Pig Market Update

All pig factories reduced price by 4c/kg in early January, leaving today quotes as follows.

Rosderra €1.52-1.54c/kg

Kepak €1.52-1.54c/kg

Cookstown (NI) €1.56-1.60c/kg

Dawn P&B €1.54-1.58c/kg

Staunton’s €1.52-1.54c/kg

Sows €0.62-0.75ckg

Current Pig Market and Outlook

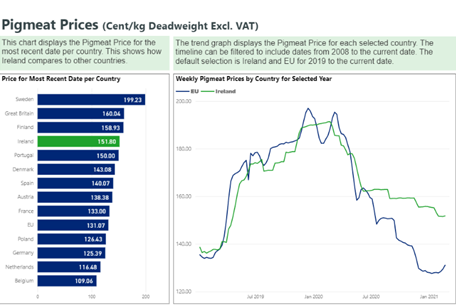

While the European pig market has remained extremely challenging with an average pig price below €1.30/kg for January and February, the price has remained stable in most countries. The first real positive signs of price improvements have been witnessed in the past 3 weeks, on the sow price front, with price improvement week on week and now stand at 0.75c/kg. Nothing to write home about, but a vast improvement from the lows of 30-50c/kg that farmers had to accept since summer 2020. The prime pig price increase is slowly starting to follow with an 11c/kg increase in the carcass price in Germany and a similar significant increase in the Spanish liveweight price, the two largest pig producing nations in Europe. The IFA Pig Committee has increased pressure on all pig processors to increase the Irish pig price back towards €1.60/kg on Friday 5th March.

Marketing of pork from countries affected by ASF (African Swine Fever) remains an issue across Europe with many Asian nations, including the biggest pork importer, China, not accepting EU disease regionalisation in relation to ASF. This has excluded all German pork from many important markets and caused high disruption to the internal German and EU pork trade. The overall deficit in pork on a worldwide scale, which still pertains as a result of the ASF outbreaks in Chain and Eastern Europe in the past 2-4 years, has underpinned demand. This demand, despite some reports of the rebuilding of the Chinese pig herd, will dominate the market for 2021 and the coming years. Almost 25% of all pigs in the world were lost to ASF in China alone in 2018-2019 and this will take years to recover.

Targeted Agricultural Modernisation Scheme TAMS for Pigs

Following a sustained campaign over the past 4 years by the IFA to get the investment limit increased for Pig & Poultry Investment Schemes (PPIS), the decision to approve an increase still lies with the Minister for Agriculture. Some media reports of the impending increase in the PPIS investment limit increase is going to happen in Mid-April, has not been confirmed by DAFM as yet.

Bord Bia- Updated 2021 Quality Assurance Standard

IFA have engaged with Bord Bia over the past number of weeks and months on updating the Pig QA Standard. Pig welfare indicators have been a contentious issue in Ireland and across all EU pig producing countries. It is clear that IFA will need to be vigilant going forward and tackle head-on some of the uninformed and unworkable EU legislation when it comes to implementation at farm level. The IFA Pig Committee recognise the important role that Bord Bia plays in marketing our pork on a global market and we must continue to work through conflicting issues to reach practical and workable agreement on difficult topics.

| Roy Gallie Chair | Robert Malone Senior Policy Executive |