Feed demand is described as strong, particularly in the dairy and sheep sectors, with the beef demand back somewhat since December. With high spot prices there is considerable demand for local grain supplies. Most of the native grain is now accounted for, which will leave stores empty heading into the next harvest.

The price differential between barley and wheat/maize has narrowed slightly, however, the difference in prices of €30-40/t is significant and above the historic norm.

Forward green prices for harvest 2021 are somewhere in the region of €160-165/t for barley and €170-175/t for wheat. Again, these are €20-€30/t below current spot prices. In relation to maize and soymeal, forward prices for next Autumn are significantly lower with price differentials of €70 – €80/t. It remains to see what happens as the year progresses but any major weather events or interruption to Spring plantings in the northern hemisphere will certainly trigger a rise in the forward prices to match current spot offers.

Despite the decline in beer demand the EU malting barley market has remained strong due to increased demand for feed barley. China has already secured significant quantities of French barley from the 20121 harvest. The FOB Creil malting barley 2021 price is currently trading at €205/t.

Irish Native / Import Dried Feed Prices 02/02/2021

| Spot €/t | Mar/April 2021 €/t | |

| Wheat | 235-240 | 235-240 |

| Feed Barley | 205 | 205-210 |

| Oats | 180 | 180 |

| OSR | 410 | |

| Maize (Import) | 245 | 245 |

| Soymeal (Import) | 540 | 485 |

International Markets

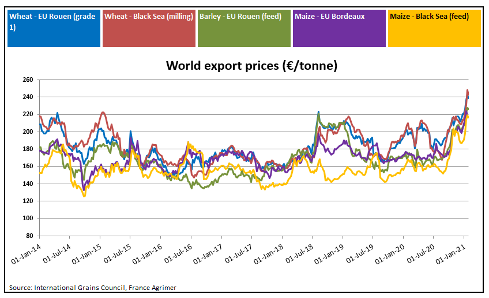

Matif wheat front month prices spiked to seven-year highs of €240/t in mid-January but have tempered since and currently trade at €223/t. Wheat has risen in tandem all with other grains, however, the prospect of increased taxes on Russian grain exports and Chinese buying has been bullish for the commodity. However, as we look forward, the issues of high world production, and good condition of Northern hemisphere Winter crops must also be considered regarding the direction of prices.

Probably the biggest driver of grain markets has been the demand from China. Last week China bought 2.1m tonnes of US corn in one daily order, which is the second largest since records began. So far in this marketing year, China has bought over double the amount of corn and wheat, and almost 40% more barley than it purchased in the previous year. These recent deals have pushed corn prices to seven-year highs. In addition, delays to the harvesting of soybeans in Brazil will mean delays in planting of the second Safrinha corn crop, much of which will be exported to Europe from August onwards.

Soybean futures remain off recent highs, however ongoing concerns regarding the S American harvest and Chinese demand continue to support prices.

A large rapeseed harvest in Australian has offered short-term availability for the oil seed, however prices remain strong due to reduced supplies from the Ukraine and Canada.

EU rapeseed stocks at the end of the 2020/21 season on June 30 are expected to be very low, which could push late-season EU rapeseed prices even higher.

For next season, EU and UK production is expected to rise by only 1 million tonnes which will leave it close to historic lows.