Grain Council Report July 2022

Grain Market Update

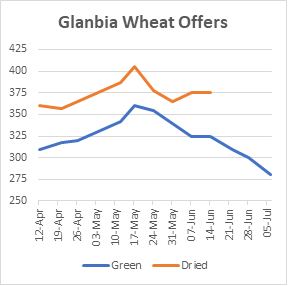

Global wheat markets have dropped significantly throughout June and at one point were €100-105/t down on the highs of May 16th. There has been a recovery of €25-30/t on the Paris MATIF futures markets in the days prior to writing on July 12th and the MATIF Sep 22 position currently sits at €350/t for dried wheat.

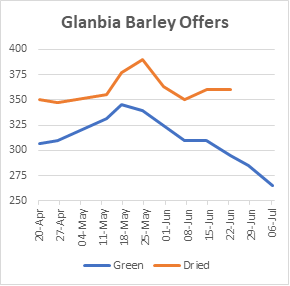

The overall decline in prices is best illustrated on the two graphs below; these detail the weekly prices for Irish green barley and wheat offered by Glanbia Co-op which are freely available. What is behind this sentiment? Optimism over talks on Ukrainian sea export corridors started the downward trajectory but harvest pressure from an early Northern Hemisphere harvest has been a larger contributor to the decline. Much of the large price rises in May were attributed to the very dry spring conditions in France, Europe’s No.1 wheat producer. Yields there have been better than expected and progress has been excellent, AgriMer the French farm advisory body reported that winter barley harvesting was 15 days ahead of last year and four days ahead of the five-year average.

Other factors include a very large Russian wheat crop forecast and a general market fear of a global recession which has pushed commodity speculators out of the market. In recent days, prices have recovered some ground with reduced winter plantings in Argentina providing some more slightly bullish news.

Combines are now rolling in winter barley crops in south Munster and localised parts of south Leinster. Yields to date from crops grown on light soils appear moderate to poor but it remains very early days, with hot, dry weather currently forecast for the weekend of July 16th, harvesting should begin on a more national level very shortly.

Maize Trends

Global maize prices have seen a significant correction, maize ex port was trading at €385/t in late May but was quoted at €325/t last week. Chicago maize futures slipped to a seven-month low on July 5th. A large Brazilian Safrinha maize crop has been forecast for some time and this will fill some of supply shortage from the reduced – but now larger than expected – Ukrainian maize crop. The area of maize planted in the US Corn Belt had been forecast to drop as result of high input prices and a late wet spring. Production now looks to be better than expected, weather over the next few weeks will be very important as the crop enters the key development stages of silking and pollination.

Soya and Oilseeds

Soya prices have remained steadier relative to other prices throughout the past few months with lower daily volatility than other grains. Nonetheless, recent concerns over a global recession have a put pressure on markets with fears of reduced consumption in key users such as China. Soya meal prices ex. port in Ireland are currently trading at approximately €545/t. Weather in the US Midwest and south American planting intentions will drive prices over the next couple of weeks.

Oilseed rape futures prices remain at historical highs of approximately €700/t Paris Nov 2022, down from the high of €866/t on May 16th. With a larger Irish area planted for 2022, interest in prices will remain higher than normal and are expected to be in the region of €650/t. The first crops will be likely be harvested in 7-10 days.