Dairy market blog – 3rd February 2020

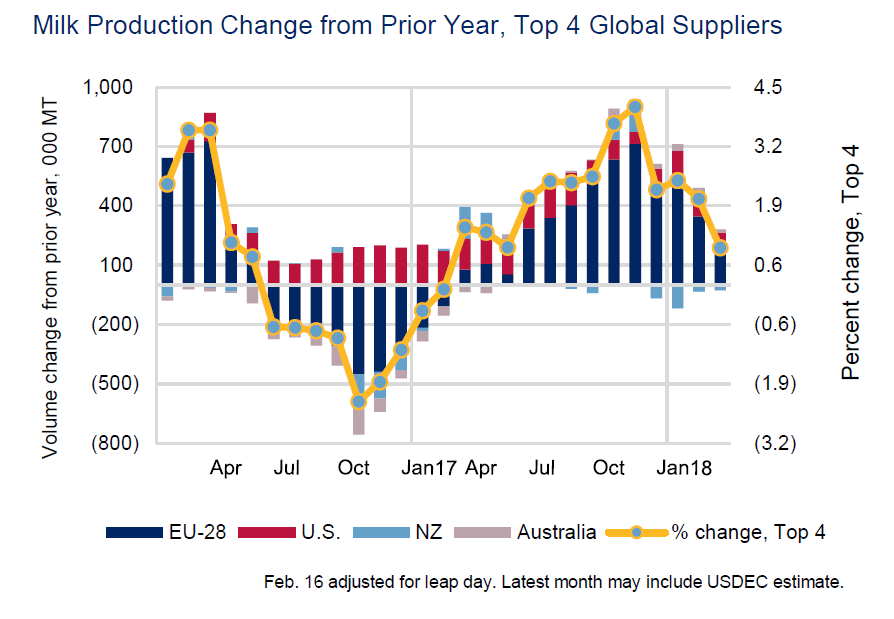

Global milk supplies have been growing by less than 0.5% for most of 2019, and according to Rabobank’s Q4 Dairy Report, this trend will likely continue with growth of less than 1% through 2020 and possibly into 2021.

Ornua concludes that 2019 global milk supplies will likely be about on par with 2018.

Latest output trends in the EU have seen a fall off in Irish deliveries by 5.7% for December – though it should be remembered that the December 2018 figure was a massive increase on the previous December. Output for Jan/Dec 2019 is up 5.2%, reaching (some expect exceeding) 8 bn litre.

Source: USDEC

Source: Rabobank Q4 Dairy Report 2019

In Germany, milk collections are estimated down by 0.2% at this point of the season compared to the same period last year.

Early January collections in France were up modestly at around 0.6% with the season todate up around 0.4% compared to the same period.

UK supplies for the 2019/2020 season todate are 0.8% up on the previous period, with late January supplies down 1.4%. INTL FCStone estimate that the December supplies were down 1.1% and January 1.3%.

In all three cases, while the supplies are only modestly up, or even down, on the reference period, they tend to be higher than the 3 or 5 year average, so the underlying trend of growth remains, but it is very subdued.

New Zealand supplies for the calendar year 2019 were down 0.32% (milk solids), though up 0.2% in December and something similar in November.

US output was 0.9% up in December, but up only 0.3% for the calendar year 2019.

Subdued international milk output, coupled with somewhat better international demand, boosted by cheaper dairy products, is the main reason why, despite concerns over Brexit, and other international trade difficulties, dairy prices have not fallen as much as expected during 2019, and have even started to improve, especially for SMP, since August or so.

Demand – impact of coronavirus and Brexit?

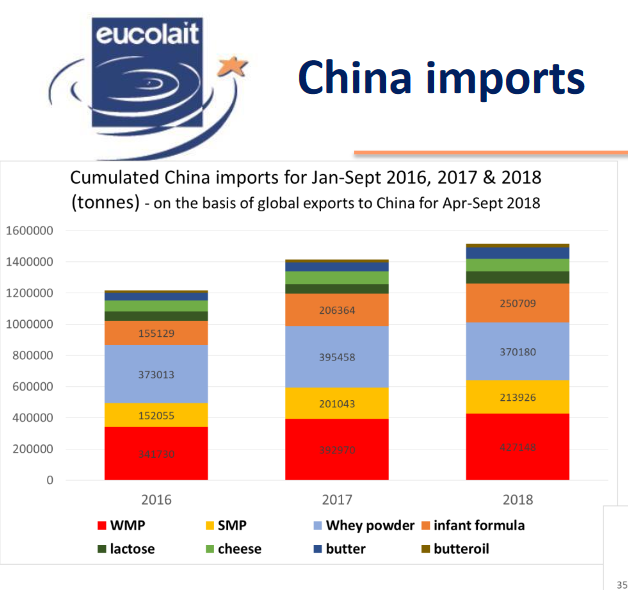

China has played a huge part in recent years in maintaining strong global dairy demand, as the comprehensive table below shows. Since 2015, imports of bulk and packed milk has increased 81%, infant milk formula imports practically doubled, as did WMP. SMP imports grew 72%. Cheese, from low levels, rose 51% and butter rose by 60% by 2018, but has come back somewhat since.

Chinese consumers still have greater confidence in imported product, and the national capacity to produce more milk is in any case limited, especially by production costs.

Source: CLAL.it

The recent outbreak of the coronavirus, and the reaction to it, have seen entire regions closed down in an attempt to contain contagion. As we write it is not clear how long it will take to first contain then fully treat/vaccinate the populations so that normal movement of people can resume.

