Pigs Council Report October 2022

Pig Market update:

When the last report was submitted (11.07.2022) the prices were as follows:

Rosderra €1.90 – 1.94c/kg

Kepak €1.90 –1.94c/kg

Dawn P&B €1.92-1.96c/kg

Staunton’s €1.92-1.96c/kg

Karro €2.00/kg

GPM €2.00/kg

Sows €0.95c/kg

Today, pig prices are reported at the following prices:

Rosderra €2.08 – 2.12c/kg

Kepak €2.08 –2.12c/kg

Dawn P&B €2.08-2.14c/kg

Staunton’s €2.06-2.12c/kg

Karro €2.10-2.14/kg

Sows €1.15

Current Pig Market and Outlook

There was no change in pig price quotes from factories this week. European prices are static this week and last week Germany fell by 10c/kg with the Grade E carcass averaging at €1.92/kg for a Grade E Pig Carcase, Week 26. Week 1 2022, the Grade E average price was €2.06c/kg, which is an increase of 56% on the same week last year, however with input costs having soared, its proving very difficult for farmers to return to break-even let alone profitability. Teagasc estimate that the Margin Over Feed for September was 48c/kg which is an improvement of 15c/kg on MOF for August, however, farmers are still unfortunately in a loss-making position and have been for over 450 days now.

The IFA Pigs Committee led by Chairman, Roy Gallie, are campaigning nationally to ensure an increase in the pig price, and are in engagements with factories, retailers, the foodservice sector and also within the channels of government procurement. The total throughput for week end 09/10/2022 was 69,540 as recorded by the Department of Agriculture, of which 1,654 were sows. Relating to the Irish sow herd reduction, Teagasc estimate that circa 12,500 sows are permanently exiting the sector. Over the last 8 week period, pig slaughtering’s are back -6% and supplies are tightening.

Irish producers have now received their DAFM Exceptional Payment of €90,000-€100,000, which in most cases was used to reduce feed credit – this extended by 2-3 weeks in credit days but by €300,000 in real terms due to ingredient price increase. However, Teagasc estimate that the average size family farm of 600 sows is now forecast to generate losses of circa €480,000 for the period Apr21 – Dec22 (excluding government aid).

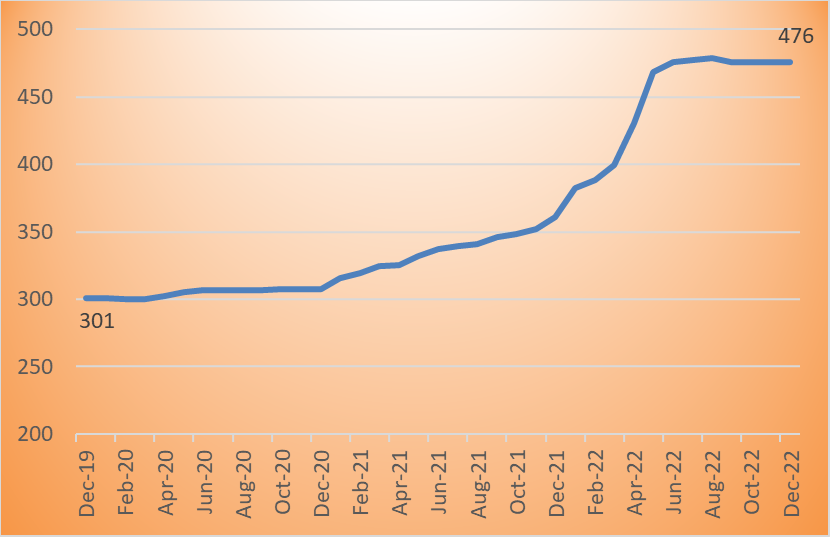

The rise in international feed ingredients obviously increased the Irish composite pig feed price. The rate of increase (Fig.2) from €301 in December 2019 to €476 in Dec 2022 (forecast) is a rise of 58%, with the majority of this rise (62% of total) occurring from October 2021 to Jul 2022. The pig producer’s feed credit days only rose marginally during this period, with an estimated increase of 14-21 days, to give an estimated total average credit days of 105 days per pig unit. However, the total feed credit per average 600 sow pig unit, in cash terms, has increased by an estimated €300,000. Similarly the total feed credit extended by the five principal pig feed mills to the pig sector has increased from an estimated €76m in 2020 to €119m in 2022 (+€43m).

Fig. 2 Irish Composite Pig Feed Cost (€/tonne)

Source: Teagasc PDD

When the 2022 feed cost is compared to previous historic high cost periods (Fig.3), unsurprisingly we see that it’s at an historic high of 156 cent per kg dead wt. (c/kg dwt), with 2013 being the previous highest feed cost at 132 c/kg dwt.

The high feed cost in 2022 was further acerbated by the rapid rate of the rise. Traditionally there is a lag phase of 6-8 months between a pig feed price rise and corresponding pig price rises. If feed cost rises modestly then this puts a moderate strain on cashflow/profitability, however a rapid feed cost rise, as per 2022 (Fig. 4), placed a severe strain on cashflow. The 2022 rate of feed cost increase year-on-year (YOY) was 32%, which was double the next highest rate (16%) in 2008.

Fig.3: Annualised Irish composite pig feed cost c/kg Fig.4: Rate of feed cost change YOY %

Source: Teagasc PDD Source: Teagasc PDD

Fig 1. Pig Prices EU & UK (Early October)

| Country | €/kg | Change +/- |

| GB bacon | 2.316 | = |

| GB cull sows | 0.831 | -0.02 |

| German cull sows | 1.220 | -0.05 |

| Belgium | 1.828 | -0.09 |

| Denmark | 1.667 | = |

| France | 2.464 | = |

| Germany | 2.00 | -0.10 |

| Ireland | 2.10 | = |

| Netherlands | 1.877 | = |

| Spain | 2.23 | = |

| European average | 2.02 | 0.02 |

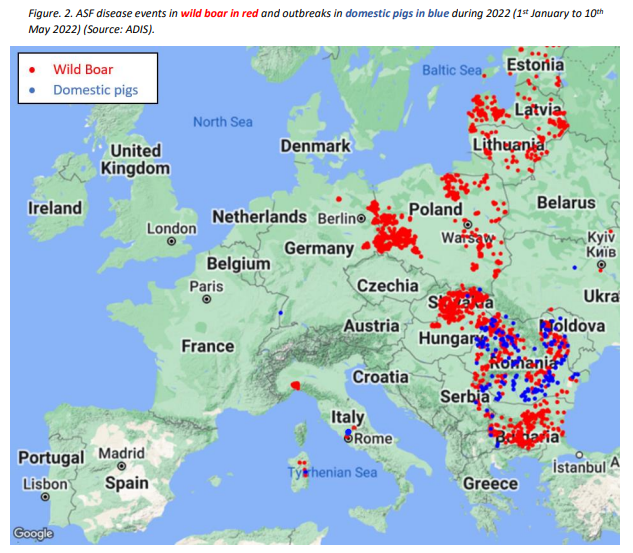

African Swine Fever Update

Strict National Biosecurity is key in maintaining our ASF free status