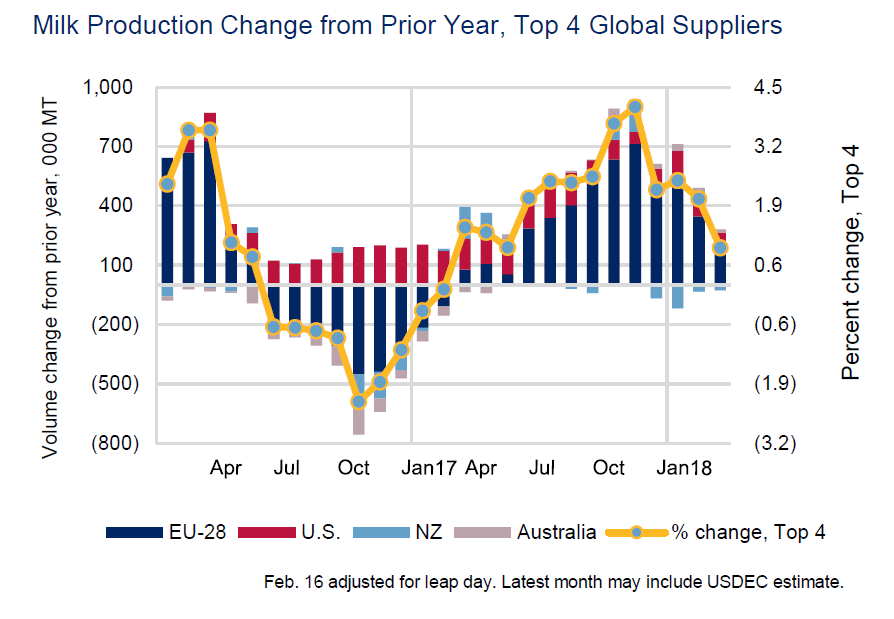

Weather events continue to moderate US and EU milk output into Summer

Milk supplies for April 18 lifted a little for the EU 28, at +2.1%. In the US, the growth was quite modest for April (+0.7%) and in May (+0.9%). Together with a 4% increase for April/May 2018 in New Zealand, this has led AHDB to predict a slight recovery from the trend to March.

However, I would venture to guess that dry and hot weather in North Western Europe, and wet weather in other parts of Europe in May and June will probably moderate growth in the EU 28 again for those months.

Source: AHDB Dairy

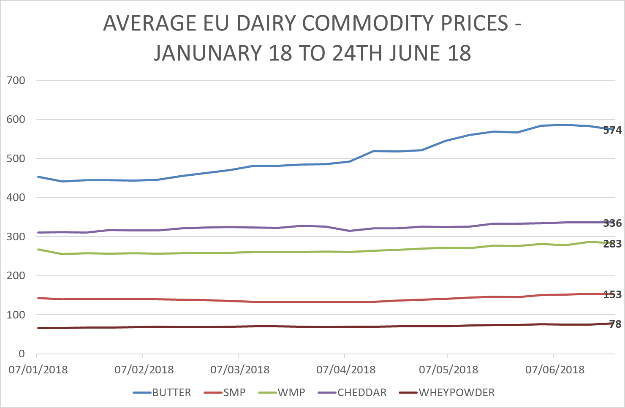

Commodity prices strengthened through June – easing somewhat now

EU and international commodity prices have been strengthening since the beginning of the year, in response to strong demand and moderate production growth, especially in the EU 28.

