The latest IFA Dairy Market Report asks are SMP markets on the mend at last?

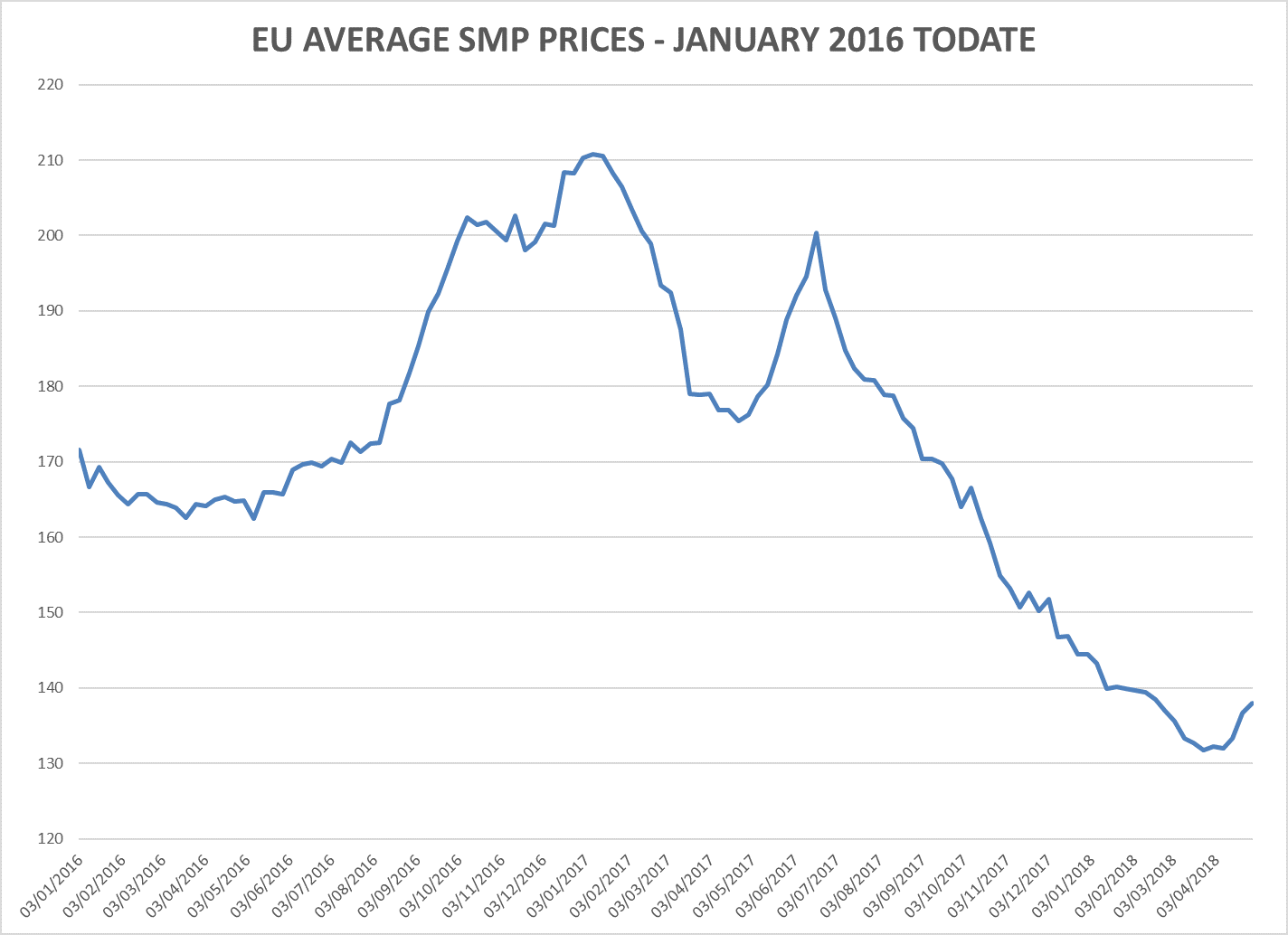

SMP prices have languished well below €2000/t since June 2017, after which they staged a free-fall. They have been below €1500 since November. In the last few weeks, average EU SMP prices as reported by the EU MMO have first stabilised just over €1300/t, and in the last couple of weeks have even staged a small recovery to €1380 (29th April 2018). Could it be that we’ve seen the worst of the SMP prices?

While we all hope so, there are a number of indicators which suggest that we might just be right to be optimistic.