Meanwhile, however, it is only to be expected that the movement of goods, indeed demand for goods, will be affected by the lock down. What impact this might have on the global market for dairy will obviously depend on how soon the situation can be brought under control, then resolved.

Regarding Brexit, after approval by the UK and EU Parliaments of the Withdrawal Agreement, we have entered an 11-month transition period during which trading conditions will remain unaltered – so after a very uncertain 12 months, at least some short to medium term certainty.

That is not to say that there will not be plenty drama and political statements, as we already hear Boris Johnson say he will seek to diverge on a number of standards including labour, environmental and others, and Michel Barnier warn him that such statements will make trade negotiations difficult if not impossible. Do expect possible fluctuations in the value of Sterling as markets take various views of the latest goings on, but no custom delays or tariffs until 31st December 2020, and after that only if we have a no-deal Brexit, or if we have a deal with includes some level of tariffs and requires some checks – and this is very likely.And yet, prices continue to firm

Concerns over the Chinese situation and Brexit aside, it looks like, after the quiet period which always follows Christmas, most dairy commodity indicators have resumed their firming trend.

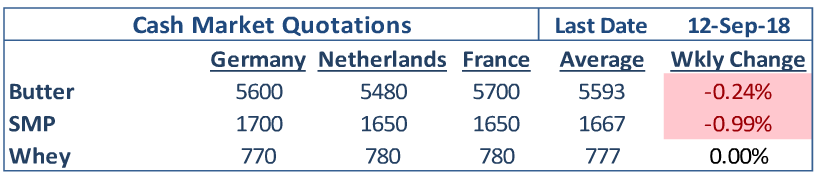

EU spots have seen butter prices stabilise for some weeks at around €3600, while SMP has been inching its way first above €2500/t and now above €2600. Whey is the biggest gainer, however, now breaching the €800/t.

Source: INTL FCStone

EU average dairy prices show the same trend, with stable butter prices, rising SMP and whey powder prices.

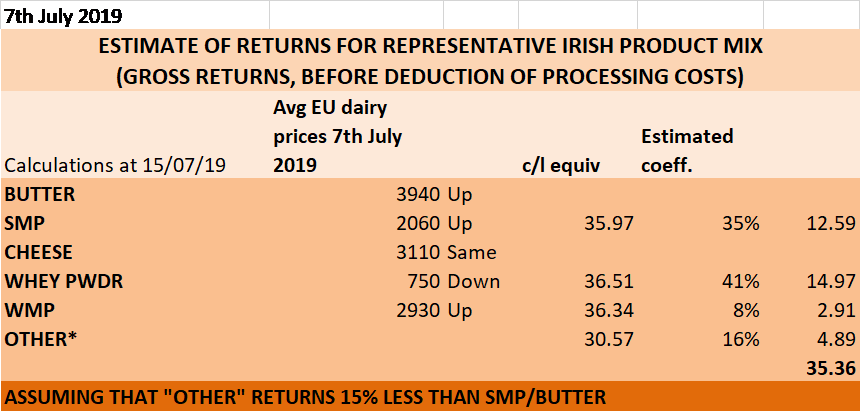

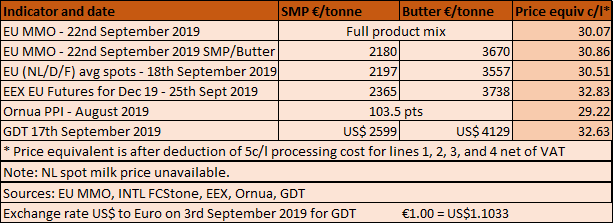

Based on the prices reported for the EU average of the product mix most relevant for Ireland, gross returns for late January rose to nearly 38c/l, which is equivalent, after a 5c/l processing cost is deducted, to a milk price of 32.97c/l + VAT (34.75c/l incl VAT).

Based on EU MMO data

The trend towards firmer commodity prices has also shown through the first 2 GDT auctions of 2020, which saw an uplift in the price index by 2.4% (7th Jan) and 1.7% (21st Jan) respectively. At US$4250/t, the butter price is comfortably above the middle of the price range for the last 5 years. SMP, at just over US$3000/t is at its highest for the same period.

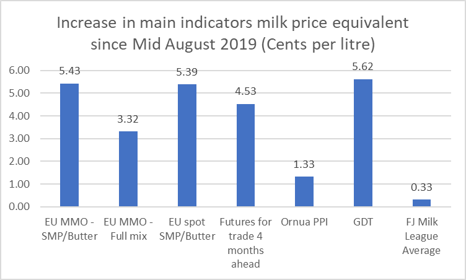

Taking stock of all the relevant indicators since mid-August, we see a significant increase in the milk price equivalent they represent, with the EU MMO and EU spot SMP/butter combo returning over 5.4c/l more, the EU MMO full mix 3.32c/l and the Ornua PPI (to December 2019) a more modest 1.33c/l. Meanwhile, a comparison of the average Farmers’ Journal Milk Price League for August 2019 with an estimate of December 2019 suggests an increase of only 0.33c/l – this is because many co-ops cut their milk price in August 2019, at a time when commodity returns had just bottomed out.

Based on data sourced as above, and FJ Milk League

It is clear that there is scope for further milk price increases by Irish co-ops, after the modest price lifts (around 2c/l) applied in different ways for the October to December period.

CL/IFA/3rd Feb 2020