World Markets Overview June 2018

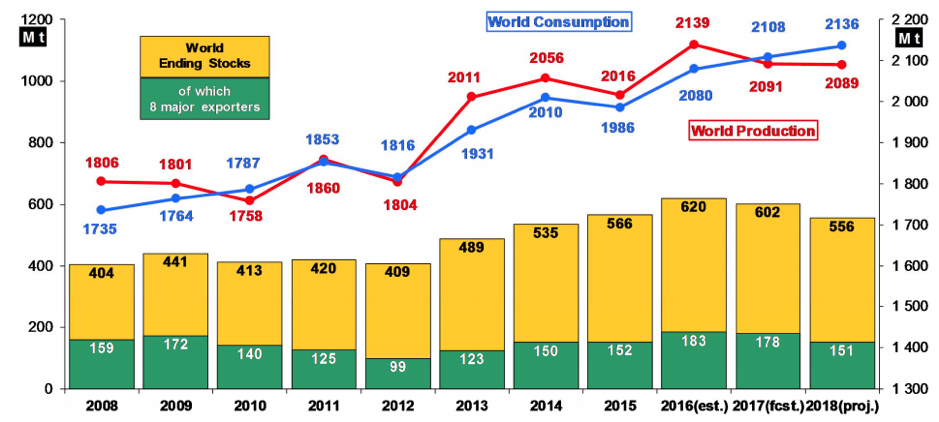

A marginal decline in world total grains production is predicted in 2018/19 with supplies are down 1% due to tighter opening stocks.

Global total grains (wheat and coarse grains) production in 2017/18 was 2% short of the previous year’s record, but heavy stocks at the start of the season saw overall supply rise for the fifth year in succession. However, given sustained consumption growth set to be at a new high, the first world stocks contraction since 2012/13 is predicted. Trade (Jul/Jun) will be the highest ever, including record shipments of maize and barley.

Total grains production in 2018/19 is projected to be below the season before as a reduced wheat harvest is almost balanced by better out-turns of maize, barley and sorghum. But taking account of reduced opening stocks, total supply is set to decline to a three-year low.

The global carryover is therefore seen coming down for a second year, taking inventories to a four-season low.

(Source: International Grains Council, May 2018 Report & GMR 488 21st June 2018)

Wheat

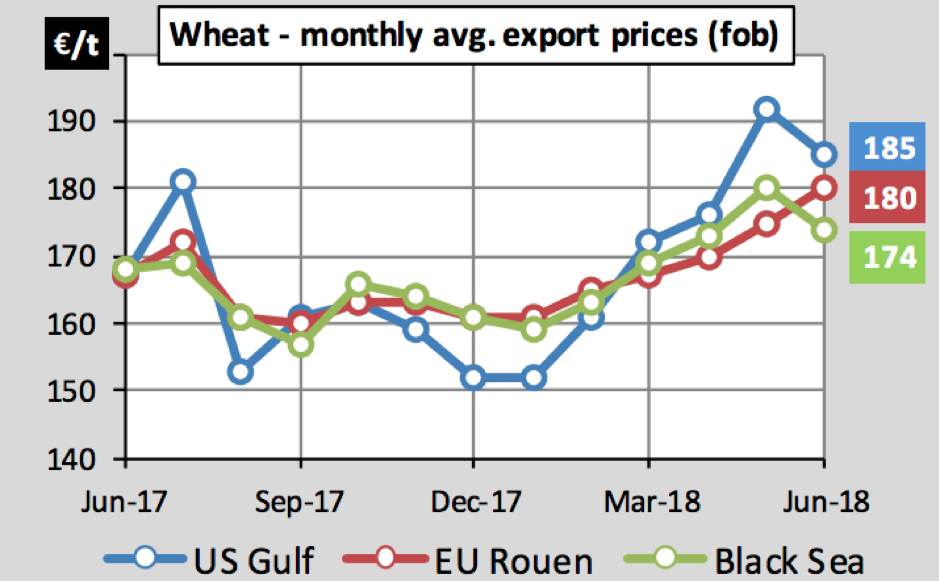

EU prices have remained stable/supported on the week as the trade continues to focus on new crop prospects. Egypt issued another August tender that secured 120,000t of Russian wheat, but with almost 1mln t offered between Russia and Romania, it is likely these origins will still be there when Egypt comes seeking any top-ups.