Based on EU MMO data

While we all hope so, there are a number of indicators which suggest that we might just be right to be optimistic.

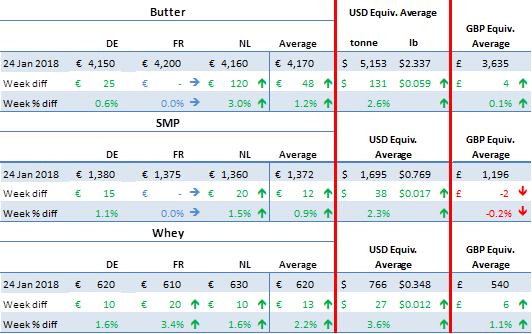

Spot markets too have been rallying of late, now reaching €1420/t on average for the Dutch, German and French quotes on 2nd May 2018. This is around €200/t above the early April quote for SMP.

Source:FCStone

What is also very interesting to observe is the buyers’ attitude to the SMP intervention stock. The last tender, on 17th April last, saw for the first time a significant amount of product sold (24,066 t, compared to just around 10,000t sold over the 17 preceding months). Even more meaningful was the price at which the product sold: poor at €1051, but stable/up for the first time in those 17 months. Furthermore, the range of prices buyers were prepared to bid at reached above the intervention reference price of €1700 for the first time since last September.

It would seem that buyers are now prepared to pay more for SMP intervention stock. Some operators have suggested that sellers are now finding it a little easier to dismiss the relevance of SMP stock because it is aging rapidly, and is no longer real competition for the fresh stuff. Facts appear to prove them right!

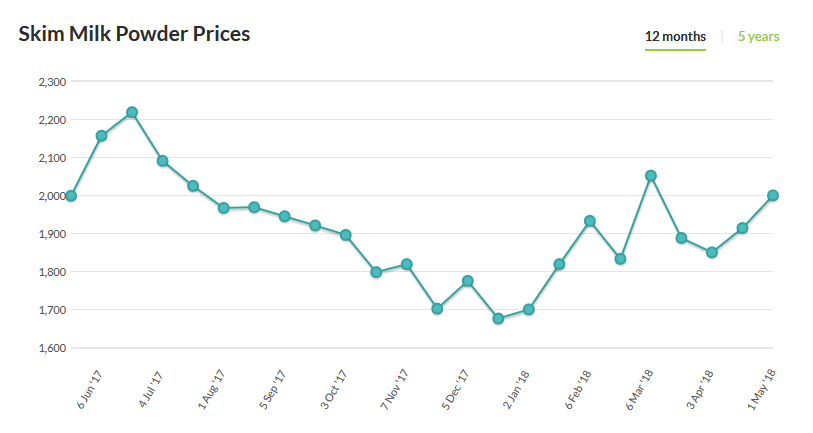

Looking at global market trends for SMP, GDT auctions over the last couple of months have shown stronger prices than even European prices. At US$1,999/t at the auction of 1st May, it would be equivalent in Euros to €1670/t.

The GDT butter and SMP price combination reached on 1st May would be equivalent to a gross Irish milk price return (before processing costs are deducted) of 35.65c/l.

