Domestic Market

Despite significant recent rain in places, it has been very variable and localised. It has come too little too late for many crops, particularly up through the midlands and into the east and north east. Grass growth has remained poor in areas also, which has led to supplementary feeding of concentrates and strong feed demand. However, it is disappointing to see some advice instructing livestock farmers to use imported feed sources with dubious sustainability standards, such as palm kernel and soya hulls when native feedstuffs are available.

The recently released preliminary BPS figures from DAFM show a slight reduction in the overall cereal area for 2020. However, as expected Winter crop plantings are down over 40%. Although most of the lost area was made up with Spring crops, the lack of Winter crops and the prolonged dry conditions will see overall crop production down below 2 million tonnes.

Green harvest prices for barley and wheat remain in range of €135 – €142/t and €155 – €162/t respectively. Due to the continuation of the low US maize price, the automatic mechanism calculating import duties was triggered again, raising the import duty on maize into the EU from € 5.27 to €10.50/t

The FOB Creil malting barley average price is currently at €172/t. Prices rose significantly following a decision by the Chinese to put an 80% tariff on Australian barley, which led to Chinese demand for French malting barley. With a lot of social establishments now reopened across Europe and with some Irish pubs reopening on June 29th, this should help malt demand.

Irish Native / Import Dried Feed Prices 18/06/2020

| Spot €/t | Nov 2020 €/t | |

| Wheat | 195-198 | 190 |

| Feed Barley | 167-170 | 168 -170 |

| FOB Creil Malting Barley | 172 | |

| Oats | 160 | 160 |

| OSR | 360 | 370 |

| Maize (Import) | 180 | 174 |

| Soymeal (Import) | 330 | 328 |

International Markets

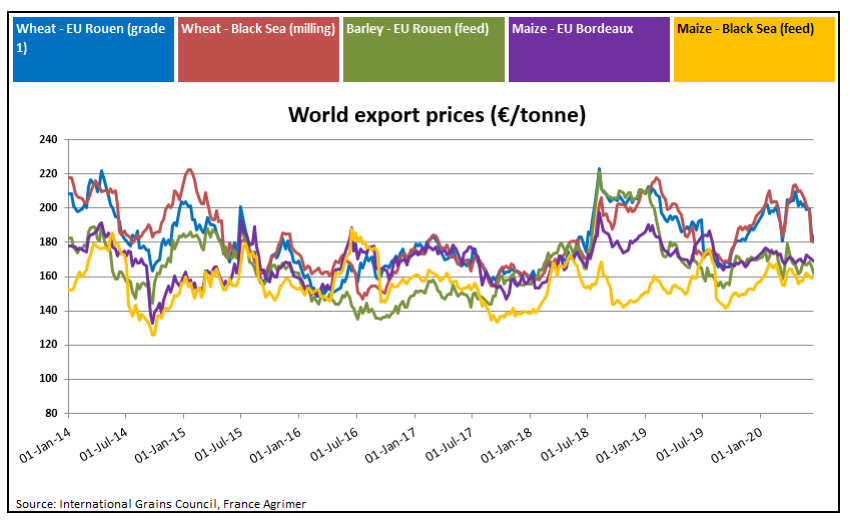

Wheat and barley harvesting have begun in parts of the US, France and Russia. Due to recent beneficial rainfall across Europe and the Black sea region, EU wheat prices have fallen to 3-month lows. However, yields in the EU are expected to be down significantly on last year on Winter and Spring crops due to the wet Autumn and Spring followed by very dry conditions from late Spring onwards. World demand for wheat is very strong, however, stocks are at record high and the wheat price is coming under increasing pressure in the feed market due to the relatively large price gap with maize.

US maize prices are off their historic lows due to the increase in ethanol demand as world economies reopen following the pandemic. In addition, US maize plantings have again been revised downwards and there is some concern for continuing dry weather across that mid-west and northern plains. However, with world maize production expected to be near record highs and the reduction in industrial demand, it is difficult to see much more upside in prices from here, unless there is a significant weather event in the US.

In the soybean market, markets have been supported due to increased Chinese purchases. However, like maize, it is difficult to see any major upside in the market due to projected production levels in the US.

With EU rapeseed production again revised lower, futures prices have remained strong. Over 60% of the rapeseed production in the EU goes into biofuel and this market is expected to remain robust once all economies in the EU fully reopen.