Domestic Market

The Winter crop harvest is now well underway having commenced last week. The acreage of Winter crops is one of the lowest on record, so weather permitting, progress in these crops will be swift. As predicted, due to the poor Winter following by the dry spell in April/May,crops are very variable. Some growers are reporting yields as low as 6t /ha, with very few seeing crops yielding anywhere close to the 10t/ha. Straw is well back also, with fields struggling to produce 20 4x4 bales/ha.

Unlike last year, in general all grain stores are now empty coming into the harvest. As a result, grain prices have strengthened with green harvest prices for barley and wheat now inthe range of €139 – €145/t and €158 – €162/t respectively. It is very positive that grain prices have increased to coincide with the start of the harvest across Europe.

The FOB Creil malting barley average price is currently at €173/t with the market remaining strong due to continued Chinses interest in French supplies and predictions of a reduced EU spring barley harvest.

Irish Native / Import Dried Feed Prices 21/07/2020

Spot €/t | Nov 2020 €/t | |

| Wheat |

197 |

192 – 195 |

| Feed Barley |

170 |

172-174 |

|

FOB Creil Malting Barley |

175 | |

| Oats |

160 |

160 |

| OSR |

|

370 |

| Maize (Import) |

183 |

175 |

| Soymeal (Import) |

327 |

325 |

International Markets

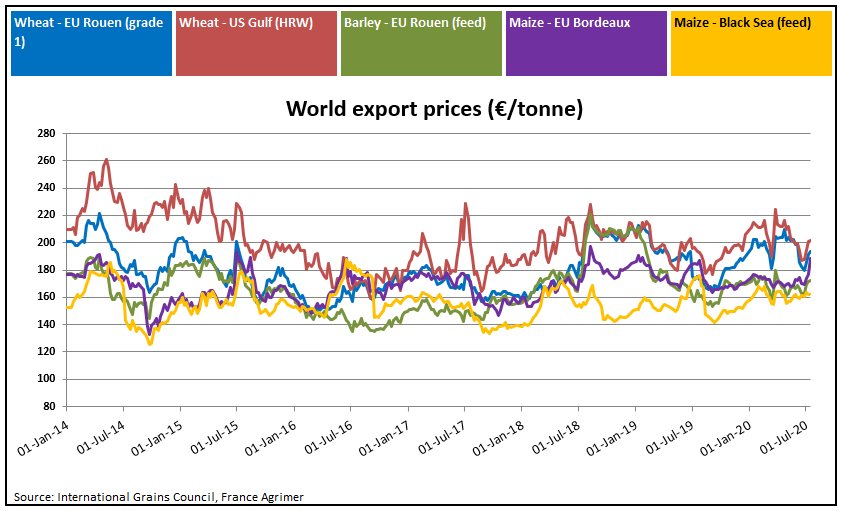

EU wheat prices had fallen to 3-month lows during June but picked up significantly at the start of July, mainly due to initial harvest yields below expectations and a lowering of the US maize area. The Matif wheat front month price initially went to €190 per tonne but is nowback at €183. Russian wheat export prices rose for the second consecutive week last week due to the slow pace of harvesting because of poor weather. Both European and Black sea wheat yields initially came in lower than expected but have improved as the harvest progressed. The continuation of good weather in the EU’s largest grain producer France, is expected to see most of the wheat harvest there completeted by the end of the week.

US maize prices spiked from their historic lows at the start of the month as it was reported that US farmers had planted 5 million acres less of maize than had been initially predicted.Increasing imports of US maize by China also added to the positive sentiment. Due to the upswing in the US maize price, the automatic mechanism calculating import duties into the EU has resulted in all import duties being removed from maize for the moment. The import duty had been as high as €10.40/t a month ago. However, the continuation of good crop growing conditions in the US and weakness in the ethanol market, has dragged futures lower again but the possibility of increased Chinese demand is providing support.

The soybean market continues to be supported due to increased Chinese purchases. However,like maize, with crop growing conditions in the US remaining favourable, it is difficult to see any major upside in the market due to projected production levels in the US.

With EU rapeseed production revised lower, futures prices continue to remained strong as we approach the harvest.