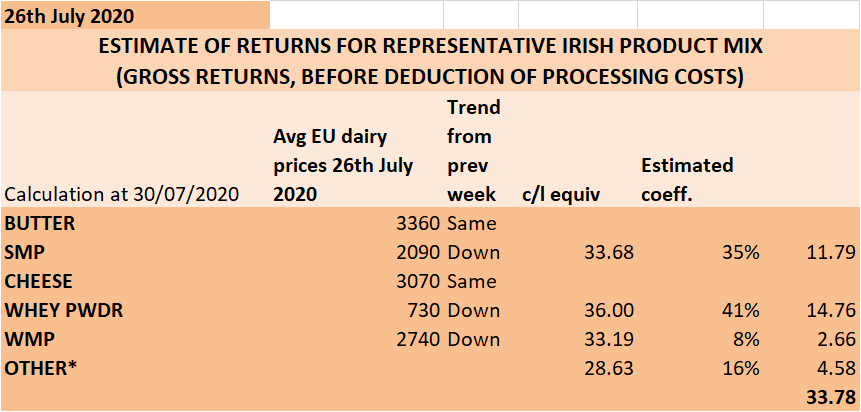

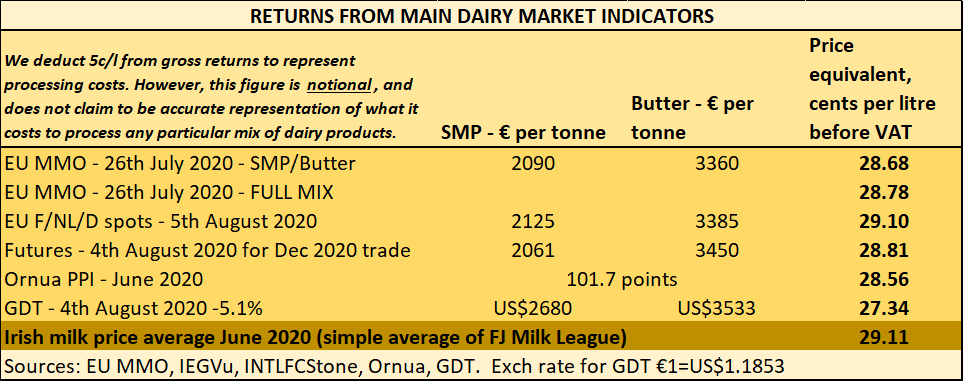

Market returns, after falling steeply between February and mid-April due to the impact of COVID19 on food services and trade generally, have been rallying since May. In recent weeks, spots have stabilised at those improved levels. While they have a way to go to recover to pre-COVID19 levels, they nonetheless support current price levels comfortably, as is obvious from the gross returns/milk price equivalents from the main market indicators in the tables here.

Based on EU MMO data

Source: StoneX

GDT: mostly Oceanian product trading

Many will have been worried by the 5.1% drop in the average GDT index in the first auction in August earlier this week. The first thing to note is that trade concerns mostly new season Oceanian product for the period from Sept to December 2020. Very little powder and no butter from European traders featured in this event.

Also, August does tend to be a summer holiday month the world over. Serious trading decisions regarding the really heavy trading period – the last quarter of 2020 and first of 2021 – which gathers most of the demand promoting events and religious festivals (Thanks Giving, Christmas, Passover, New Year, Chinese New Year, Easter, Ramadan…) will start from autumn, after the summer holiday period.

So, we should not read too much in this month’s GDT results.

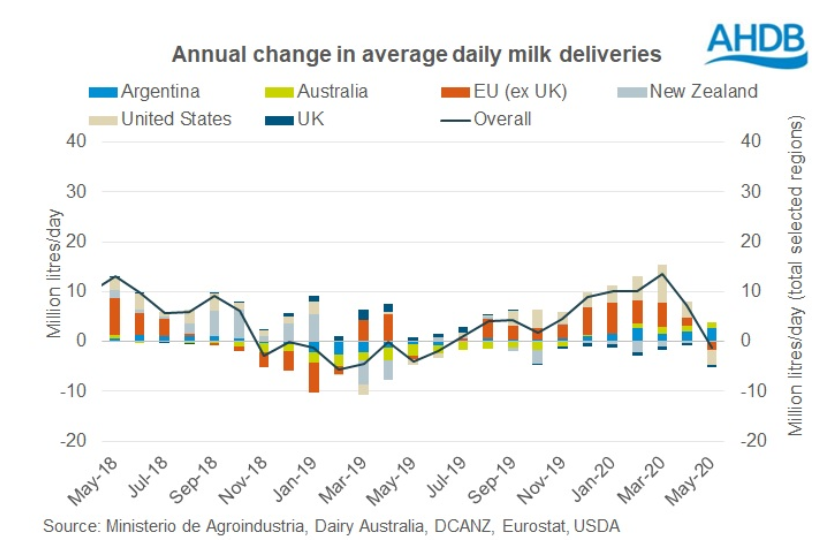

Global milk supplies subdued till May, now picking up

US milk supplies for June were up a massive 5% compared to last year, but that followed an equally steep 5% drop for May.

