Domestic Market

The continuation of the wet weather has left the planting of winter crops very difficult. The window for planting Winter barley and oats has virtually closed although some will still plant Winter wheat if the weather allows. Some estimates suggest that total Winter plantings of the 3 main grain crops could be as low as 110,000 ha, which would even be lower than the 2018 winter crop figure of 120,000ha.

The situation in the UK is similar with Winter crop acreage expected to be significantly reduced. Many British growers are now holding on to wheat and barley in the expectation that overall domestic grain production will be reduced in 2020. Along with the strengthening of sterling this has helped Irish barley prices, which have risen approximately 6% since the lows at harvest. However, we could see an increase in the plantings of Spring barley in 2020, which could be negative for the Irish market next season.

Irish Native/Import Dried Prices

| Spot €/t | Jan 2020 €/t | |

| Wheat | 183/185 | 185 |

| Barley | 172 | 173/175 |

| Oats | 160 | |

| OSR | 370 | |

| Maize (Import) | 180 | 182 |

| Soya (Import) | 332 | 335 |

International Markets

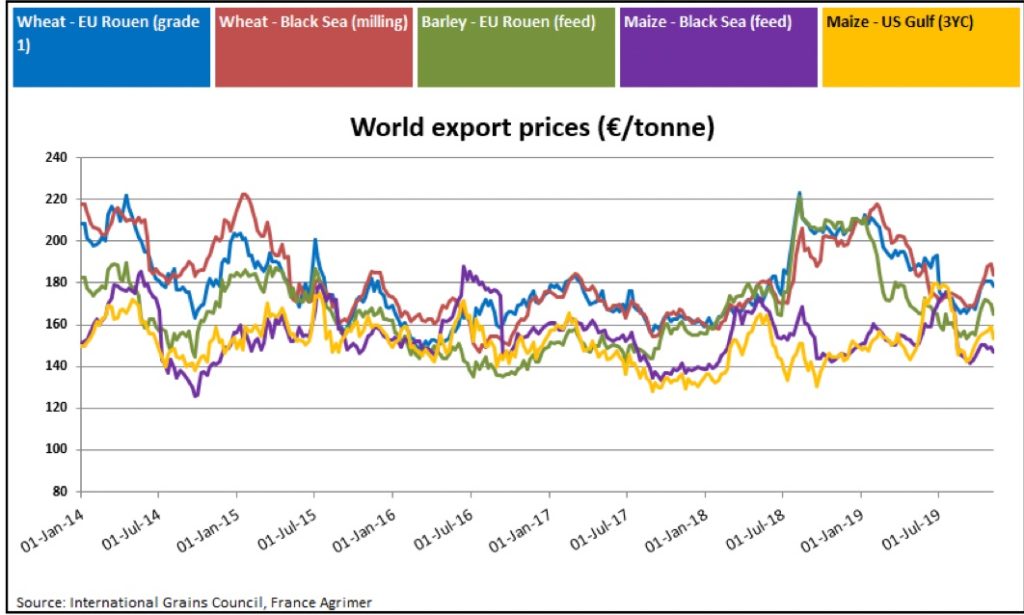

The Dec 2019 Matif wheat contract is now back trading at €178/t, as French exports have come under pressure from increasingly competitive black sea wheat. However, it is positive that EU wheat exports are up 55% on last year, while barley are up by 28%. Last Friday’s USDA report gave some small support to the market, as it lowered US and southern hemisphere production. However, this was balanced by increased forecasts from the EU and Black sea regions, with overall global ending stocks rising slightly from 287.8 to 288 million tonnes. On the planting front, there have been some delays for Winter crops particularly barley in France and Germany, however, progress is better than the UK. Meanwhile in the Black sea region 95% of the planned Winter grain crop is planted.

Corn (Maize) futures have continued to trade based on the final outcome of the US harvest. As harvest has progressed futures have continued to weaken in recent weeks. Friday’s USDA report gave some support to the market as it reduced US forecasted production, while another report last night indicated US corn harvest progress at only 66% versus the 5-year average of 85%. On the negative side US export demand remains very slow due to competition from the Ukraine and Brazil.

Yet again some positive signals from the US/China trade dispute such as tariff rate free quotas for US soybeans have boosted the soybean market, however there still appears to be ample supplies available from the South American countries.The soybean harvest in the US is now 85% complete, versus 92% on the 5 year average, with an expected reduction in yield now also factored in. With 2020 soybean plantings in South America now well advanced due to favourable weather, it is difficult to see much upside in this market for the short term.

Rapeseed futures continue to trade strongly due to poor harvesting conditions in Canada. Although EU winter plantings have increased on last year, the area planted is still at a historic low due to the loss of vital PPP’s and another dry sowing season in France and Germany. As a result, the EU has fallen from a position of producing 33% of the world rapeseed production to now only 25%.