Pigs Council Report March 2025

- Policy proposals for approval by National Council

N/A

- Market Report

When the last council report was submitted in November prices (including vat) were as follows:

Kepak €2.06 –2.12c/kg

Dawn P&B €2.07 – 2.12c/kg

Staunton’s €2.06 – 2.12c/kg

Sows €1.50/kg

Today, as we enter the middle of March, we do so following a 4c/kg increase in Irish pig prices on Friday last (March 7th), with the average pig price reported by farmers to be €2.13/kg including VAT.

Rosderra €2.10 – 2.14c/kg

Kepak €2.12 –2.14c/kg

Dawn P&B €2.12- 2.14c/kg

Staunton’s €2.08 – 2.10c/kg

Sows €1.20/kg

The Irish pigmeat sector has demonstrated a strong performance throughout 2024 and into early 2025. The market has seen a steady increase in production, export value, and overall price stability, despite facing challenges such as international competition and evolving trade dynamics. Irish pig prices increased by 4c/kg on the March 7th bringing the average price up to €2.13/kg including VAT. Total pig throughput in Irish export meat plants for the year up to February 23rd, 2025, reached 514,368 head, marking a 4.5% increase compared to the same period in 2024.

Weekly throughput figures continue to rise, with 67,942 pigs processed in the week ending February 23rd, an increase from 61,103 in the same week of 2024.

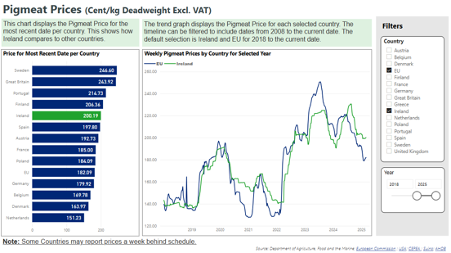

Live exports to Northern Ireland also surged, reaching 52,210 head by mid-February, a 24% increase driven by strong UK demand and competitive pricing. Irish prices remain significantly higher than the EU average, which stands at €1.81/kg, marking an 11% decrease compared to February 2024.

EU pigmeat production grew modestly by 3.4% in 2024 but remains below pre-2021 levels. The expected slight decline in EU pig production for 2025 may support price stability in Ireland.

The total value of Irish primary pigmeat exports in 2024 reached €490 million, a 7% increase from 2023.

Export volume similarly rose by 7% to 200,000 tonnes.

The UK and EU markets showed strong growth, with Irish exports increasing by 15% (€155 million) and 12.5% (€105 million), respectively.

Exports to China declined by 5% to €100 million, while shipments to other Asian markets rose by 7% to €57 million.

Retail sales data from Kantar Worldpanel indicate strong consumer engagement with pigmeat products.

Higher beef prices are expected to encourage further consumer interest in pigmeat as a more affordable alternative.

The official ‘average’ Irish price quoted by Bord Bia as of the 1st of March was €2.00 excluding VAT. The average European pig price for the Grade E carcass was quoted as €1.82/ kg dead weight for the same week excluding VAT.

Source: https://www.bordbia.ie/farmers-growers/prices-markets/pig-trade-prices/pigmeat-price-dashboard/

- Activity since last National Council

- IFA Pig Committee has elected it’s new Chair at it’s first committee meeting in January, Michael Caffrey.

- IFA Pig Committee representatives are actively engaging with the Nitrates Division on the 4day export notification proposal from DAFM as this would be totally unworkable for pig farmers.

- IFA Pig Committee members have been engaging intensively with processors and secondary processors to improve prices.

- Ongoing engagement with department, Animal Health Ireland, Environmental Protection Agency, Meat Industry Ireland and Bord Bia.

- Engagements with the Food Regulator, Niamh Lenahan, who we will be working closely with over the coming year.

- Ongoing work with the DNA scheme and testing in particular the foodservice sector as we work toward ensuring as much Irish product as possible is utilised on home soil.

- Meeting with retailers on specific issues relating to price, changes in production systems, sustainability, and viability of the sector.

- Ongoing discussions with EPA on various issues, technical amendments, online, and IED.

- EU/COPA developments

- We will continue to work with Copa and Cogeca and the commission on the implementation of the IED to ensure it is as simplified as possible. Policy Executive, Sarah Hanley recently attended the IED Uniform Conditionals for the Operating of Livestock Pig & Poultry kick-off meetings. Ensuring that simplification remains a priority of the UCOL working group is of utmost importance for our smaller pig and poultry farmers.

- Engaging directly with Copa and Cogeca on the revision of Animal Welfare in Transport Regulation.

- We will engage in EU commission meetings around the implementation of the revised IED.

- Last year the European Food Safety Authority released its recommendations for the welfare of pigs on farms. We are actively engaging with Copa-Cogeca to ensure that a strong position is held among farm organisations to lobby on these recommendations.

- End of cages – presentation of study’s conclusions. Copa-Cogeca have conducted an impact assessment on the end of cages and the potential impact associated with the change for agriculture and associated transition periods. Should this come into immediate effect by 2025, it is expected that circa 37% of pork meat would cease and 3% of EU egg production would cease.

- Engaging with COPA COGECA and at National level on the EUDR which has now been halted until Jan 2026 however, we will engage with DAFM on the matter.

- EU Horizon project – WelFarmers – IFA are partaking in an EU welfare project on pig welfare which is a 3-year project. We have secured funding from the EU to partake in this project and will be working closely with our Irish pig farmers and EU colleagues on this over the next 3 years or so.

- Upcoming issues

- Engagement with DAFM on slurry exports – 4-day rule proposal by DAFM and establishment of an alternative method of reporting for pig farmers.

- A reduction in the use of imported pigmeat in the foodservice sector is something the committee are eager to work on and see improvements.

- Actively engaging and working to ensure fair price is being returned to producers.

- Engaging with Bord Bia on the revision of a Quality Assurance Scheme.

- Engaging with the EPA regarding various issues including emissions, the revision of the AER and IED.

- Engaging with the Pig Health Check Implementation Group on the National Salmonella Control Programme and on the Biosecurity code of practice.