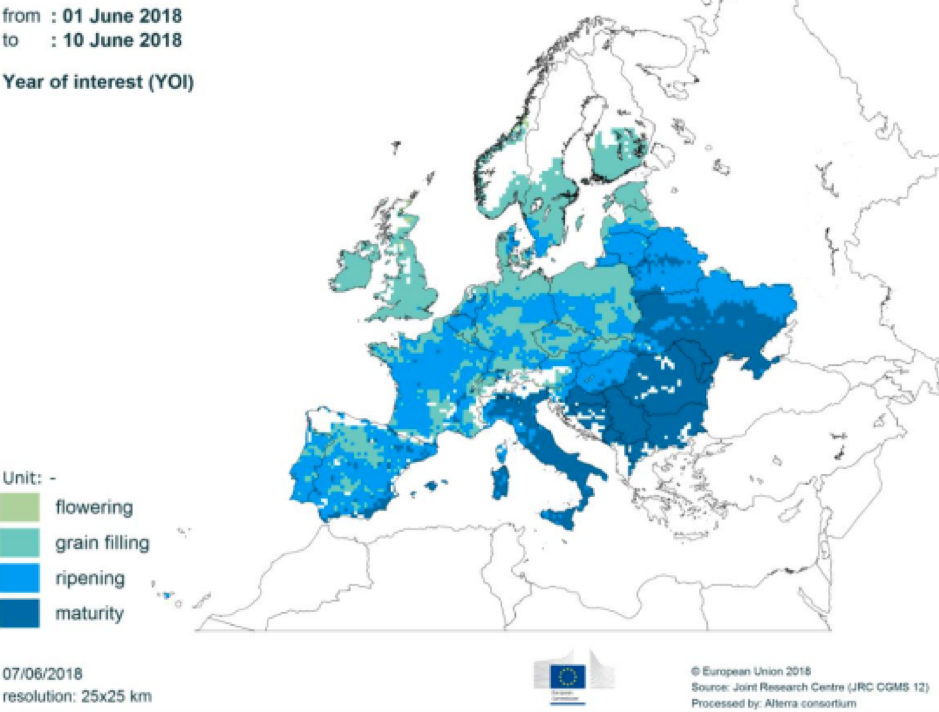

Weather is still providing some issues, with dry conditions across much of Western Europe, while rains are seen in the Ukrainian and Russian spring crop areas, where the ministry expects Russia to harvest up to 100mln t of grain. That is lower than many analysts’ forecasts and is due to adverse weather and delayed sowings. However, the French crop is now being talked up to around 39mln t, and this will compensate lower production in Scandinavia, Denmark and some of the Balkan states.

(Source: Gleadell Market Report 28th June 2018: http://www.gleadell.co.uk/report/)

(Wheat Production Forecast, International Grains Council, May 2018 report)

(Source: DG AGRI)

Barley including malting barley

The French winter malting barley harvest is underway. First reports are of average yields and normal nitrogen. Screenings levels are reported to be higher than usual. The hot dry weather conditions are continuing through the EU, which is keeping malting barley prices high. Traders are getting concerned about the impact on yields and quality, but so far, the brewing industry has not reacted and are waiting for the spring harvest. The winter malting harvest should start in the UK next week, which will be extremely early.

(Source: Gleadell Market Report 28th June 2018: http://www.gleadell.co.uk/report/)

Rapeseed

The global oilseeds market continues to be dominated by the ongoing trade discussions between the US and China. The retaliatory imposition of tariffs on US soybeans imported in China has sent the CBOT soybean market into steep declines, as US traders try to work out how to price the 30mln t of Chinese demand that now attracts a 25% tariff.

Rapeseed harvest is underway in the Black Sea, with yields being described as average. First cuts on crops in eastern Poland are poor, and in France the crops harvested so far have been very variable.

In Ireland and the UK, the ongoing, hot, dry, weather is pushing crop maturity, and some growers have been desiccating crops this week. Harvest 2018 isn’t far away if it hasn’t already begun already.

(Source: Gleadell Market Report 28th June 2018: http://www.gleadell.co.uk/report/)

Winter Rapeseed Crop Stage

(Source: European Union Joint Research Centre, June 2018)

Soyabean

Despite record crops in Brazil and the USA, 2017/18 world soyabean output is forecast to fall by 4% y/y, to 336m t. This is almost entirely linked to a plunge in production in Argentina, but with falls, too, in India, Paraguay, Ukraine and Uruguay.

Most of the anticipated contraction stems from a heavy reduction in Argentina, outweighing stock building in the USA. Acreage gains are likely in 2018/19, especially in South America, as production recovers to a peak of 356m t, up by 6% y/y.

(Source: International Grains Council, Grain Market Report GMR 488 21st June 2018)