Dairy Council Report July 2022

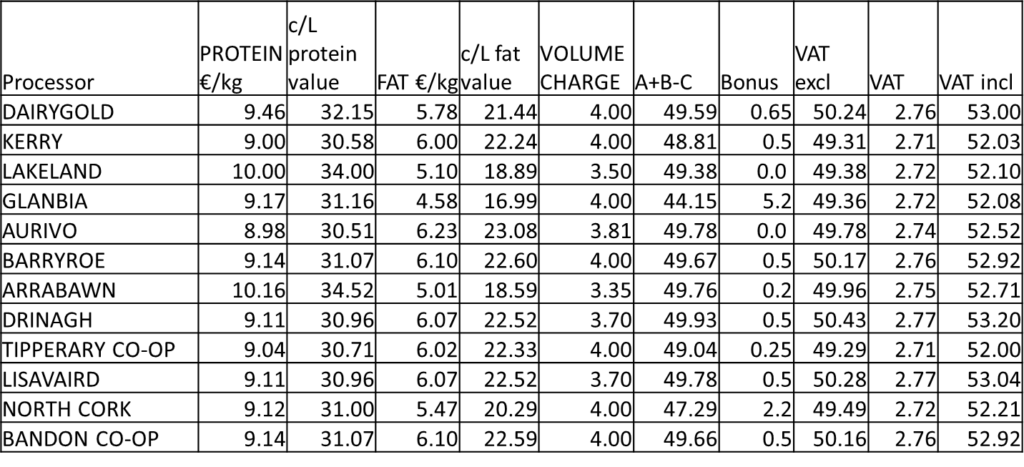

Farmgate Prices – May 2022

Ornua PPI – June 2022

Below are the last four months prices, including VAT. The PPI is continuing in an upwardly trajectory all be at a decreased rate of growth. As can be seen there is still scope for further milk price increases as farm gate level to reflect what the market is returning for Irish dairy products.

| Mar | Apr | May | Jun | |

| Ornua PPI | 164.3 | 177.6 | 178.5 | 179.4 |

| Ornua PPI (c/L) | 49.1 | 54.4 | 55.2 | 56.0 |

| Ornua Value Payment | €5.55m | €6.64m | €8.16m | €10.4m |

| Adjusted PPI (c/L) | 51.71 | 57.09 | 57.65 | 58.33 |

Milk supply -May 2022

Domestic milk intake by creameries and pasteurisers was estimated at 1,153.2 million litres for May 2022. This represents a decrease of 2.4% on March 2022.

The Protein content decreased from 3.49 % in May 2021 to 3.47% in May 2022.

During the period January to May 2022, domestic intake was estimated at 3,567 million litres, a decrease of 1.1% when compared to the corresponding period for 2021.

Latest Commodity prices

GDT 5th July

| Price | Trend | |

| GDT | €4360 | -4.1% |

| Butter | €5648 | -9.1% |

| Cheddar Cheese | €4908 | +1.1% |

| SMP | €4063 | -5.2% |

EU Spot Commodity Prices 6th July

| Butter | Price /tonne | Trend |

| Butter | €7345 | -0.4% |

| Whey | €1032 | -9.9% |

| SMP | €4007 | -0.7% |

| WMP | €5070 | -0.3% |

European Futures Market

| EEX | Period | Price/ tonne | Trend |

| Butter | Jul 22 – Feb 23 | €6912 | -1.4% |

| SMP | Jul 22 – Feb 23 | €3746 | -2.2% |

| Whey | Jul 22 – Feb 23 | €1008 | -7.8% |

Dairy Market Summary

- Global milk supply fell again in May with output weaker in the US, Europe and New Zealand. There are signs global supply is stabilising, but the scope for significant supply growth in the second half of the year appears limited.

- There are growing concerns regarding future global demand as inflationary pressures bite. The price of many non-dairy commodities, most notably oil, have eased in recent weeks.

- Most European dairy commodities have been stable to slightly weaker. However, with pricing well above historic averages and at a big premium to global levels, the risk of a price correction has increased.

- These concerns are reflected in dairy futures with the price of most products falling in June.

- Ongoing concerns over milk supply should ensure no major negative price pressure in the short term.