On the domestic front demand for feed is beginning to edge lower following the jump in demand over the past three weeks. Farmers and merchants are struggling to move barley however there is some demand for the smaller quantities of wheat remaining in store. As we approach April there is now a real worry that if barley does not regain some of the market share lost to imported maize, we could have an overhang going into next harvest. Forward prices for green barley next harvest are around €147/t for green barley and €157t for wheat.

Native/Import Dried Prices

| Spot 25/03/19 | April – Jun 2019 | New Crop 2019 | |

| Wheat | €205 – €207/t | + €1/t per month | €185 |

| Barley | €185 – €190/t | + €1/t per month | €175 |

| Oats | €225 | ||

| OSR | €380 | €378 | |

| Maize (Import) | €180 | €180 | €180 |

| Soya (Import) | €328 | €330-335 |

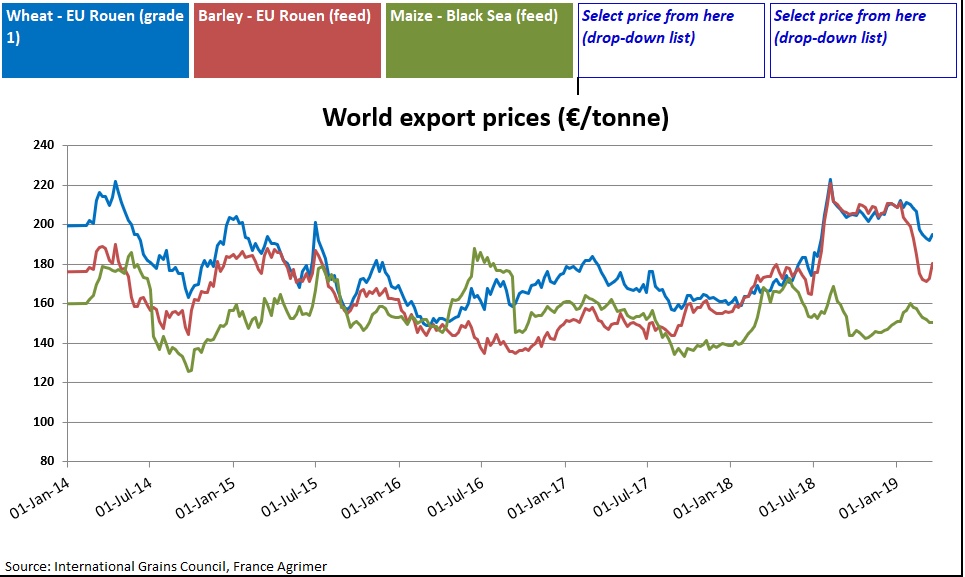

Grain markets have seen a significant turnaround in the past two weeks with CBOT prices for wheat regaining 11% while the Matif is up almost 6%. A number of factors have contributed to the market rise namely traders buying for short cover, increased international demand for French wheat and the record flooding in the mid-western grain belt of the US mainly in Iowa and Nebraska. Early estimates of lost crops and livestock are approaching $1 billion in Nebraska alone. There is some concern that sowing of the Spring wheat crop will also be delayed in North Dakota due to snow cover.

On the barley front some news regarding a 730,000-tonne purchase by Saudi Arabia grain buyer SAGO and a rare purchase by China of a load of French barley has created some optimism as both countries have been out of the market for some time. The FOB Creil for malting barley has come off its recent low of €180/t and is now trading at €188/t. This is due to the reduction in old season stock and the prediction that plantings of Spring barley will be down in France and Germany which is where most of the malt barley is sourced as opposed from Winter crop.

Corn/Maize futures jumped to their highest level in 3 weeks on reports about flooded stores and delayed planting in the US Midwest which stoked buying and fund short-covering. Growers in this area had been planning to switch some land from soybean to corn but this may now change. It was also confirmed that China had purchased 300,000 tonnes of US corn, its largest purchase in more than 5 years.

The soybean market has been fairly stagnant over the past two weeks as the market continues to wait for news on Chinese/US trade talks. On Friday the USDA will release their quarterly grain stocks report along with prospective plantings so this may give some direction to the market.

In other news the EU Commission recently published its criteria for determining what crops cause environmental harm, as part of a new EU law to boost the share of renewable energy to 32 percent by 2030 and determine what are appropriate renewable sources. It has singled out palm oil for removal from transport fuel by 2030 due to its association with deforestation in south east Asia.