Pigs Council Report June 2021

Pig Market update:

Pig Price has increased slowly over the past 2 months to the following prices.

Rosderra €1.68-1.74c/kg

Kepak €1.68-1.74c/kg

Cookstown (NI) €1.74-1.78c/kg

Dawn P&B €1.72-1.76c/kg

Staunton’s €1.72-1.76c/kg

Sows €0.92-1.00ckg

Current Pig Market and Outlook

There was no change in pig price quotes from factories once again this week. The vibes early last week gave some hope that an official 4c/kg increase was imminent, but farmers were once again were left disappointed. Slight improvements in the European average pig price with Spain, France and the UK saw more price improvements and have left the EU average rising up to closely follow the Irish average price of €1.71c/kg. Further compound feed increase from 1st June have reduced the margin over feed on Irish pig farms. The prospect for the months ahead remains very positive with better BBQ weather across European and the return of sporting events which should reinvigorate consumers to spend and pork will benefit. The reduced global availability of pigmeat should see our price heed towards the Spanish mark of €1.99c/kg. Last week’s total throughput was 72,797 as recorded by the Department of Agriculture. The continued strong supply of pigs from Irish farms is a testament the improvements in both breeding and management, but strong supply does revert the shift of power in the market back to factories when a production day is lost due to bank holidays.

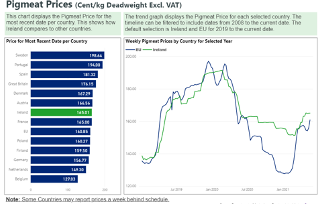

European Pig Market Report.

The range of pig price ranges from €1.99c/g (incl vat) down to as low as €1.35c/kg across Europe. The importance of market access is clear when explaining the reasons for this variation, along with a recognised quality assured programme, such the Bord Bia Pig Quality scheme. The importance of keeping Ireland free of African Swine Fever (ASF) cannot be overstated, and with the reduction in international trade due to Covid -19 restrictions. With the reopening of our borders in the summer months of 2021, the message of reducing the potential of importing this catastrophic pig disease into the island of Ireland must be gotten out to international travellers, IFAwill meet with the National Disease Control Centre (NDCC) of the DAFM

Marketing of pork from countries affected by ASF (African Swine Fever) still remains an issue across Europe with many Asian nations, including the biggest pork importer, China, not accepting EU disease regionalisation in relation to ASF. This has excluded all German pork from many important markets and caused high disruption to the internal German and EU pork trade. The overall deficit in pork on a worldwide scale, which still pertains as a result of the ASF outbreaks in Chain and Eastern Europe in the past 2-4 years, has underpinned demand. This demand will dominate the market for 2021 and the coming years. Similar to re-occurring waves of human Covid-19 over the past number of months, there has been a 2nd serious wave of ASF which has caused more devastation to the Chinese pig herd, following a level of restocking, including restocking with imported pigs from Europe.

Targeted Agricultural Modernisation Scheme TAMS for Pig

Following a sustained campaign over the past 4 years by the IFA to get the investment limit increased for Pig & Poultry Investment Scheme (PPIS) scheme, the decision to approve an increase still lies with the Minister for Agriculture. An initial draft of building specifications requires to comply with the new TAMS Pig investment scheme is prohibitive and will make the scheme as it currently stands, of little value to Irish pig farmers.

EPA Engagement

Issues facing the pig (& poultry) intensive agriculture EPA licenced sector

IFA have engaged with the licence division of the EPA bilaterally negotiation how famers can be compliant with current licences and review licenses where needed.