Domestic Market

As expected, feed demand has dropped off considerably as we near the end of April. The continuing spell of dry weather has ensured that planting of the main cereal crops is finished in all parts of the country, with only small amounts of maize and potatoes remaining.

Anecdotal reports suggest that up to 145,000ha of Spring barley may have been planted. This would leave the total barley acreage at approximately 190,000ha which would be a similar figure to 2016 but with a lower Winter barley area. However, it must be noted that overall cereal production may be down by 300,000 tonnes on last year due to the lower area of wheat and oats.

Imported maize prices have dropped considerably which has pulled down barley prices in particular. Again, it is very frustrating to see grain imports with low sustainability standards, from third countries, having such influence on Irish grain prices. Due to the low US maize price the automatic mechanism calculating import duties was triggered recently, setting an import duty of € 5.27 per tonne. This will help to put a floor in futures prices however in future the duty should be triggered sooner and at a higher amount per ton.

The FOB Creel malting barley average price is currently at €168/t. There may be plans to cut the intake of malting barley next harvest but this should have little impact on the feed market which imports over 4 million tonnes of ingredients per year. The real impact on the Irish feed market is the import of cheap maize from third countries such as Brazil.

Irish Native/ Import Dried Feed Prices 28/04/2020

| Spot €/t | Nov 2020 €/t | |

| Wheat | 200-205 | 190-195 |

| Barley | 170 | 165-170 |

| Oats | 160 | 160 |

| OSR | 375 | 365 |

| Maize (Import) | 185 | 173 |

| Soya (Import) | 390 | 340 |

International Markets

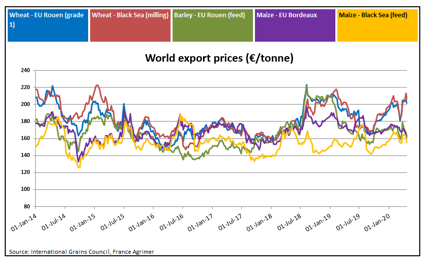

A combination of recent rain across Europe and the Black sea region, and countries such as Russia and Ukraine yet to impose any serious export taxes or restrictions, has caused wheat prices to ease back from recent highs. However, it has been one of the driest starts to spring in Western Europe since 1979 and this has had a negative impact on the sowing and emergence of spring and summer crops so as always weather will play a major role in prices as the season progresses.

Maize prices have remained at historic lows, with the outlook continuing to remain bearish. Issues such as the collapse in demand for ethanol is not expected to change soon while news that US framers have 30% of their maize crop planted already has added to the negative sentiment. The further weakening of local currencies in Brazil and Argentina versus the dollar, has further increased the competitiveness of their maize and soymeal exports.

Soymeal prices have eased back again on the reduction in transport restrictions and currency weakness in Argentina. The positive soybean production figures from South America and the good start to the US planting season is keeping prices on the low side. In addition, China’s soymeal demands this year are expected to be slightly lower than last year on smaller pig herds and delayed poultry production. There has been some better news on the rapeseed front with prices stabilising and seeing some slight increases.