The Irish winter barley harvest is now essentially complete with only a few remaining crops left to be harvested in the very north of the country. Overall, yields were described as generally good to very good with yields in the range of 3.5-4.2t/ac with some fields after break crops yielding closer to 4.5t/ac. KPH/hectolitre weight reports are more variable with variety having a large effect on the end result. Moistures have been unusually low at typically less than 17% thanks to the very warm temperatures and high sunshine levels present during the main winter barley harvesting window.

Despite the break in the weather a good proportion of winter oat crops now been cut to date with reports generally very positive with yields ranging from 3.5-4.2t/ac and good grain quality. Winter oilseed rape crops are described as generally good with yields ranging from 1.4-2.0t/ac in south Leinster and east Munster. Poor weather conditions and a later maturing crop have delayed harvesting in the northern half of Leinster.

Spring barley crops established in February and the first half of March are now being harvested in between rain showers in south Leinster and east Cork/West Waterford. Yields are described as good ranging from 3-3.5t/ac. Protein levels in malting barley crops are very low ranging from 8-9% to date. Some wheat crops were cut in eastern coastal areas before the breakdown in weather 6-7 days ago but no yield reports are available as of yet.

Green grain prices for barley (20% MC) around the various counties are ranging from €180-185/t before bonuses. For malting barley growers, the FOB Creil July 21 index closed at a yearly high of €256/t on Wednesday August 4th. This brings the average price for malting barley on this contract to €223.76. Oats prices are reported as €170/t for animal feed with €180 -185 available for in-spec milling grade. Dairygold offered €233 for dried November wheat and €220 for dried barley on August 10th. Glanbia offered €183/t for green barley and €193 for green wheat on August 6th.

Irish Native / Import Dried Feed Prices

| Spot €/t | Nov 2021 €/t | |

| Dried Wheat | €250 old crop | €230-235 |

| Dried Feed Barley | N/A | €220 |

| FOB Creil Malting Barley | €256 | |

| Dried OSR | €530-540 | €530-540 |

| Maize (Import) | N/A | |

| Soymeal (Import) |

International Markets

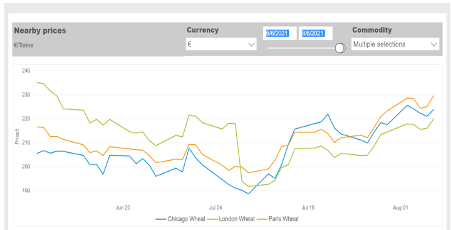

Paris MATIF wheat futures have recovered some of the ground lost in July as a result of uncertainty caused by variable crop quality amidst rain delays in France and Germany. The November 21 position has increased from €216 in mid to late July to around €230/t – see graph overleaf. Much of the European crop is grown for milling and variable grain quality in these markets will likely see more crops downgraded to feed markets. This factor could have a negative impact on final Irish green grain prices which will be likely be finalised in the next six weeks or so.

In the UK, milling wheat premiums for November have increased to £35 over feed for November 21 according to the AHDB weekly market report. Wheat harvest is underway in much of eastern England but rain delays at the time of writing this week have halted progress.

Global Crop Trends

Wheat crop condition and crop yields around the world are very variable. Spring wheat condition in the USA is now very poor, with the worst crop since 1988. 95% of the US winter wheat crop is cut and spring wheat harvesting is ahead of the 5-year average so the influence of this poor USA crop on global markets is likely to diminish. Across the border into Canada, winter wheat harvest has commenced early in provinces such as Saskatchewan due to the severe drought conditions present here.

At an eastern European level, the Black Sea harvest is well underway, although in Russia harvest yields are reported as below expectations. A new export tax has resulted in lower July tonnages being shipped. In Ukraine, harvest is progressing well with >70% of wheat and barley now harvested. Total Ukrainian grain production is now forecasted to increase by 11 million tonnes compared with 2020.

Similarly in Argentina, Rueters reports of extremely low water levels in the Parana, the country’s main agricultural export artery which is severely curtailing shipping out of the country.US maize crops are rated at 64% good overall compared with 71% good at this stage in 2020 according to the USDA. A contrasting picture is emerging in the Corn belt with excellent crops in Illinois and Iowa – the largest corn producing state – experiencing more favourable weather conditions in July.

However, states such as North Dakota and Minnesota remain very drought stricken, whilst in the eastern states of Indiana and Ohio rain is needed rapidly during the ongoing grain fill period to rescue some yield potential.

European oilseed rape prices continue to remain very buoyant with the MATIF November closing on Friday August 6th at €542 gaining €20 in the week. There are several supporting factors for these high prices including a yield forecast drop in European oilseed crops from analyst MARS and the severe drought conditions in Canada. Dairygold offered oilseed rape growers €485/t green for harvest 21 on August 10th, with €410/t available for harvest 2022.

In the Midwest, US soybean crop condition is mixed overall due to dry weather, crop conditions have improved in the top producing state of Illinois but worsened in other states of Minnesota and North Dakota according to the USDA. However, record demand for the first six months of 2021 for soya from China is expected to recede later in 2021 according to Reuters with pig producers there substituting out soyameal for wheat and rice, this has the potential to alter global protein/oilseed prices in the coming months.