Domestic Market

The harvest is now underway and some progress has been made in parts of north Cork, Tipperary and Kilkenny. Initial reports suggest that yields are reasonable with good quality.

There is still no confirmation on prices as merchants report no firm orders from the feed trade as of yet. Forward green prices for the harvest still remain around the €145-mark range for barley and €156/t for wheat.

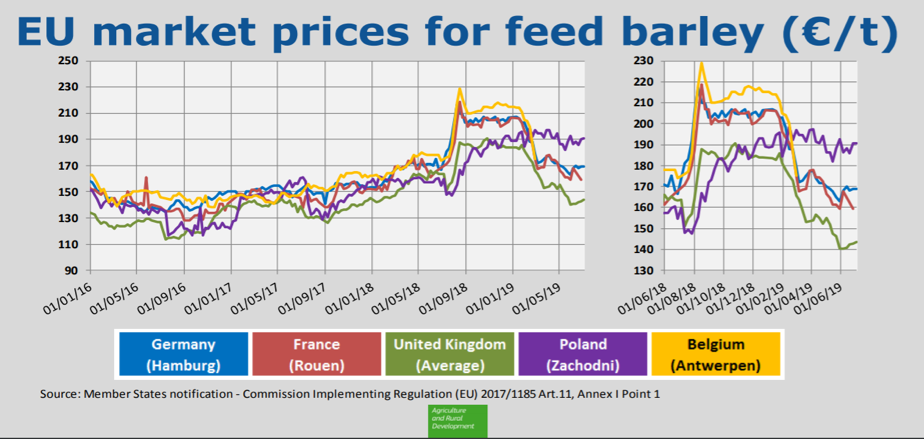

It is predicted that the UK will have a grain harvest over 15 million tonnes, which will leave them with a significant surplus this year. The UK has some of the cheapest feed barley in Europe at the moment. There is a danger that with a weak sterling and a potential Brexit deadline of Oct 31st, British growers may try to export a lot of grain before this date. Hopefully most of this grain will go to the Iberian Peninsula where drought conditions are set to reduce the barley harvest in Spain by 27% from last year.

Harvesting of winter barley, which accounts for around half of EU production, is well advanced in Germany and France with good early yield indications. The production outlook for French winter barley could see an increase of 7% from 2018 while the estimate of the spring barley crop predicts an increase of 27%, mainly due to a jump in sowings.

The French harvest has now moved as far north as Paris, with harvest pressure affecting the spot FOB Creil malting barley price which has now dropped to €170/t with the running average now at €184/t. However, later-developing spring malting barley may have suffered more from the recent heatwave and this could be positive for the price in the coming weeks.

Irish Native/Import Dried Prices

| Spot 16/07/19 | New Crop 2019 | |

| Wheat | €188/t | €184/t |

| Barley | €170/t | €175/t |

| FOB Creil Malting Barley | €170/t | €184(av) |

| Oats | €200 | €175 |

| OSR | €360 | |

| Maize (Import) | €192 | €192 |

| Soya (Import) | €335 | €335 |

International Markets

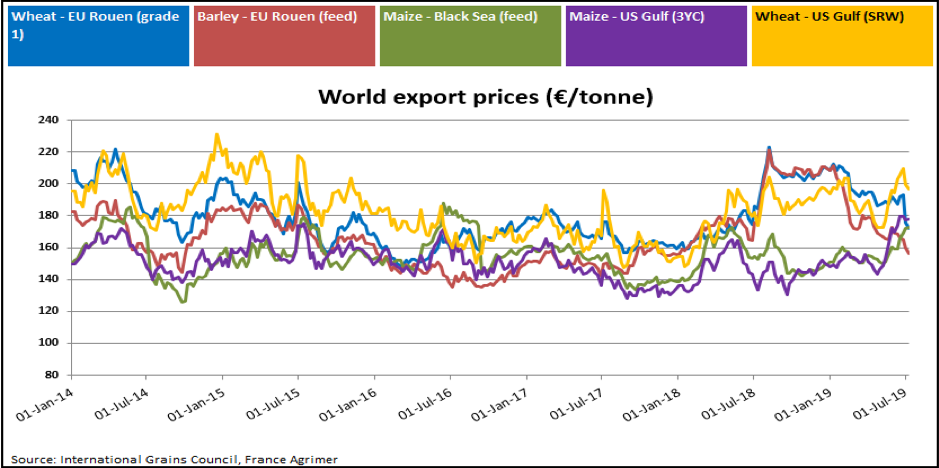

There is little forward demand from the major international buyers as many are sitting back and adopting a wait and see approach. Wheat harvests are continuing across the northern hemisphere, with the US harvest making considerable progress following previous delays due to wet weather. Initial reports indicate that yields and quality are positive, with estimates anticipating a 4% increase on world production compared to 2018 with the EU predicting an 11% production increase on 2018.The Matif Dec 2019 wheat is currently trading at €180/t which is the midpoint of the recent price range.

Black Sea Wheat is the cheapest in the market at present as the Ukraine will have another bumper harvest. As the world’s largest producer, Russia will have the biggest influence on the wheat market. Production estimates are varying anywhere between 72 and 78 million tonnes, which is above last year’s 70m but below the 85m of 2017.

The corn (maize) market is continuing to trade on weather related news. Futures had jumped in the US last week as very hot weather had threatened the development of plants already frail from poor establishment conditions. This week prices have eased as cooler more temperate conditions were seen to benefit crops. Markets are really waiting for the next USDA crop report on the 12th of August, which will give more clarity to what was actually planted in the US this season.

Although maize prices are still close to 5-year highs and production should be reduced, markets may have peaked for this year as we still have large stocks of corn in store and countries such as Brazil have a lot of corn available. Brazil’s 2018/2019 total corn harvest forecast is now revised upwards to 100 Million tonnes versus 98.2 million tonnes In June.

Like corn the Soybean market is being driven by weather effects on crop development in the US. However, unlike corn prices, they are still near 10year lows as there are large stocks around the world due to the swine fever issue in China and large crops in South America.

The EU is facing large rapeseed imports in the coming months as indications intensify that Europe’s rapeseed crop this summer will be small. According to analysts the severe decline in EU rapeseed production is likely to boost rapeseed imports to a new high of close to 5.6 million tonnes, compared to imports for 2018/19 at 4.3 million tonnes.

Some interesting news from the EU Commission, states that the EU soybean area has tripled over the past ten years to almost 1 million hectares, with most of the soybeans grown in Italy.