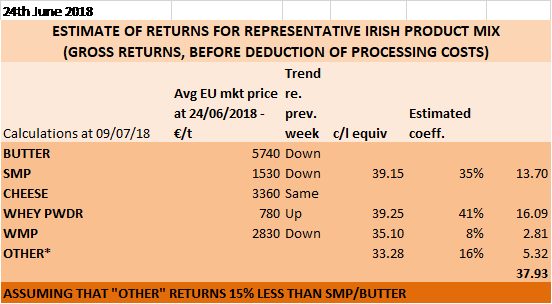

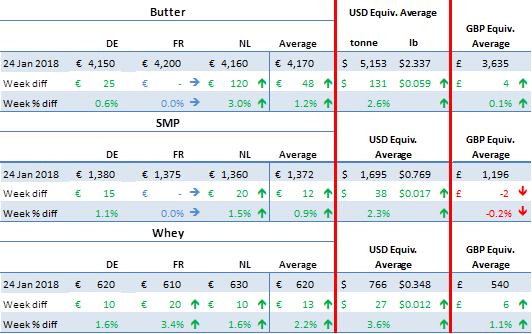

EU average dairy commodity prices as reported to the EU Milk Market Observatory (EU MMO) at 24th June (most recent available as we write) suggested a gross return before processing costs are deducted of 37.93c/l for a reasonably representative Irish product mix. This was despite a slight easing that week of butter, SMP and WMP prices. After deduction of a nominal 5c/l processing cost, this would be equivalent to a price level of 32.93c/l + VAT (34.70c/l incl VAT).

Based on EU MMO data

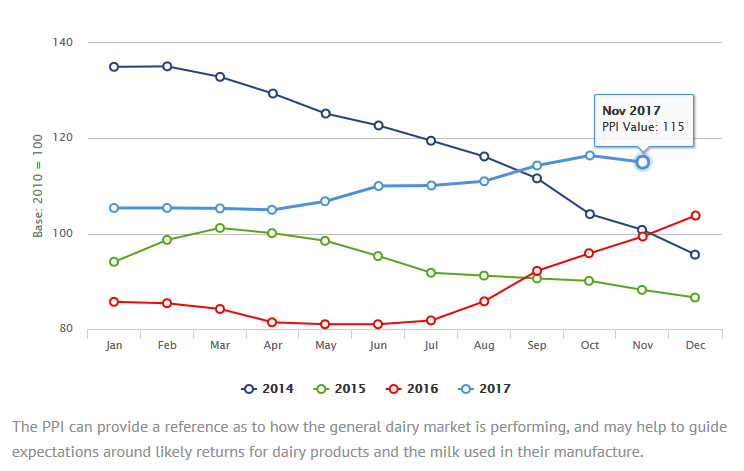

The Ornua PPI for June also showed improved butter and SMP returns, rising from 105.4 points for May to 109 points for June. This is equivalent to a price level – as stated by Ornua – of 31.1c/l + VAT (32.78c/l incl VAT).

Source: Ornua

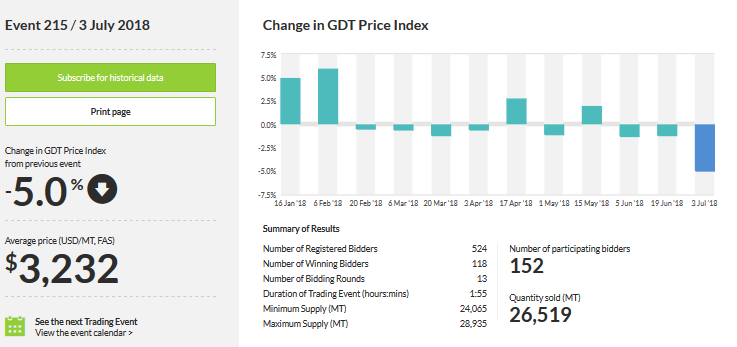

n recent days, however, some commodity prices have eased a little, influenced by 3 consecutive negative GDT auctions.

Spot prices have also eased, as have futures markets for the main commodities (butter and SMP).

For all that, the combined GDT average price for SMP and butter based on 3rd July results would yield a gross return of 34.64c/l and a price equivalent at Irish constituents of 29.64 c/l + VAT (31.24c/l incl VAT).

Source: GDT

Most recent European cash market (spot) quotes for butter and SMP (4th July 2018), though slightly easier, would nonetheless yield a gross return of 39.57c/l and a milk price after deduction of 5c/l nominal processing costs of 34.57c/l + VAT (36.47c/l incl VAT).

Source: FCStone International

Price increases expected, needed and justified for June milk

All these indicators would suggest that a price increase is well and truly justified for June milk – as well as being badly needed by farmers who are now again struggling with fodder shortages, this time due to drought! What a challenging year 2018 will have proven for dairy farmers! A market based price increase on June volumes will go a long way to support farmers’ ailing cash flow as grazing grass, never mind fodder stocks, get scarce, and the cost of feed rises dramatically.