Pigs Council Report March 2022

Pig Market Update

When the last report was submitted (09.11.2021) the prices were as follows:

Rosderra €1.44 – 1.48c/kg

Kepak €1.44 –1.48c/kg

Dawn P&B €1.46-1.50c/kg

Staunton’s €1.46-1.50c/kg

Sows €0.35 – 37c/kg

Today, pig prices are reported at the following prices:

Rosderra €1.40 – 1.44c/kg

Kepak €1.40 –1.44c/kg

Dawn P&B €1.46-1.50c/kg

Staunton’s €1.46-1.50c/kg

Sows €0.35c/kg

Current Pig Market and Outlook

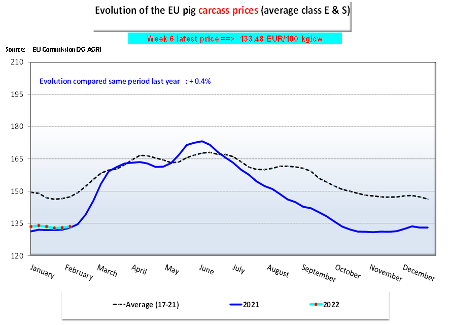

2022 is set to be a challenging year for pig producers with significantly higher input costs, lower pig price to begin with, Covid-19/ Brexit and labour impact all proving difficult to manage as these factors are outside the control of the farm gate. There was no change in pig price quotes from factories once again this week. Slight improvements in the European situation at the moment as the price seems to have stabilised at a low-price averaging at €1.31/kg for a Grade E Pig Carcass. Over the past year, margin over feed has decreased by 78% from 46c/kg January ‘21 to just 10c/kg last month as reported by Teagasc. To break even, margin over feed would need to be at 50c/kg which we are a far cry from at present. Last week’s total throughput was 75,796 as recorded by the Department of Agriculture. The continued strong supply of pigs from Irish farms is a testament to the improvements in both breeding and management. The labour shortage issue has been of utmost concern over the past number of months for all pig farmers and for processing plants. Consignments of pigs have been cancelled for farmers now since mid-July due to a shortage in meat plant operatives. This issue began with the processing plant in Cookstown, which had a shortage in labour due to Brexit and Covid namely. The backlog of unprocessed pigs on farms seems to have alleviated slightly, but still exists. Overall weights of pigs on farm have increased as a result of this and unfortunately at present, to feed a heavy pig that should have been sold a number of weeks ago is costing farmers circa €1.52 per pig per day to feed. Essentially, feeding pigs which in normal circumstances would not be on your farm means very expensive feed. 1500 work permits were issued in October 2021 by DETE to the slaughtering plants however these have not yet been processed as there is a backlog in work permits to be processed. As of today, the department are processing standard permits which were submitted on the 27 of September 2021 and trusted partner permits dated 10th of November 2021.

The Minister for Agriculture Charlie McConalogue has announced a €7m support scheme for pig farmers. The package is worth €20,000 to approximately 300 farmers to help address the soaring input costs endured by farmers. However, Teagasc estimate that the average size family farm of 600 sows is now generating losses of circa €56,000 per month (€40/pig). The total industry loss from September 2021 to August 2022 is estimated at €128 million according to the Teagasc pig department.

European Pig Market Report

The European pig price has stabilised since the new year albeit at the lower end. Last week, The German price increased 5c/kg as did the Spanish price. This is the 4th week in a row that Spain have seen an increase in price. African Swine Fever has had a detrimental effect on pig production, pig price and, not least, market access. The importance of keeping Ireland free of African Swine Fever (ASF) cannot be overstated.

EU production reached a record high last year at 23.6m tonnes, while Ireland reached 4m tonnes (incl. live exports) which is testament to farm management, efficiency and genetic improvements. The impact of ASF in Europe can be seen in the breeding herd developments from 2012 – 2021. Germany is down – 24%, Poland – 33% and Romania -36%. The marketing of pork for regions affected by ASF remains a massive challenge with market access in some cases blocked as a result. The European breeding herd overall has declined by 7% (Dec 2020 vs Dec 2021)