Domestic Market

Feed demand remained strong for the last two weeks of March but as expected has slowed into April. The recent spell of good weather has allowed farmers to plant significant acreages of Spring wheat and beans. Estimates put the Spring wheat acreage close to 10,000ha compared to the 3,700ha planted last year. The bean acreage should also increase to over 10,000ha compared to the 7300ha planted in 2019. At this stage there appears to be no shortage of Spring barley seed, despite an expectation of plantings being in excess of 120,000ha.

Imported maize has dropped in price. To date it has had no effect on barley or wheat prices but may have if these low prices persist. Feed mills need to ensure that they continue to use high percentages of native grains and not switch to less sustainable imported alternatives.

The restrictions imposed due to the Corona virus have had a serious impact on demand in the drinks sector and this has been reflected in a weakening of the FOB Creel malting barley price to €167/t.

Irish Native / Import Dried Feed Prices 07/04/2020

| Spot €/t | Nov 2020 €/t | |

| Wheat | 198-203 | 190 |

| Barley | 172 – 175 | 173 |

| Oats | 160 | 160 |

| OSR | 345 | 360 |

| Maize (Import) | 185 | 178 |

| Soya (Import) | 435 | 360 |

International Markets

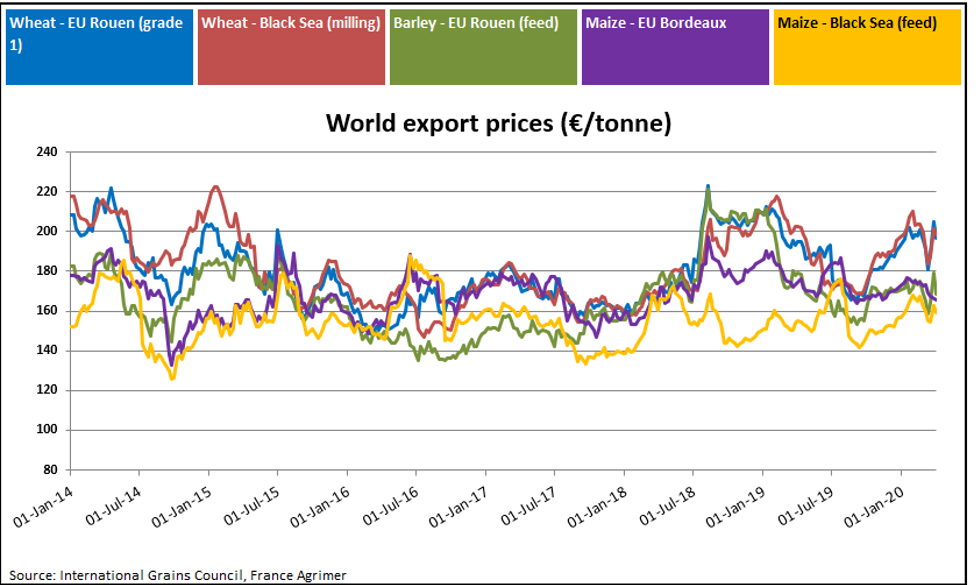

A combination of strong overall demand, logistical difficulties and rumours/facts of export restrictions have kept wheat prices in the higher price range. However, in the past week prices have softened as the panic buying has subdued and countries such as Russia and Ukraine have yet to impose any serious export taxes or restrictions. In general, wheat stocks are quite high and world production is forecast to be similar to last season. In a report from the French farm ministry it predicts French wheat sowing to drop 7.5% and barley to increase by 2.8% on 2019.

Maize prices took a further tumble lower last week on the news that US farmers were considering planting more corn acreage this season, despite the poor outlook for the commodity. Prices had already fallen to four lows due to the collapse in demand for ethanol, which has fallen in tandem with world oil prices. Up to 30% of US maize production is used in the production of ethanol.

Soymeal prices have increased again due to continuing transport restrictions in the world’s top exporter Argentina due to the corona virus outbreak. However, restrictions have eased slightly in recent days which should see an easing in the spot price in the coming weeks. Rapeseed futures have steadied on news of predictions regarding lower EU and Canadian production.