Source: GDT

Positive EU price trend extends beyond SMP

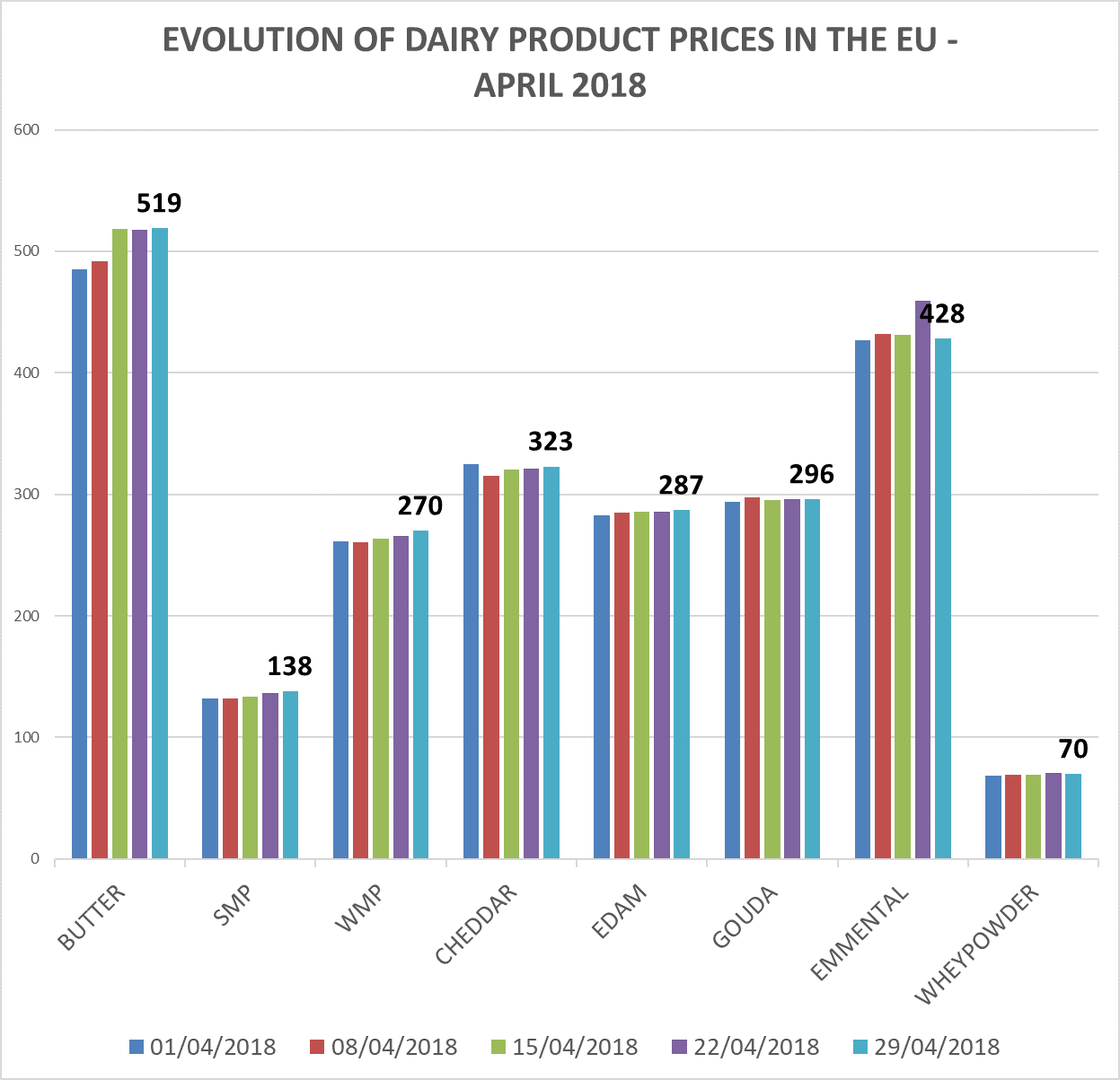

Other EU dairy prices have also improved somewhat in April.

Butter prices are nearing €5200/t, a price over twice the butter price of two years ago, WMP has inched up to €2700/t during the month, while whey powder has lifted slightly to finish the month $700/710/t. All commodity cheese prices have held up well during the month, too.

Returns in terms of cents per litre do reflect the improved average returns – however, where operators have sold on forward contracts signed some weeks back, those would have been at somewhat lower prices. Hence the Ornua PPI may well end up trailing slightly the EU average returns over the coming weeks, just as it was slightly ahead of them when prices started to ease in the last quarter of 2017.

Based on EU MMO data

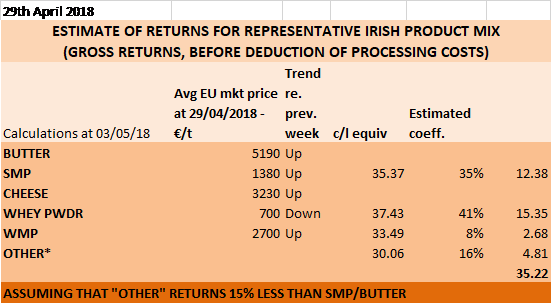

EU returns at end April equivalent to 30c/l + VAT

Taking account of recent price improvements, the average returns before processing costs for a representative Irish product mix based on the most recent data for 29th April quoted by the EU MMO now exceeds very slightly 35c/l – or, excluding a nominal 5c/l processing cost, would be equivalent to 30.22c/l + VAT.

While co-ops may have contracts which were signed for lower returns than those, it would appear at least that those will progressively be replaced by higher priced contracts.

This should give co-ops the confidence to continue supporting milk prices, which farmers still suffering from the consequences of the disastrous spring need badly.

Based on EU MMO data