EU supplies were up 1.3% to May, leapyear adjusted, with the EU Commission predicting an overall increase for 2020 of just 0.7%, which would suggest tighter supplies for the remainder of the year.

New Zealand production for June – the trough month – was up 2% on June 2019. Jan to June was up only 1%, but we are now in the new 2020/21 season.

Australian milk supplies for May were up a whopping 6%, following a series of monthly increases since January. Season todate, however (July 2019 to May 2020) is down 0.6%.

Source: AHDB Dairy UK

Demand continues to be sustained by COVID19 supports

Just as the Irish government has brought in a July stimulus package, so have various governments around the world extended (or not!) the initial COVID19 supports targeted to businesses, employers and employees. Those have played a crucial part in sustaining purchasing power and therefore demand, including for food and dairy.

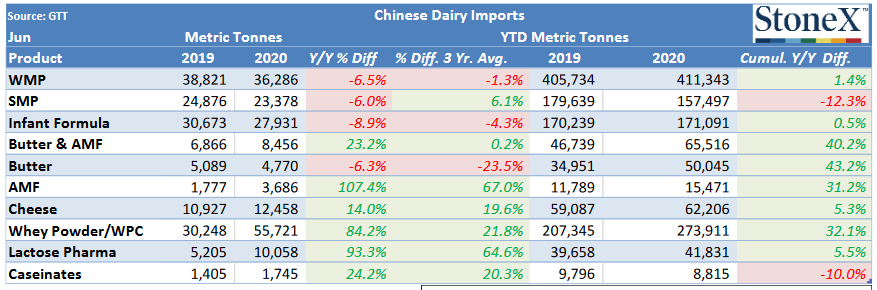

Trade has resumed, with Chinese imports a mixed picture for June and the year to June. Butter and AMF (butteroil) are doing quite well, while powder imports are weaker and infant formula just marks time for the year to June.

Whey powder and whey protein concentrates and lactose also appear to do quite well.

Source: StoneX

EU exports of butter and WMP have performed well, through the pandemic, with other products a less positive picture.

Butter exports for January to May rose a whopping 37% with WMP a more measured 8%. SMP was down 17%, with cheese down 4%.

Outlook for milk prices?

In the rest of Europe, milk prices are recovering after steep falls.

Friesland Campina’s guaranteed prices has increased for July by €0.5/100 kgs, and by €1.00/100kgs for August. Over those two months, that is equivalent to around 1.25c/l at Irish constituents over those two months. The August milk price, at Irish constituents, would be equivalent to 28.5 + VAT (30.05 incl Irish VAT at 5.4%).

Arla UK will pay 29.26ppl for August milk, which at Irish constituent level is equivalent to 29.33c/l.

August milk prices for French suppliers to Sodiaal Co-op hover around 34c/l (3.2-3.8 constituents) and 36c/l (3.3-4.2 constituents) in Savencia. Those prices include seasonality bonuses, and are an increase for Sodiaal, and same as July for Savencia.

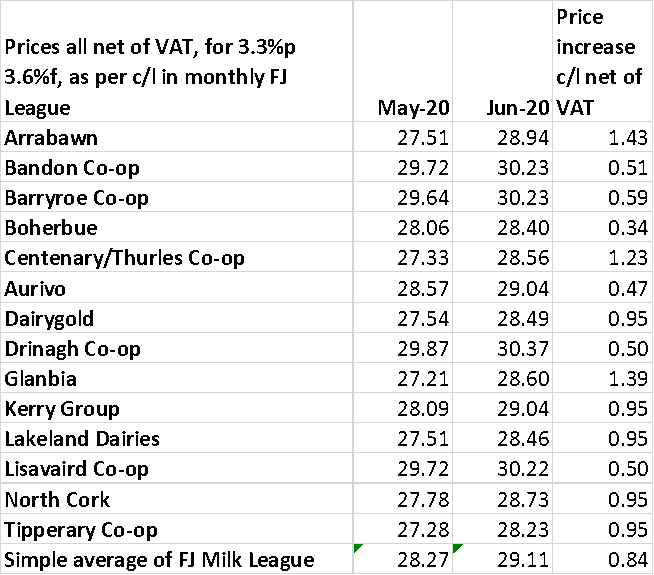

Irish milk purchasing co-ops (see table right, based on the cents per litre column in the monthly Farmers’ Journal League, which is not ranked on that column, but on the value of solids in €/kg) have increased milk prices in June by an average of 0.84c/l + VAT (88.5c/l incl VAT).

The simple average of the table for June suggests an average price of 29.11c/l + VAT (30.68c/l incl VAT). It is clear that this simple average is heavily influenced by the performance of the West Cork co-ops, all paying in excess of 30c/l + VAT – in fact the only milk purchasers to do so.

Source: FJ Monthly Milk League

Commodity indicators as analysed above, would suggest that there is scope at least for the lower payers in the table above to further improve their July milk price. Anything less than 1c/l would be mean spirited, as volumes start to dwindle past peak.