Domestic Market

The continuation of the wet conditions throughout November, has ensured there were few further opportunities to plant Winter crops. Some areas in the East and South east have received up to twice the annual rainfall for October and November which will lead to loses in the crops which were planted. This will have significant implications for the availability of wheaten straw in particular next harvest. Many are now considering planting Winter wheat in January/February if conditions allow.

According to Eurostat figures, Ireland has imported 255,000 tonnes of Maize from third countries outside the EU since the marketing season started in July. The majority of the imports were GM maize from Brazil. This figure is 82,000 tonnes down from the same period last year however, it is still a huge figure considering the favourable domestic grass growing season and extra availability of native grains.

There have been some forward prices offered for green barley at €140/t, however, with the price on the low side and the lack of Winter barley plantings, few will be considering these offers for the moment.

Irish Native / Import Dried Prices

| Spot €/t | Jan 2020 €/t | |

| Wheat | 186/188 | 189 |

| Barley | 172 | 175 |

| Oats | 160 | |

| OSR | 370 | |

| Maize (Import) | 182 | 185 |

| Soya (Import) | 335 | 335 |

International Markets

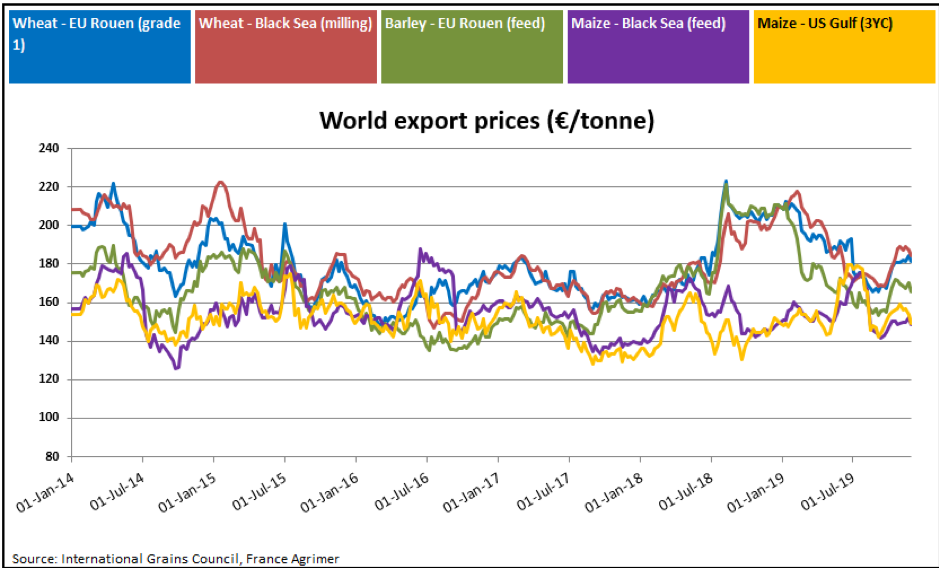

The Dec 2019 Matif wheat contract, is now trading at €186/t, a major change from the low of €165/t during September. This increase in the futures price has been driven by the reduced Winter plantings in the UK and France as a result of the wet weather experienced in North western Europe. Chicago wheat futures have also jumped in tandem with European prices however some of this is being attributed to technical moves and covering of short positions.

Black sea wheat prices remain strong however Russian wheat production is up 7 million tonnes on last year and they also have increased their Winter cropping area by 4% compared to 2019.This may more than account for the potential reduction in the EU planted area, and may cancel out the potential reduction in the European area.

With the greater potential for EU wheat production being reduced compared to barley, we are seeing some divergence in the market between wheat and barley. The market is assuming that framers will plant more Spring barley crops in 2020 in order to compensate for the inability to plant wheat etc.

Corn (Maize) futures rose in tandem with wheat towards the end of last week as sales of US corn increased and snowfall in the north mid-west of the US is causing problems with finishing the corn harvest. Increased internal demand in Brazil from ethanol and livestock producers has also being positive for future prices.

Rapeseed futures continue to remain robust however soybean prices have fallen significantly in the past week due to continued uncertainty in US/China trade talks, and the potential for increased production from south America in 2020. The EU continues to be over dependent on imported protein crops with the block increasing soymeal imports by 15% compared to last year.